It’s been a wild trip within the inventory market this 12 months:

The S&P 500 was up round 5% on the 12 months by means of mid-February. It was roughly straight down from there.

By the tip of the primary week in April the market was down greater than 15%, adequate for a drawdown of 18.9% from peak to trough.

Now shares are up almost 14% from the lows and down lower than 4% on the 12 months.

It is a traditional puke and rally, which occurs extra typically than you’d suppose.

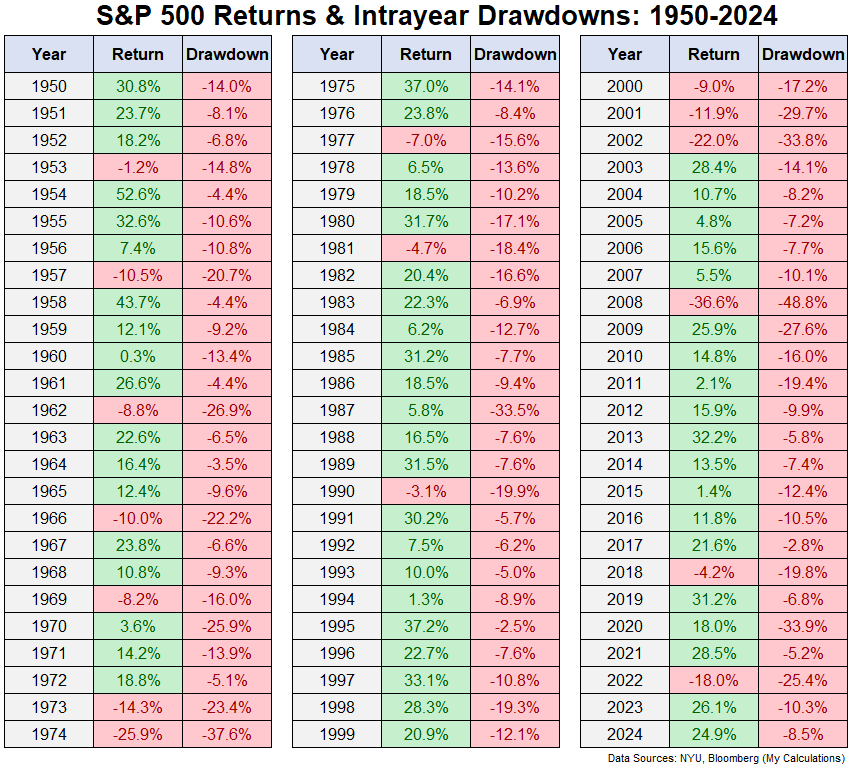

That is annual S&P 500 returns together with the intra-year peak-to-trough drawdowns:

It is a first rate encapsulation of threat and reward. There could be inexperienced even when the pink is fairly unhealthy though typically the pink ends in pink.

Take into account the truth that there have been 41 years with a double-digit drawdown sooner or later since 1950.1

There are clearly years when a drawdown results in a poor end result. In 16 of these 41 downdrafts, the S&P 500 completed the 12 months down. Eight of these years had been down double-digits.

That’s threat.

Now comes the attention-grabbing half. The market is commonly down however not out. We’ve had loads of puke and rally conditions.

In these 41 years with a double-digit drawdown sooner or later through the 12 months, the market completed with a achieve 25 occasions or 61% of the time.

That’s an incredible win price throughout years with a correction.

And of these 25 years with double-digit drawdowns that completed within the black, 16 occasions the market ended the 12 months with double-digit beneficial properties.

Take into consideration these numbers.

Years in which there’s a correction of 10% or worse usually tend to end the 12 months with beneficial properties than losses. And the inventory market additionally completed with far more double-digit beneficial properties than double-digit losses.

Corrections could be painful however they aren’t all the time the tip of the world.

It’s typically very troublesome to separate the rationale for the correction from the correction itself. This one feels completely different due to the commerce struggle and the entire uncertainty it has launched.

However from a purely market historical past standpoint, the motion within the inventory market this 12 months is completely regular.

In fact the 12 months isn’t over.

The market may fall off the bed once more.

There have been cases when the inventory market goes down, recovers, then goes again down once more all in the identical 12 months.

The final time this occurred was 2018. The inventory market fell 10% early within the 12 months, bounced again after which dropped 20% by means of Christmas Eve.

Sarcastically sufficient, that downturn occurred over the past commerce struggle.

In some methods it feels just like the inventory market is all the time shocking us. In different methods, it feels just like the inventory market is consistently repeating itself for various causes.

It does really feel comforting to know the puke and rally is completely regular.

The exhausting half isn’t understanding if and when the market will get sick once more.

Additional Studying:

Shopping for When the Inventory Market is Down 15%

142 if you happen to rely 2025. I didn’t embody this 12 months as a result of the 12 months isn’t over but.

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here shall be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.