In 2021, the S&P 500 was up 28.7%.

In 2022, it was down 18.1%

In 2023 and 2024, the market went up 26.3% and 25%, respectively.

This 12 months the S&P 500 is down 6% or so.

That’s loads of ups and downs in a brief time frame. The annualized return on this 4 years and alter was *drumroll* a bit greater than 10% per 12 months.

All of that motion and we landed proper on the very long-run common.

This acquired me pondering — how typically does the inventory market offer you 10% annual returns over varied time frames?

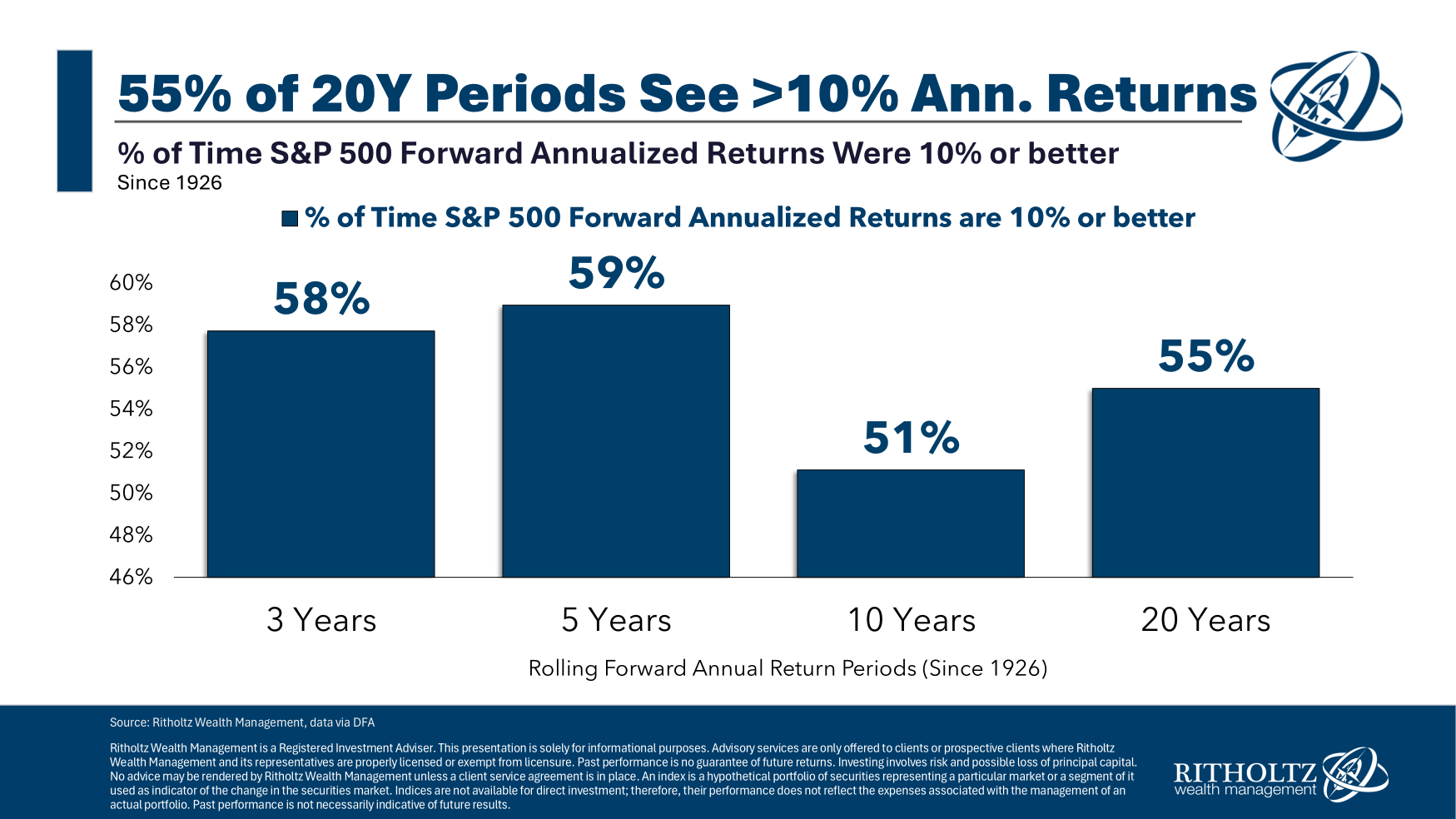

Right here’s what I did — checked out S&P 500 return knowledge going again to 1926, calculated the three, 5, 10 and 20 12 months returns from the beginning of every 12 months after which found out what number of of these annual return streams had been 10% or higher.

These are the outcomes:

I suppose it is smart that common returns happen round half the time. That’s how averages work though outliers can probably skew the information.1

For example, 15% of all 3 12 months returns had been destructive. Over 5 and 10 years, returns had been destructive 13% and 4% of the time, respectively. There have been no 20 12 months durations with destructive returns.

Alternatively, 35% of all 3 12 months durations skilled returns of 15% per 12 months or greater. Over 5, 10 and 20 years it was 32%, 24% and 10% of the time, respectively.

So there’s a decently wide selection across the averages, even over longer time frames.

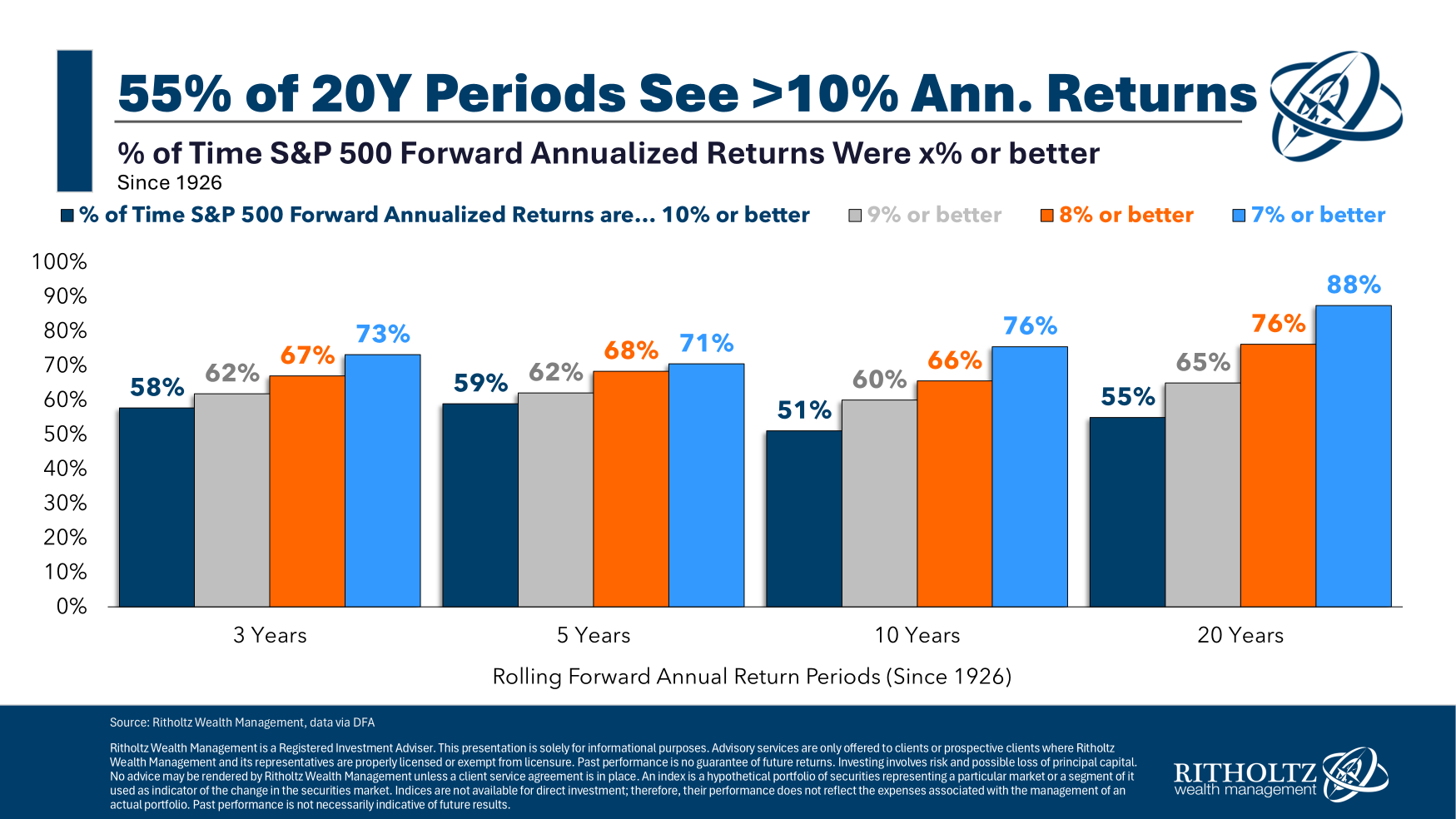

It’s value noting that there have been a variety of returns that had been comparatively near the long-term averages. So I seemed on the proportion of time the inventory market returned greater than 7%, 8% and 9% as properly:

These win charges are clearly greater however you may see excessive returns are promised to nobody.

The chances have been in your favor traditionally however 24% of the time the U.S. inventory market returned lower than 7% per 12 months over 10 years.

This is without doubt one of the nerve-wracking and irritating points of investing in danger belongings. More often than not issues are going to work out for you as a long-term investor. However a few of the time you in all probability aren’t going to be thrilled with the outcomes.

So goes the character of danger within the markets.

This is without doubt one of the causes I’m such a giant proponent of greenback price averaging. It’s a method to diversify your entry factors to extend your odds of success.

Additional Studying:

31 Years of Inventory Market Returns

1This can be a little nerdy but it surely’s additionally value declaring that these are geometric averages that consider compounding and never a easy arithmetic common.

This content material, which incorporates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will probably be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.