Generative AI (GenAI) has the potential to remodel the insurance coverage business by offering underwriters with beneficial insights within the areas of 1) danger controls, 2) constructing & location particulars and three) insured operations. This expertise will help underwriters establish extra worth within the submission course of and make higher high quality, extra worthwhile underwriting choices. Elevated score accuracy from CAT modeling means higher, extra correct pricing and decreased premium leakage. On this submit, we’ll discover the chance areas, GenAI functionality, and potential impression of utilizing GenAI within the insurance coverage business.

1) Danger management insights zone in on materials information

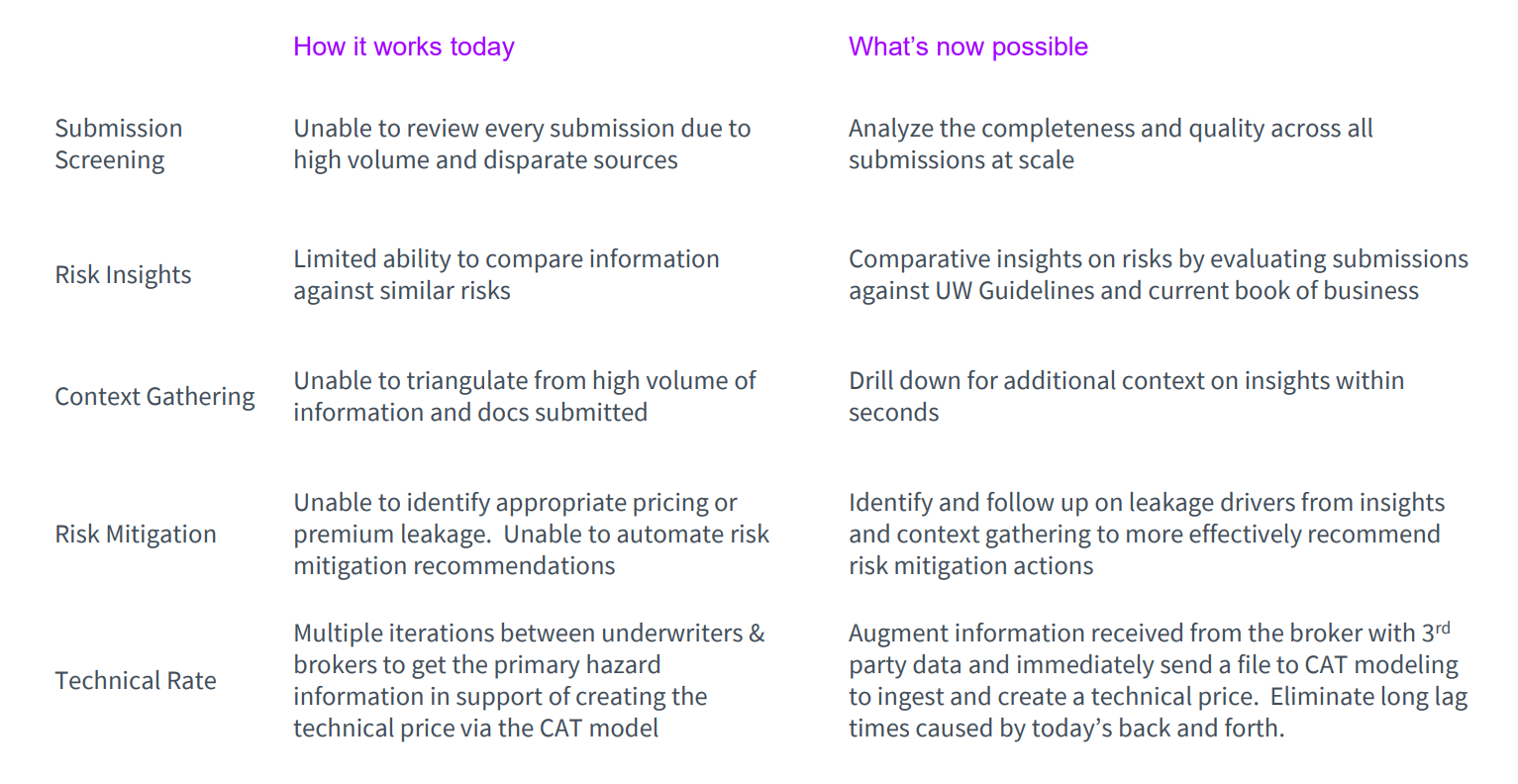

Generative AI permits risk management evaluation insights to be highlighted to point out loss prevention measures in place in addition to the effectiveness of these controls for lowering loss potential. These are crucial to knowledgeable underwriting choices and might tackle areas which are persistently missed or ache factors for underwriters in information gathering. Presently in terms of submission screening, underwriters are unable to assessment each submission on account of excessive quantity and disparate sources. Generative AI permits them to analyze the completeness and high quality throughout all submissions at scale. Which means they transfer from a restricted capacity to check info in opposition to related dangers to a state of affairs the place they’ve comparative insights on dangers by evaluating submissions in opposition to UW Pointers and present e-book of enterprise.

What generative AI can do:

- Generate a complete narrative of the general danger and its alignment to carriers’ urge for food and e-book

- Flagging, sourcing and figuring out lacking materials information required

- Managing the lineage for the info that has been up to date

- Enriching from auxiliary sources TPAs/exterior information (e.g., publicly listed merchandise/providers for insured’s operations)

- Validating submission information in opposition to these further sources (e.g., geospatial information for validation of vegetation administration/proximity to constructing & roof building supplies)

Synthesizing a submission bundle with third social gathering information on this means permits it to be introduced in a significant, easy-to-consume means that finally aids decision-making. These can all enable sooner, improved pricing and danger mitigation suggestions. Augmenting the data obtained from the dealer with third social gathering information additionally eliminates the lengthy lag occasions attributable to right now’s backwards and forwards between underwriters and brokers. This may be occurring instantly to each submission concurrently, prioritizing inside seconds throughout all the portfolio. What an underwriter may do over the course of every week may very well be finished instantaneously and persistently whereas making knowledgeable, structured suggestions. The underwriter will instantly know management gaps primarily based on submission particulars and the place important deficiencies / gaps might exist that would impression loss potential and technical pricing. In fact, these should then be thought of in live performance with every insured’s particular person risk-taking urge for food. These enhancements finally create the flexibility to jot down extra dangers with out extreme premiums; to say sure once you may in any other case have mentioned no.

2) Constructing & Location particulars insights help in danger publicity accuracy

Let’s take the instance of a restaurant chain with a number of properties that our insurance coverage provider is underwriting for instance constructing element insights. This restaurant chain is in a CAT-prone area resembling Tampa, Florida. How might these insights be used to complement the submission to make sure the underwriter had the complete image to precisely predict the chance publicity related to this location? The high-risk hazards for Tampa, in accordance with the FEMA’s Nationwide Danger Index, are hurricanes, lightning, and tornadoes. On this occasion, the insurance coverage provider had utilized a medium danger degree to the restaurant on account of:

- a previous security inspection failure

- lack of hurricane safety models

- a possible hyperlink between a previous upkeep failure and a loss occasion

which all elevated the chance.

Alternatively, in preparation for these hazards, the restaurant had carried out a number of mitigation measures:

- obligatory hurricane coaching for each worker

- metallic storm shutters on each window

- secured outside objects resembling furnishings, signage, and different free objects that would grow to be projectiles in excessive winds

These had been all added to the submission indicating that that they had the mandatory response measures in place to lower the chance.

Whereas constructing element insights expose what is really being insured, location element insights present the context wherein the constructing operates. Risk management evaluation from constructing value determinations and security inspection experiences uncover insights displaying which areas are the highest loss driving areas, whether or not previous losses had been a results of coated peril or management deficiency, and adequacy of the management methods in place. Within the case of the restaurant chain for instance, it didn’t have its personal hurricane safety models however in accordance with the detailed geo-location information, the constructing is positioned roughly 3 miles away from the closest fireplace station. What this actually means is that when it comes to context gathering, underwriters transfer from being unable to triangulate from excessive quantity of knowledge and paperwork submitted to with the ability to drill down for extra context on insights inside seconds. This in flip permits underwriters to establish and comply with up on leakage drivers from insights and context gathering to advocate danger mitigation actions extra successfully.

3) Operations insights assist present suggestions for extra danger controls

Insured operations particulars synthesize info from the dealer submission, monetary statements and knowledge on which facets should not included in Acord varieties / functions by the dealer. The hazard grades of every location related to the insured’s operations and the predominant and secondary SIC codes would even be supplied. From this, rapid visibility into loss historical past and high loss driving areas in contrast with complete publicity can be enabled.

If we take the instance of our restaurant chain once more, it may very well be attributed a ‘excessive’ danger worth fairly than the aforementioned ‘medium’ because of the truth that the location has potential dangers from e.g. catering supply operations. By analyzing the operation publicity, that is how we establish that prime danger in catering :

The utmost occupancy is excessive at 1000 individuals, and it’s positioned in a procuring advanced. The variety of claims during the last 10 years and the typical declare quantity might additionally point out a better danger for accidents, property harm, and legal responsibility points. Though some danger controls might have been carried out resembling OSHA compliant coaching, safety guards, hurricane and fireplace drill response trainings each 6 months, there could also be further controls wanted resembling particular danger controls for catering operations and fireplace security measures for the outside open fireplace pizza furnace.

This supplementary info is invaluable in calculating the actual danger publicity and attributing the right danger degree to the client’s state of affairs.

Advantages to generative AI past extra worthwhile underwriting choices

In addition to aiding in additional worthwhile underwriting choices, these insights provide further worth as they educate new underwriters (in considerably decreased time) to know the info / pointers and danger insights. They enhance analytics / score accuracy by pulling all full, correct submission information into CAT Fashions for every danger they usually cut back important churn between actuary /pricing / underwriting on danger info.

Please see under a recap abstract of the potential impression of Gen AI in underwriting:

In our latest AI for everybody perspective, we speak about how generative AI will remodel work and reinvent enterprise. These are simply 3 ways in which insurance coverage underwriters can achieve insights from generative AI. Watch this area to see how generative AI will remodel the insurance coverage business as an entire within the coming decade.

Should you’d like to debate in additional element, please attain out to me right here.