The U.S. inventory market has been on fireplace of late.

Nevertheless it doesn’t really feel like we’ve entered the euphoric part of investor psychology simply but. Actually, many prognosticators have been decreasing expectations.

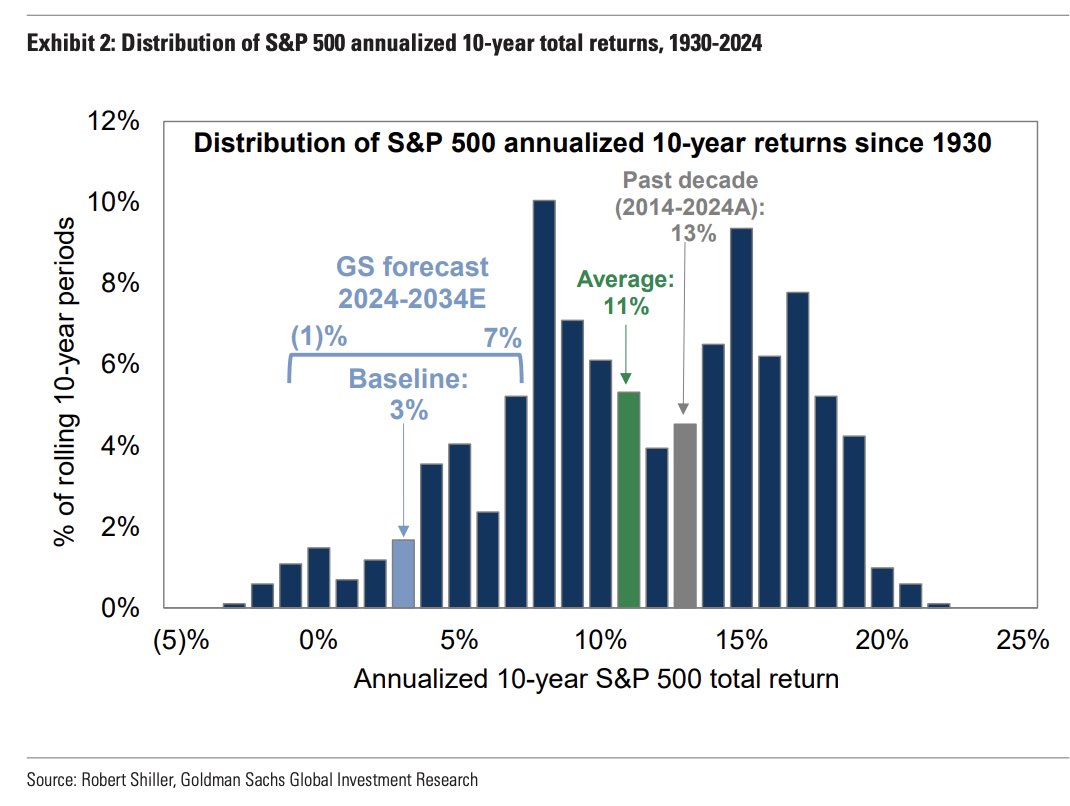

Goldman Sachs put out a analysis piece that posits the S&P 500 might return simply 3% annualized over the subsequent 10 years (simply 1% after inflation):

These are their baseline assumptions and so they provide a variety of potential outcomes however that might be a tough decade for inventory market buyers. Goldman additionally estimates a greater than 70% probability that U.S. Treasuries will beat shares in that timeframe.

The same old caveats apply right here. Predicting future returns is difficult. Goldman Sachs doesn’t know the longer term any higher than you or I do. Individuals have been predicted below-average returns for the reason that begin of this epic bull market run.

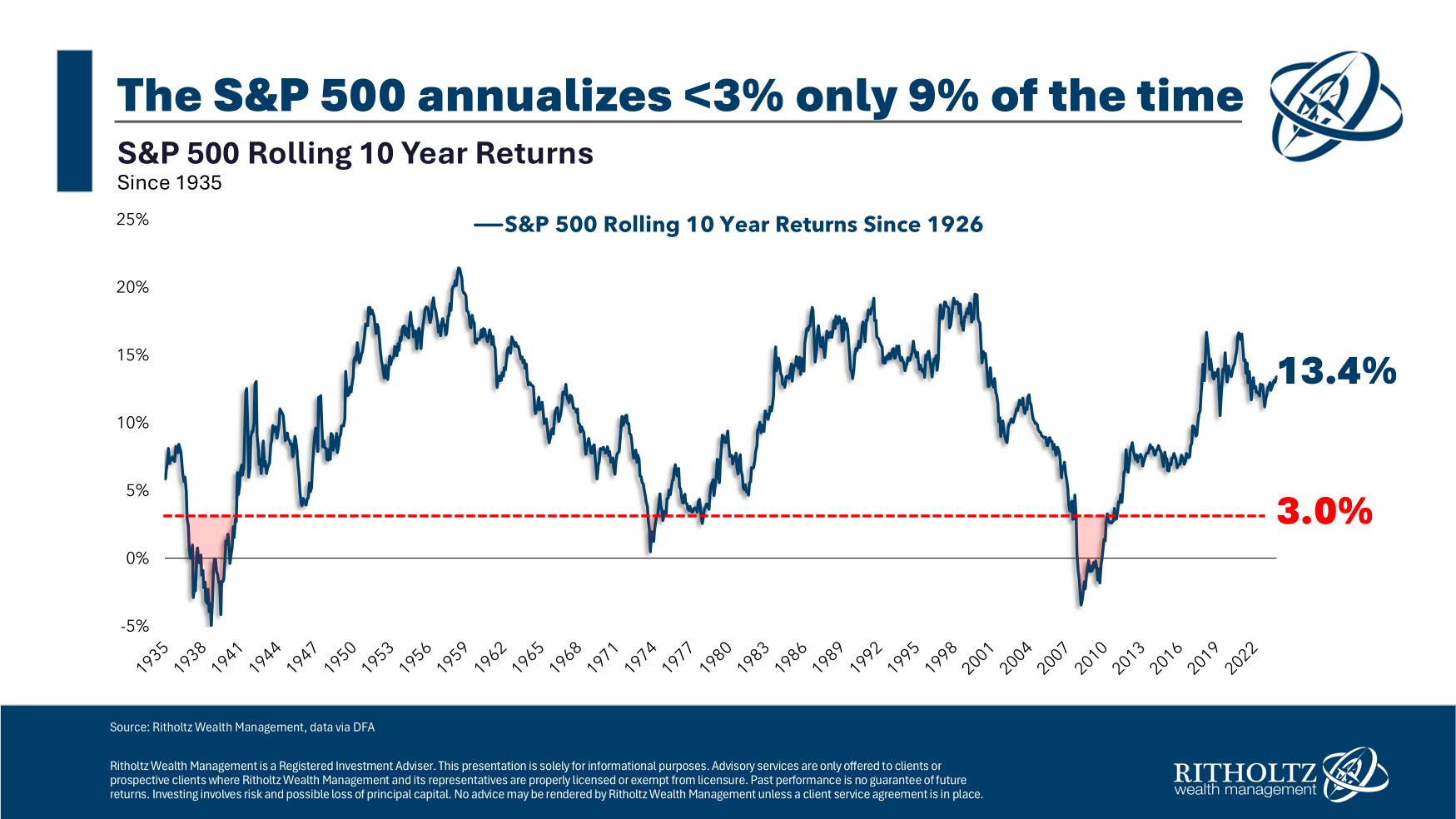

Now that the disclaimer is out of the best way, I used to be curious how typically this has occurred traditionally so I checked out rolling 10 12 months returns for the S&P 500 going again to 1926:

It’s uncommon to see such low returns over a ten 12 months stretch however it may well occur. Roughly 9% of all rolling 10 12 months annual returns have been 3% or much less.

It’s price noting that there are some similarities within the three situations wherein this has occurred prior to now. These below-average returns all occurred in or round among the worst financial occasions of the previous 100 years or so — the Nice Melancholy within the Thirties, the stagflation of the Nineteen Seventies, and the Nice Monetary Disaster.

You’ll suppose there must be a reasonably nasty monetary disaster for this to occur. That’s not out of the realm of prospects, however there may be usually a motive for unhealthy occasions like this.

It’s additionally not out of the realm of prospects for bonds to beat shares over a ten 12 months window. I regarded again on the 10 12 months returns for each the S&P 500 and 5 12 months Treasury bonds:

Shares have crushed bonds over rolling 10 12 months returns 83% of the time, which means bonds have crushed shares 17% of the time. The additional you lengthen the time horizon, the extra seemingly it’s that inventory beat bonds.

So it’s unbelievable however doable.

I nonetheless recall attending a convention means again in 2010 the place a really well-known hedge fund supervisor made the case that U.S. inventory market returns can be muted over the subsequent decade due to beginning valuations. As an alternative, we’ve skilled an enormous bull market with above-average returns for 15 years.

For bonds, the beginning yield offers an honest approximation of ahead returns, however predicting the inventory market’s efficiency is anybody’s guess. Though low returns occur occasionally, it does make sense to plan for this threat. It’s going to occur sooner or later.

Since nobody can predict the timing of inventory market returns — good or unhealthy — your greatest protection towards poor returns in anyone asset class, area, issue, or technique is diversification.

The S&P 500 has been lights out for a decade-and-a-half however went nowhere for the misplaced decade that preceded the present run.

Loads of different areas of the inventory market — small caps, overseas shares, worth shares, dividend shares, top quality shares, rising market shares, and so on. — haven’t fared almost as effectively. And bonds will beat shares sooner or later since you don’t get the long-term threat premium within the inventory market with out the danger.

Diversification has felt ineffective this cycle as a result of massive cap development shares have so massively outperformed.

That received’t final without end both.

Diversification will show its price once more sooner or later.

I simply don’t know when and I don’t know why however that’s why I diversify.1

Additional Studying:

When is Imply Reversion Coming within the Inventory Market?

1Yeah it rhymes.

This content material, which accommodates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here will probably be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.