Unlock the unique world of accredited investing the place the stakes are excessive, the alternatives are huge, and the rewards may be game-changing. From hedge funds to enterprise capital delights, embark on an funding journey that solely a choose few have the privilege to discover.

After I turned an accredited investor, I discovered myself amongst an elite group with the monetary means and regulatory clearance to entry investments that many couldn’t. This opened doorways to unique realms like hedge funds, enterprise capital companies, particular funding funds, personal fairness funds, and extra.

Although I had this “unique entry” it took me some time to start out investing in various asset lessons.

The Securities and Trade Fee states that as an accredited investor, I possess a degree of sophistication that equips me to craft a riskier funding portfolio than a non-accredited investor. Whereas this won’t be universally true for everybody, in my case, I had demonstrated the monetary resilience to bear extra danger (see barbell investing), particularly if my investments took an unexpected downturn.

One of many intriguing points I found was that funding alternatives for accredited traders aren’t mandated to register with monetary authorities. This implies they typically include fewer disclosures and won’t be as clear because the registered securities out there to most people.

The underlying perception is that my standing as a classy investor implies a deeper understanding of economic dangers, a necessity for much less disclosure of unregistered securities, and a conviction that these unique funding alternatives are apt for my funds.

On a private observe, as a practising CFP®, I haven’t at all times labored with accredited traders. Early in my profession, I didn’t fairly grasp the attract. Nonetheless, as time went on, I started to see the broader spectrum of funding choices out there to accredited traders.

As I discovered extra the clearer it turned why this realm was so wanted. The variability and potential of those unique alternatives had been actually eye-opening, reshaping my perspective on the world of investing.

Introduction to Accredited Buyers

An accredited investor is a person or a enterprise entity that’s allowed to commerce securities that might not be registered with monetary authorities. They’re entitled to this privileged entry as a result of they fulfill a number of necessities relating to revenue, web value, asset dimension, governance standing, or skilled expertise.

The idea of an accredited investor originated from the concept people or entities with the next monetary acumen or extra sources are higher outfitted to know and bear the dangers of sure funding alternatives.

Traditionally, the excellence between accredited and non-accredited traders was established to guard much less skilled traders from probably dangerous or much less clear funding alternatives.

Regulatory our bodies, such because the U.S. Securities and Trade Fee (SEC), have set standards to find out who qualifies as an accredited investor, making certain that they’ve the monetary stability and class to have interaction in additional advanced funding ventures.

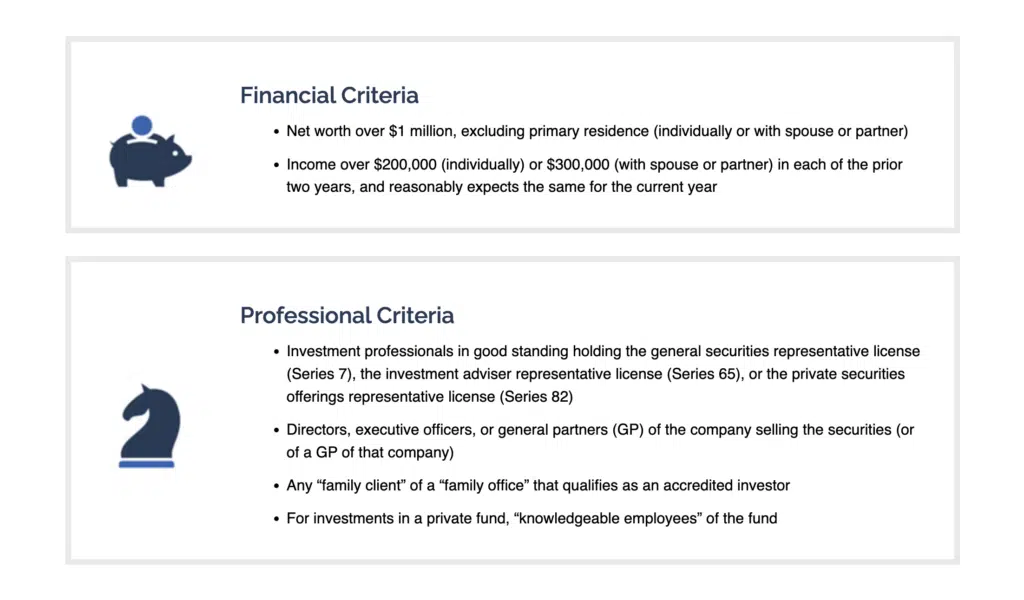

Standards for Turning into an Accredited Investor

To be labeled as an accredited investor, one should meet particular standards set by regulatory our bodies:

| Standards | Description |

|---|---|

| Earnings Necessities | A person should have had an annual revenue exceeding $200,000 (or $300,000 for joint revenue with a partner) for the final two years, with the expectation of incomes the identical or the next revenue within the present 12 months. |

| Internet Price Necessities | A person or a pair’s mixed web value should exceed $1 million, excluding the worth of their main residence. |

| Skilled Credentials | Latest updates have expanded the definition to incorporate people with sure skilled certifications, designations, or different credentials acknowledged by the SEC. Examples embrace Sequence 7, Sequence 65, and Sequence 82 licenses. |

| Enterprise Entities | Entities, akin to trusts or organizations, with property exceeding $5 million can qualify. Moreover, entities through which all fairness homeowners are accredited traders may additionally be thought-about accredited. |

Greatest Funding Alternatives for Accredited Buyers

Right here’s a rundown of among the prime investments for accredited traders…

1. Fundrise

- Greatest for Beginner Buyers

Fundrise has revolutionized the true property funding panorama. By democratizing entry to actual property portfolios, it permits people to take a position with out the complexities of property administration or the necessity for huge capital. The platform’s revolutionary method gives publicity to a historically profitable, but typically inaccessible, sector of the market

By Fundrise, traders can entry a diversified vary of properties, from industrial ventures to residential models. The platform’s skilled staff curates these portfolios, making certain a stability of danger and reward. With its user-friendly interface and clear reporting, Fundrise has turn out to be a best choice for a lot of venturing into actual property investments.

How It Works

Buyers begin by selecting an appropriate funding plan on Fundrise. As soon as invested, the platform swimming pools the funds with different traders and allocates them throughout numerous actual property tasks. As these properties generate rental revenue or appreciation in worth, traders obtain returns within the type of dividends or appreciation.

Professionals & Cons

Professionals

Cons

2. Equitybee

- Minimal Funding: $10,000

- Greatest for: Skilled Buyers

Equitybee affords a novel platform that bridges the hole between personal corporations on the cusp of going public and potential traders. This revolutionary method gives a golden alternative for traders to faucet into the potential of startups and different personal companies earlier than they make their public debut.

The platform’s main focus is on worker inventory choices. By permitting traders to spend money on these choices, they’ll probably profit from their appreciation as the corporate grows. With an unlimited array of corporations, from rising startups to established giants, Equitybee presents a various vary of funding alternatives.

How It Works

Buyers browse out there inventory choices from numerous corporations on Equitybee. As soon as they select an possibility, they make investments their funds, that are then used to buy the inventory choices from the staff. If the corporate goes public or will get acquired, the investor stands to realize from the elevated worth of those shares.

Professionals

Cons

3. %

- Greatest for Novice Buyers

% stands as a beacon within the huge sea of the personal credit score market, illuminating a sector typically overshadowed by conventional investments. This burgeoning market, valued at over $7 trillion, consists of corporations borrowing from non-bank lenders. % affords a novel vantage level into this market, permitting traders to diversify their portfolios past typical shares and bonds.

The attract of % lies in its means to supply shorter phrases and better yields, mixed with investments which can be largely uncorrelated with public markets. This makes it a lovely proposition for these trying to step away from the volatility of conventional markets.

How It Works

Upon becoming a member of %, traders are offered with a plethora of personal credit score alternatives. After choosing an funding, funds are pooled with different traders and lent out to corporations searching for credit score. As these corporations repay their loans, traders earn curiosity, offering a regular revenue stream.

Professionals

Cons

4. Masterworks

- Minimal Funding: $10,000

- Greatest for Novice Buyers

Masterworks paints a vivid image of artwork funding, mixing the worlds of finance and advantageous artwork. Historically, investing in artwork was a luxurious reserved for the elite. Nonetheless, Masterworks has democratized this, permitting people to purchase shares in artworks from world-renowned artists.

The platform’s power lies in its experience. From authentication to storage, each aspect of artwork funding is dealt with meticulously. This ensures that traders can admire each the fantastic thing about their investments and the potential monetary returns.

How It Works

After registering on Masterworks, traders can browse a curated collection of artworks. They’ll then buy shares, representing a fraction of the paintings’s worth. Masterworks care for storage, insurance coverage, and eventual sale. When the paintings is offered, traders share the earnings primarily based on their possession.

Professionals

Cons

5. Yieldstreet

- Minimal Funding: $15,000

- Greatest for: Superior Buyers

Yieldstreet stands on the intersection of innovation and various investments. It affords a smorgasbord of distinctive funding alternatives, starting from artwork to marine finance. For these trying to enterprise past the crushed path of conventional shares and bonds, Yieldstreet presents a tantalizing array of choices.

The platform’s attract lies in its curated collection of various investments, every vetted by specialists. This ensures that whereas traders are treading unconventional grounds, they’re not getting into the unknown blindly.

The way it Works

Buyers start by looking via the various funding alternatives on Yieldstreet. After choosing their most well-liked asset class, their funds are pooled with different traders and allotted to the chosen enterprise. Returns are generated primarily based on the efficiency of those property, be it via curiosity, dividends, or asset appreciation.

Professionals

Cons

6. AcreTrader

- Minimal Funding: $10,000

- Greatest for Beginner Buyers

AcreTrader, as its title suggests, brings the huge expanses of farmland to the funding desk. It affords a novel alternative to spend money on agricultural land, combining the soundness of actual property with the evergreen nature of agriculture. With the worldwide inhabitants on the rise, the worth of fertile land is barely set to extend.

The platform meticulously vets every bit of land, making certain solely essentially the most promising plots can be found for funding. This rigorous course of ensures that traders are planting their funds in fertile floor, poised for progress.

How It Works

Buyers peruse out there farmland listings on AcreTrader. After choosing a plot, they’ll make investments, successfully proudly owning a portion of that land. AcreTrader manages all points, from liaising with farmers to making sure optimum land use. Buyers earn from the appreciation of land worth and potential rental revenue.

Professionals

Cons

7. EquityMultiple

- Minimal Funding: $5,000

- Greatest for: Skilled Buyers

EquityMultiple is a testomony to the facility of collective funding in the true property sector. By leveraging the ideas of crowdfunding, it affords a platform the place a number of traders can pool their sources to finance high-quality actual property tasks. This collaborative method permits for diversification and entry to tasks that is perhaps out of attain for particular person traders.

The platform’s power lies in its curated collection of actual property alternatives, starting from industrial areas to residential properties. With a staff of seasoned actual property professionals on the helm, EquityMultiple ensures that every undertaking is vetted for optimum potential and minimal danger.

How It Works

Upon becoming a member of, traders can discover quite a lot of actual property tasks. After committing to a undertaking, their funds are pooled with different traders to finance the enterprise. Returns are generated via rental incomes, property appreciation, or the profitable completion of improvement tasks.

Professionals

Cons

8. CrowdStreet

- Minimal Funding: $25,000

- Greatest for: Superior Buyers

CrowdStreet stands as a pillar within the industrial actual property funding area. With its huge expertise and trade connections, it affords a platform the place traders can faucet into prime actual property tasks throughout the nation. From bustling city facilities to tranquil suburban locales, CrowdStreet gives a various vary of funding alternatives.

The platform’s experience ensures that every undertaking is meticulously vetted, providing a mix of potential returns and stability. For traders trying to delve into industrial actual property with out the hassles of property administration, CrowdStreet is a perfect alternative.

How It Works

After registration, traders can browse a myriad of business actual property choices. Upon investing in a undertaking, CrowdStreet manages the funding, offering common updates and making certain optimum undertaking execution. Buyers earn returns primarily based on the undertaking’s efficiency, be it via leases, gross sales, or undertaking completions.

Professionals

Cons

9. Mainvest

- Greatest for Beginner Buyers

Mainvest affords a refreshing twist within the funding panorama, specializing in the center and soul of the American financial system: native companies. From quaint cafes to revolutionary startups, Mainvest gives a platform the place traders can assist and profit from the expansion of small companies of their communities.

The platform’s community-centric method ensures that investments are usually not nearly returns but in addition about fostering native economies. For these trying to make a distinction whereas incomes, Mainvest presents a novel alternative.

How It Works

Buyers can discover numerous native companies searching for capital on Mainvest. By investing, they basically purchase a revenue-sharing observe, incomes a proportion of the enterprise’s gross income till a predetermined return is achieved.

Professionals

Cons

10. Vinovest

- Minimal Funding: $1,000

- Greatest for Novice Buyers

Vinovest uncorks the world of wine funding, providing a mix of luxurious, historical past, and monetary progress. High quality wines have been an emblem of opulence for hundreds of years, and Vinovest gives a platform the place this luxurious turns into an accessible funding.

With a staff of wine specialists guiding the way in which, the platform ensures that every wine is not only a drink however an funding poised for appreciation. From sourcing to storage, Vinovest handles each aspect, making certain the wine’s worth grows over time.

How It Works

After signing up, traders set their preferences and funding quantities. Vinovest then curates a wine portfolio primarily based on these preferences, dealing with sourcing, authentication, and storage. Because the wine appreciates, so does the investor’s portfolio.

Professionals

Cons

11. Arrived Properties

- Greatest for Novice Buyers

Arrived Properties affords a contemporary perspective on actual property funding, specializing in the attraction of single-family houses. Whereas skyscrapers and industrial complexes typically dominate actual property discussions, single-family houses provide stability, constant returns, and a contact of nostalgia.

The platform’s power lies in its focus. By concentrating on single-family houses, it affords traders an opportunity to faucet right into a steady actual property phase, benefiting from each rental revenue and property appreciation.

How It Works

Buyers browse out there properties on Arrived Properties. After choosing a property, they’ll spend money on shares, representing a portion of the house’s worth. Because the property is rented out, traders earn a share of the rental revenue. Moreover, any appreciation in property worth advantages the traders.

Cons

12. RealtyMogul

- Minimal Funding: $5,000

- Greatest for: Novice to Skilled Buyers

RealtyMogul stands tall within the industrial actual property funding panorama. It affords a platform the place diversification meets alternative, presenting a variety of business properties for funding. From bustling workplace areas to serene residential complexes, RealtyMogul gives a plethora of choices for traders to increase their portfolios.

The platform’s prowess lies in its twin method. Buyers can both dive into non-traded REITs or make direct investments in particular properties. This flexibility ensures that each novice and skilled traders discover alternatives that align with their funding objectives.

How It Works

Upon becoming a member of RealtyMogul, traders can select between REITs or direct property investments. Their funds are then channeled into these actual property ventures. Returns are generated via rental incomes, property gross sales, or profitable undertaking completions.

Professionals

Cons

The Way forward for Accredited Investing

The world of accredited investing is dynamic and ever-evolving. Rising tendencies counsel a shift in direction of democratizing funding alternatives, with regulatory our bodies contemplating extra inclusive standards for accredited investor standing. This shift goals to stability the necessity for investor safety with the popularity that monetary acumen can come from expertise and training, not simply wealth.

Moreover, technological developments are enjoying a pivotal position. The rise of blockchain and tokenized property, for example, is creating new avenues for funding and may reshape the panorama of alternatives out there to accredited traders.

As the road between conventional and various investments blurs, the long run guarantees a extra built-in, inclusive, and revolutionary surroundings for accredited traders.

The Backside Line – High Investments for Accredited Buyers

Understanding the position and alternatives of accredited traders is essential within the fashionable monetary panorama. Whereas the excellence affords privileged entry to distinctive funding alternatives, it additionally comes with elevated dangers and tasks.

Because the world of investing continues to evolve, potential accredited traders are inspired to remain knowledgeable, conduct thorough analysis, and search skilled recommendation. The realm of accredited investing, with its mix of challenges and alternatives, guarantees thrilling prospects for these able to navigate its complexities.