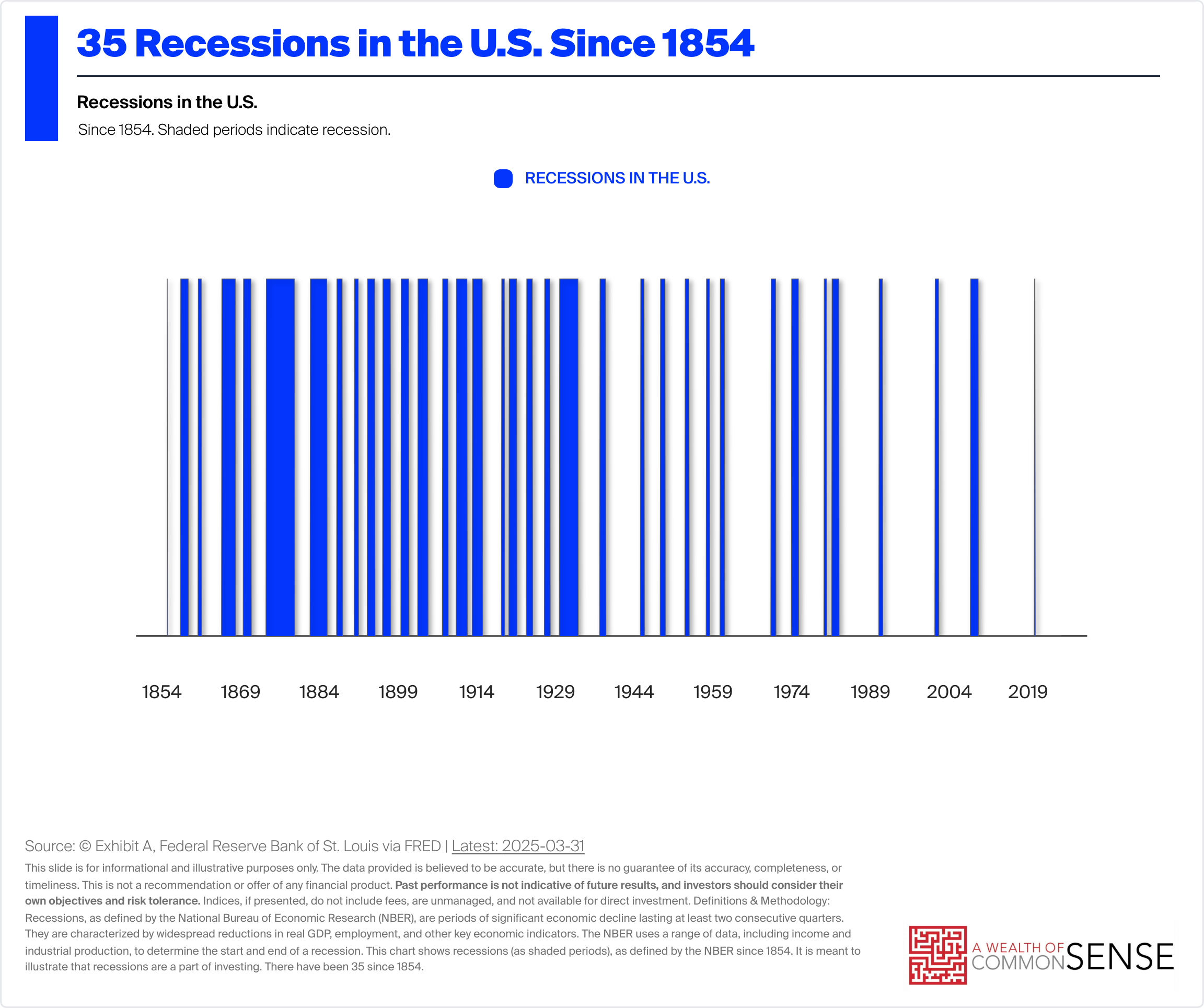

A recession is coming.

How do I do know this?

As a result of that’s what occurs generally:

We’ve had one each 5 years on common going again 170+ years.

Right here’s the massive query I don’t know the reply to: When?

I don’t know when the subsequent recession might be right here.

Perhaps it comes from the commerce struggle. Lots of people appear to assume that’s a chance.

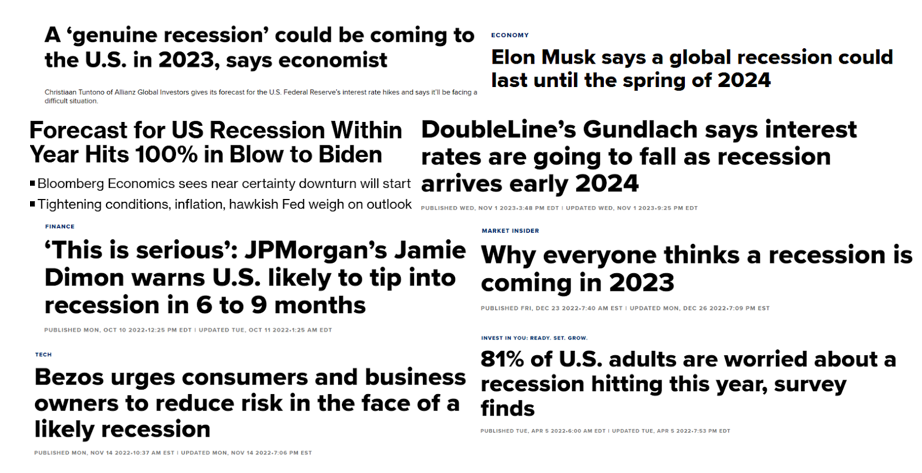

Is that this a copout? I suppose so — however I’ve realized the recession prediction sport is way more durable than individuals assume.

There have been lots of people who thought a recession was a positive factor just a few years in the past and it didn’t occur:

Up to now 15 years we’ve had precisely one recession that lasted simply two months within the spring of 2020. That contraction was man-made and over in a rush.

Each time we do have an financial contraction, it’s going to be fascinating to see how companies and customers react. Everyone seems to be just a little out of form.

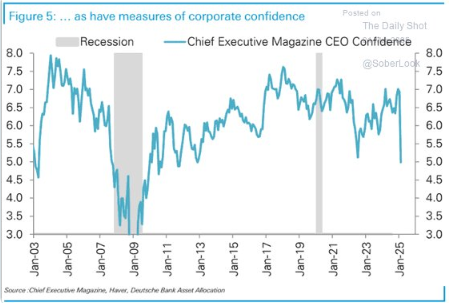

If client and enterprise sentiment have a say, issues aren’t trying so sizzling.

CEOs are nervous:

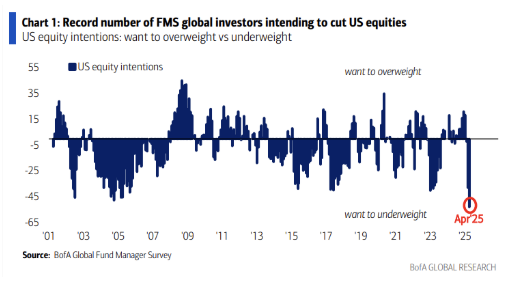

Traders are nervous:

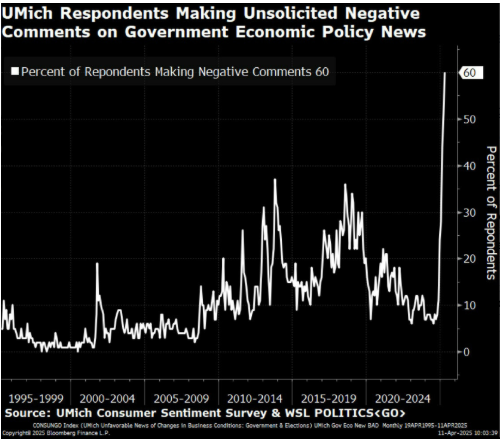

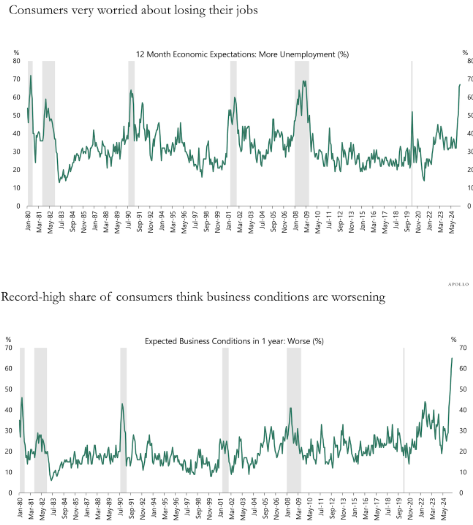

Shoppers are nervous:

Staff are nervous:

You will need to acknowledge that is sentiment not actions.

CEOs say they’re dropping confidence.

Traders say they intend to chop their U.S. fairness publicity.

Shoppers say they’re nervous about authorities insurance policies, dropping their job and enterprise circumstances worsening.

If actions match these sentiments readings then we’re completely going right into a recession.

I’m not so positive we will belief sentiment readings anymore, since they alter so quickly. You must watch what individuals don’t what they are saying.

My base case proper now might be a recession, however that’s only a guess.

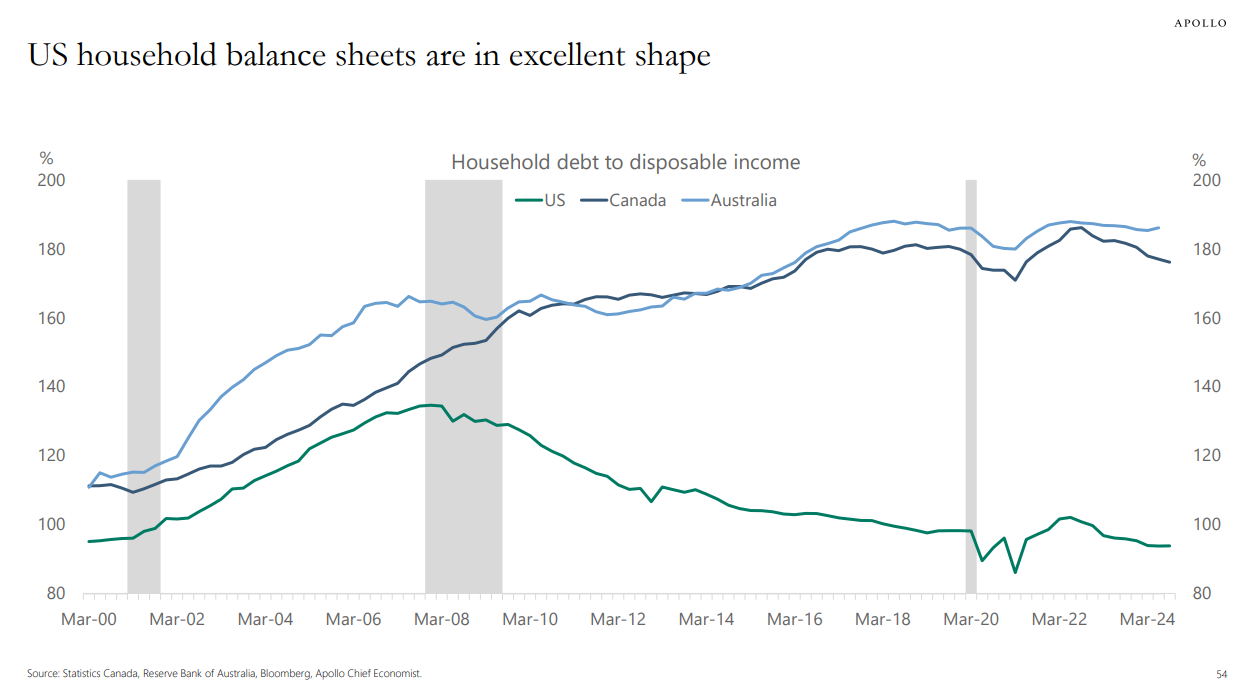

If we do have a recession the silver lining is that customers as a complete are nonetheless in fine condition:

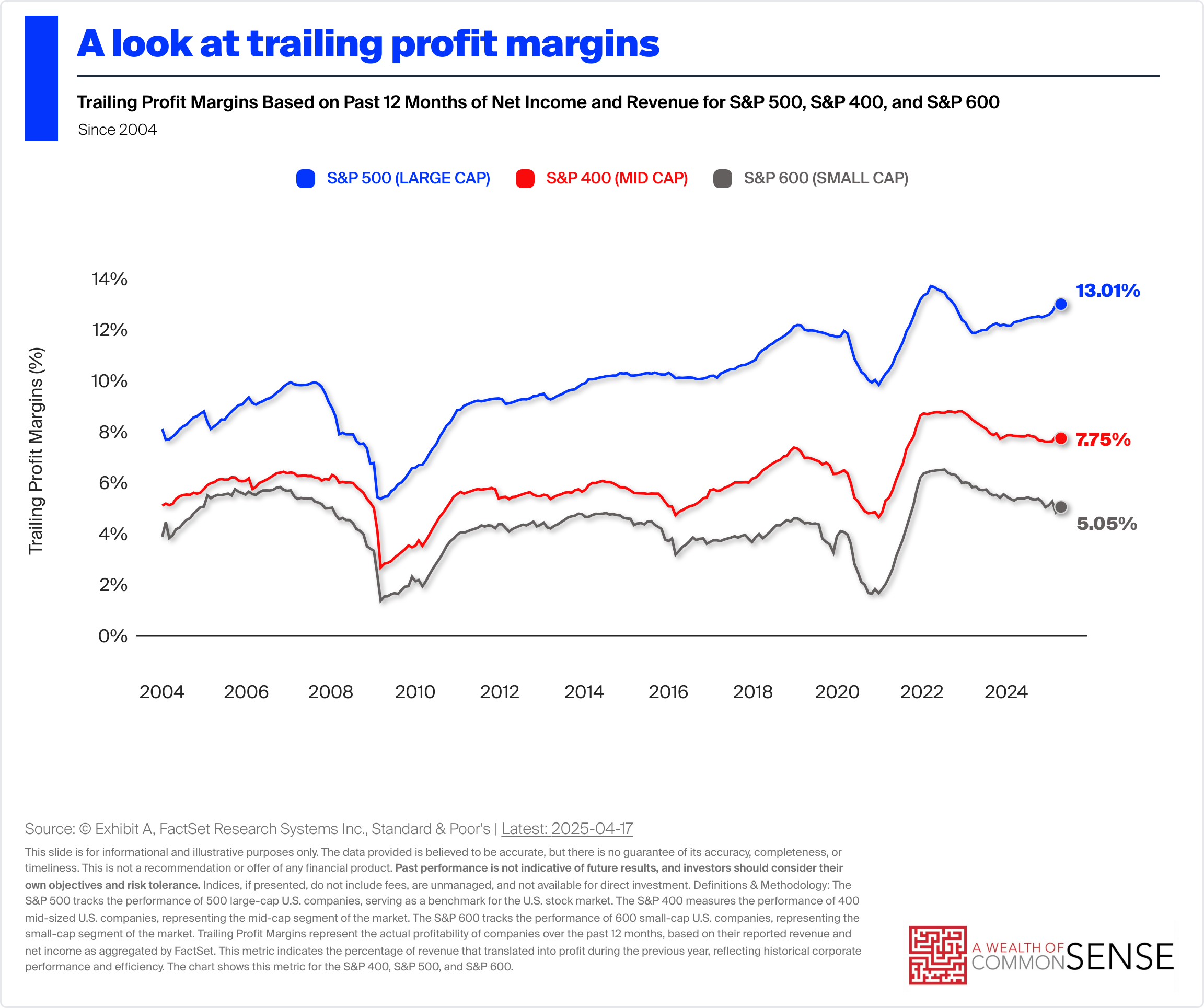

Revenue margins for companies stay close to all-time highs:

There’s a margin of security in place.

My baseline can be a light recession if and when it occurs assuming we don’t get some form of monetary disaster.

After all, a recession would nonetheless imply job loss, enterprise closures, decrease inventory costs, and so forth. Even a light recession wouldn’t be very a lot enjoyable.

Preparation for a recession is similar no matter the place we’re within the enterprise cycle.

You carry a low debt load, have an emergency fund in place, hold a excessive financial savings price, and provides your funds some wiggle room and a backstop.

However you must do these issues even when we don’t go right into a recession within the coming months.

In conclusion:

A recession is coming sooner or later.

I don’t know when.

Life can be rather a lot simpler if these occasions occurred on a set schedule so companies and customers may plan forward.

Issues won’t ever be that straightforward.

The objective is to construct a monetary life that’s sturdy sufficient to deal with a slowdown, each time it might happen.

Additional Studying:

What Occurs in a Recession?

Just like the charts on this submit? Try Exhibit A to see how you need to use them in your wealth administration observe.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here might be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.