Being financially impartial means having sufficient passive earnings to cowl your important or desired residing bills. A typical guideline is to purpose for a web value equal to 25 occasions your annual bills, usually used as a baseline for attaining monetary independence. Nonetheless, this strategy is overly simplistic as a result of it is dependent upon the composition of 1’s web value.

In case your web value consists fully of liquid, income-producing belongings, 25 occasions your bills ought to suffice. But when a lot of it’s tied up in a major residence or illiquid non-public investments, chances are you’ll not be capable to generate sufficient passive earnings or readily promote belongings for true monetary independence. Liquidity and money circulate are paramount for retirement.

For these retiring on the conventional age of 65, a web value of 25X your annual bills, supplemented by Social Safety, is often enough for a snug retirement. Nonetheless, the 25X rule turns into extra precarious for these in search of early retirement. Longer time horizons, inflation, and way of life adjustments—like rising households—can rapidly erode a seemingly ample web value.

Could not Keep Totally Retired For Lengthy On 25X Bills

After I revisited my funds after a 2013 monetary session, I used to be reminded of the restrictions of the 25X rule for attaining FIRE (Monetary Independence, Retire Early).

Though I retired in 2012 at age 34 with a web value of roughly 38 occasions my annual bills, I couldn’t maintain full retirement past 18 months. The problem lay within the composition of my web value—a lot of it tied up in my major residence—and the rising prices of sustaining a rising family. These elements made early retirement way more complicated than I had initially anticipated.

My authentic plan was to embrace a less complicated life with my spouse on my grandparents’ farm in Waianae, Oahu. The imaginative and prescient was idyllic: we’d supply most of our meals from the land and reside comfortably on $80,000 a 12 months. Nonetheless, detaching ourselves from San Francisco, a metropolis we’ve referred to as house since 2001, proved troublesome. Life pulled us in a distinct course.

Our journey took a fair greater flip with the births of our kids in 2017 and 2019, additional anchoring us to San Francisco. The imaginative and prescient of a quiet life on the farm shifted to balancing the calls for of elevating a household in one of the vital costly cities on this planet. Early retirement, it turned out, required greater than a excessive web value—it demanded higher money circulate and a willingness to adapt to life’s sudden turns.

Why A Web Price Equal To 25X Annual Bills Is Not Sufficient To Retire Early

Right this moment, our web value is even higher than the 38X bills we had in 2012. But, I do not really feel financially impartial as a result of our passive earnings would not absolutely cowl our present residing bills.

We had exchanged a considerable amount of productive investments producing passive earnings for a house that, though paid off, requires ongoing bills reminiscent of property taxes, upkeep, and utilities—prices that shares and bonds don’t have.

My objective now could be to recoup the productive investments we allotted to our house over the following three years.

Rollover IRA as a Case Research on Web Price Composition

Let’s take my rollover IRA as a easy instance of why 25X annual bills falls quick as a retirement web value goal. 25X is the inverse of 4%, the protected withdrawal price popularized within the Nineties by Invoice Bengen, creator of the 4% Rule.

Think about my IRA have been my solely asset, with a stability of $1,300,000. Because of this my complete web value consists of my rollover IRA, a 100% productive, income-producing asset.

Coincidentally, based on a Northwestern Mutual survey from late 2023, this quantity aligns with what People consider they should retire comfortably. Let’s assume I reside off $40,000 a 12 months in bills. If we multiply $40,000 by 25, that equals $1,000,000, suggesting I could possibly be financially impartial.

Nonetheless, as a result of sort of investments in my portfolio, it would not come shut to offering sufficient dividend earnings to reside on.

Low Passive Revenue On account of a Progress-Targeted Portfolio

Ninety p.c of my Equities – $826,191- is allotted to development shares. Microsoft provides the very best dividend yield on this class at about 0.78%, adopted by Apple at 0.48%. This brings my common dividend yield throughout all my development inventory holdings to round 0.2%, leading to simply $1,653 in dividends yearly.

The majority of my ETF holdings – $476,000 – is in VTI, the Vanguard Whole Inventory Market Index, which has a dividend yield of roughly 1.33%. Consequently, my blended yield for the complete portfolio is round 0.6%, translating to about $7,800 in annual passive earnings.

With post-tax annual bills at $40,000, I’d want a portfolio roughly 6.4 occasions bigger—$8,320,000—to generate $50,000 in gross passive earnings to cowl bills after taxes.

It could appear extreme to wish an $8,320,000 portfolio to attain monetary independence with annual bills of $40,000. And it’s. Nonetheless, few folks maintain their complete web value in liquid, income-generating belongings. For a lot of, their fairness just isn’t as readily accessible as it would seem.

Adjusting Your Web Price Composition Isn’t At all times Simple

Astute readers could counsel that the simple option to obtain monetary independence on a $1,300,000 web value is to regulate the funding composition: promote sufficient development shares and buy sufficient dividend shares or ETFs to generate $50,000 a 12 months, which might require a 3.8% dividend yield.

To do that, I must rebalance nearly all of my portfolio. If my retirement portfolio was in a taxable brokerage account, I might incur vital capital positive factors tax.

Thus, a rational investor is unlikely to promote shares they’re constructive on until completely mandatory. As a substitute, they might proceed working or discover supplemental retirement earnings to assist their way of life. Any surplus money circulate could possibly be directed towards dividend-paying shares or ETFs over time.

The Profit Of A Roth IRA For Early Retirees

Luckily for Roth IRA holders, investments might be traded inside these accounts with out triggering capital positive factors taxes. This permits for changes with out a right away tax invoice, providing extra flexibility for portfolio restructuring. Therefore, for individuals who can construct a big sufficient Roth IRA for retirement, the pliability in repositioning your portfolio with out tax penalties is usually a nice profit.

For individuals who want to retire earlier than 59.5, you may all the time withdraw your authentic contributions tax- and penalty-free, no matter your age or how lengthy the account has been open. Since contributions are made with after-tax {dollars}, they’re not topic to penalties or taxes. After 59.5, you may then withdraw earnings tax- and penalty-free, supplied your Roth IRA has been open for not less than 5 years.

For these planning to retire early, the method requires meticulous planning. After years of following a selected funding technique, you’ll want to regulate the composition of your portfolio to align along with your new monetary wants. On prime of that, you’ll face the problem of transitioning from accumulation to withdrawal, beginning with tapping into your contributions. This shift is simpler stated than finished and requires a transparent technique to keep away from pointless taxes, penalties, or liquidity points.

Housing Is A Excessive Proportion Of Web Price

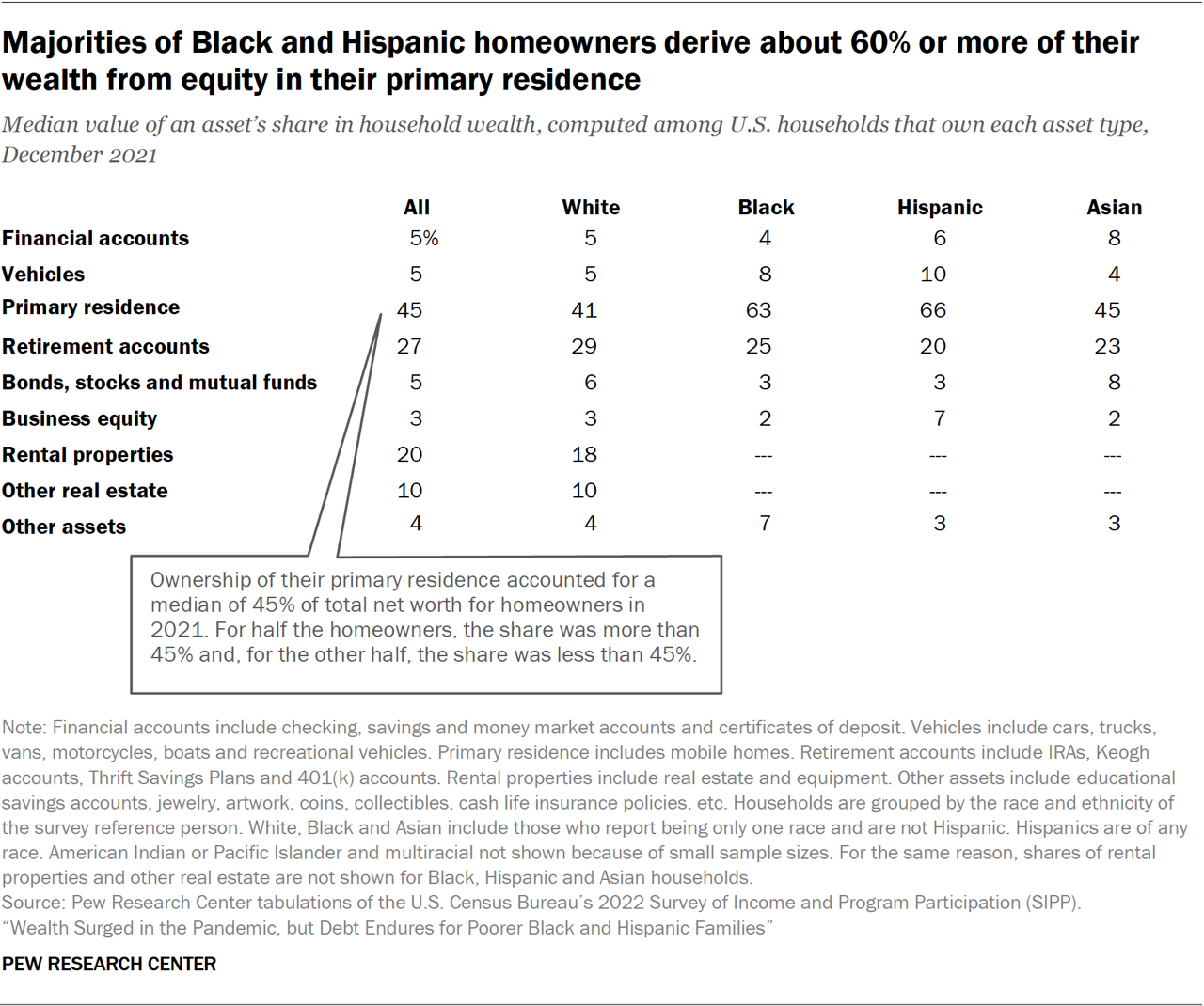

One more reason why a web value of 25X annual bills might not be enough to retire early is the excessive proportion of web value tied up in housing. In line with Pew Analysis, in 2021, the median web value of U.S. households stood at $166,900, together with all belongings, with house fairness accounting for a median of 45% of this web value. The proportion is probably going related at present.

Nonetheless, when analyzing Pew’s article, they state, “In 2021, owners sometimes had $174,000 in fairness of their houses,” alongside the nationwide median web value determine of $166,900. This discrepancy suggests house fairness could symbolize an even bigger share of web value for a lot of households.

Assuming 45% of 1’s web value is of their major residence is correct, that also leaves the everyday family with solely 55% of their web value in different belongings, reminiscent of automobiles, monetary accounts, retirement funds, enterprise fairness, rental properties, and different actual property.

Taxable Brokerage Accounts: A Small Slice of Web Price

Inside this remaining 55%, Monetary accounts—which I interpret as taxable brokerage accounts—make up a modest 5% for all races surveyed. These are the belongings that may be tapped earlier than 59.5 with out penalty. Clearly, these accounts alone aren’t sufficient to maintain early retirement for many.

Curiously, Pew’s knowledge reveals that for White households, rental properties and different actual property symbolize 30% of complete web value, indicating that many White People generate rental earnings as landlords.

Maybe Pew’s survey pattern didn’t seize enough knowledge from Black, Hispanic, and Asian households to mirror their possession of rental properties and different actual property. But, actual property is a popular asset class for a lot of Asians, together with myself.

However is a mixed 5% in monetary accounts plus 30% in rental properties and different actual property enough to generate livable passive earnings for early retirement? Realistically, it’s extremely unlikely.

So let’s be beneficiant. Let’s assume the complete 55% of web value is 100% allotted to productive income-generating belongings like shares and actual property. Additional, there is no such thing as a penalty to promote any of those belongings. What would the extra life like web value goal based mostly on annual bills be?

45.5X Annual Bills Could Be A Extra Cheap Web Price Goal For The Typical Family

Making use of some fundamental math, with solely 55% of the everyday American family’s web value outdoors of their major residence, the everyday family would want a web value equal to 45.5X annual bills to attain early retirement.

I can already hear the complaints from readers saying {that a} 45.5X annual bills goal is each unrealistic and demoralizing. But when the info in regards to the typical web value composition of People is correct, then this goal is grounded in basic math.

To grasp why, think about if 100% of your web value have been tied up in your major residence. Each room is occupied, and you may’t lease out any a part of the home for earnings. How would you fund your retirement with such a web value composition? Even when your house have been value 100X your annual bills, it wouldn’t show you how to cowl your residing prices until you took out a Dwelling Fairness Line of Credit score (HELOC), did a cash-out refinance, or carried out a reverse mortgage.

In early retirement, it’s good to depend on passive earnings or liquidating belongings to cowl your bills. In conventional retirement, Social Safety advantages and pensions present further assist, lowering the reliance on these methods.

Letting Go of a Strict Definition of Monetary Independence and Withdrawing Extra

A remaining strategy to the 25X annual bills debate is to let go of a inflexible definition of FIRE: your investments generate sufficient earnings to cowl your residing bills. As a substitute, construct a web value of not less than 25X your annual bills and easily withdraw at a 4% (or doubtlessly increased) price, no matter what anyone thinks.

Invoice Bengen’s 4% rule, established in his 1994 examine, assumes retirement at age 65. Bengen discovered that retirees starting at this age might safely withdraw 4% of their retirement portfolio within the first 12 months, then alter yearly for inflation, anticipating the portfolio to final for not less than 30 years—till age 95—with out operating out.

When you plan to retire at 65, you can confidently withdraw at a 4% price or perhaps a 5% price, as Invoice now suggests. Nonetheless, if you’d like your wealth to endure for generations, contemplate decreasing your protected withdrawal price to make sure the sustainability of your monetary legacy.

Method to Calculate Your True Annual Expense A number of Wanted to Retire Early

To find out the true a number of of your annual bills wanted to retire early, you’ll must assess two key elements:

- The minimal annual expense a number of you consider is important for early retirement.

- The proportion of your web value held in income-producing, liquid investments.

Right here’s the way it works:

Let’s assume you consider {that a} web value of 25X your annual bills is enough for early retirement. Nonetheless, solely 70% of your web value is in income-producing, liquid investments. To regulate for this, you need to use the next components:

True Annual Expense A number of = Baseline Annual Expense A number of ÷ Proportion of Web Price in Revenue-Producing, Liquid Investments

For this instance:

True Annual Expense A number of = 25 ÷ 0.7 = 35.7

If 70% of your web value is in income-producing, liquid belongings, you would want a web value of 35.7 occasions your annual bills to attain the identical monetary safety as somebody with 100% of their web value in such belongings.

It’s because the 30% of non-liquid, non-income-producing belongings will not contribute on to producing earnings for bills, so that you want the next total web value to compensate. After all, as you alter your web value composition, you may re-calculate your true annual expense a number of for early retirement.

Concentrate on Constructing Web Price First, Then Money Stream

If you wish to retire earlier, logically, it’s essential to discover a option to obtain a web value goal equal to your true annual expense a number of sooner. This often requires working longer, saving extra, and taking up extra danger.

Additional, the federal government taxes earnings extra closely than funding positive factors, making it extra advantageous to prioritize rising your web value over producing money circulate within the early levels of your monetary journey. Whereas there’s ongoing debate a couple of potential wealth tax, it’s unlikely to turn out to be a actuality anytime quickly.

Solely once you’re able to cease working fully or your energetic earnings sources considerably dwindle ought to producing passive earnings take middle stage.

In our case, my spouse and I don’t have conventional jobs, but we stay aggressive traders. Monetary Samurai, our “X Issue,” supplies supplemental earnings that we didn’t absolutely anticipate once we left our company roles in 2012 and 2015. This extra earnings has allowed us to tackle extra funding danger, reminiscent of specializing in development shares and allocating capital to enterprise funds for personal market publicity.

As we’ve elevated our investments in illiquid belongings, the trade-off has been slower passive earnings development. Someday, Monetary Samurai will come to an finish, and when that point arrives, we’ll pivot to prioritize liquidity and income-generating investments. For now, the technique of constructing web value first permits us the pliability to pursue alternatives whereas conserving future money circulate in thoughts.

Do not Take The 25X A number of For Monetary Independence At Face Worth

Simply as focusing solely on income as an alternative of revenue can mislead in evaluating a enterprise, so can assuming that 25X annual bills is all one wants for monetary independence. Many individuals have web value tied up in houses, development shares, non-public corporations, or collectibles that don’t generate earnings.

Based mostly on my early retirement expertise and that of others pursuing FIRE since 2009, a web value equal to 25X bills usually doesn’t actually present monetary independence. You’ll seemingly end up nonetheless working or in search of new earnings sources.

To really feel genuinely free, contemplate aiming for 40X bills or 20X your common gross earnings over the past three years. Higher but, do the easy math as I proposed in my components above. Whereas these web value targets could seem bold, don’t underestimate the facility of compound returns and disciplined saving.

When you don’t attain these multiples, that’s okay too. Many individuals proceed to earn energetic earnings to fund their way of life targets. However now, I am much more emboldened by these targets because of knowledge from Pew Analysis.

I’ve all the time felt these web value benchmarks have been life like based mostly on my observations. And now, with this nationwide knowledge, my instincts are validated.

Reader Questions And Strategies

Readers, do you assume a web value equal to 25X your annual bills is sufficient to retire early on? Have you ever ever met somebody who did retire early on 25X bills and would not generate any energetic earnings?

Free monetary checkup and $100 present card: In case you have over $250,000 in investable belongings, take benefit and schedule a free session with an Empower monetary skilled right here. Full your two free video calls with the skilled by November 30, 2024, and you may obtain a free $100 Visa present card. There is not any obligation to make use of their companies after.

With a brand new president in workplace, it’s a good time to get a second opinion in your portfolio positioning. Consulting a monetary skilled in 2013 helped me develop my web value by a further $1 million. If I met with one at present, I’m certain they’d suggest a extra balanced portfolio. However I’m a risk-taker at coronary heart.

The assertion is supplied to you by Monetary Samurai (“Promoter”) who has entered right into a written referral settlement with Empower Advisory Group, LLC (“EAG”). Click on right here to study extra.