At present’s Animal Spirits is delivered to you by KraneShares and Cloth:

See right here for extra on KraneShares AI and Tech ETF

Go to meetfabric.com/spirits for extra info on life insurance coverage from Cloth by Gerber Life

Get a random Animal Spirits chart right here

See right here for extra info on Exhibit A

On as we speak’s present, we talk about:

Pay attention right here

Suggestions:

Charts:

Tweets/Bluesky:

A chilly e mail one yr in the past modified my life.

With out it, Exhibit A wouldn’t exist. Right here’s our story:Round this time final yr, @michaelbatnick, @Downtown, @Ritholtz, @awealthofcs, and @krisvenne gave me the chance to reinforce @TheCompoundNews and @RitholtzWealth‘s chart…

— Matt Cerminaro (@mattcerminaro) March 20, 2025

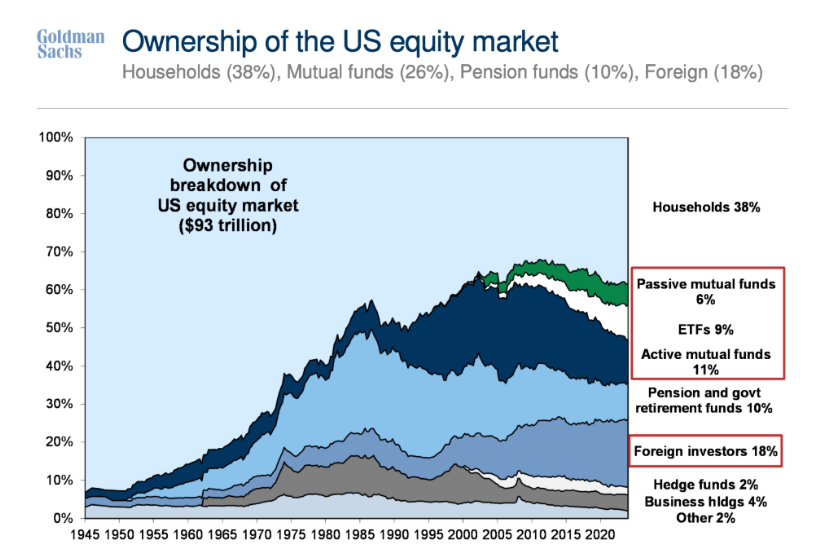

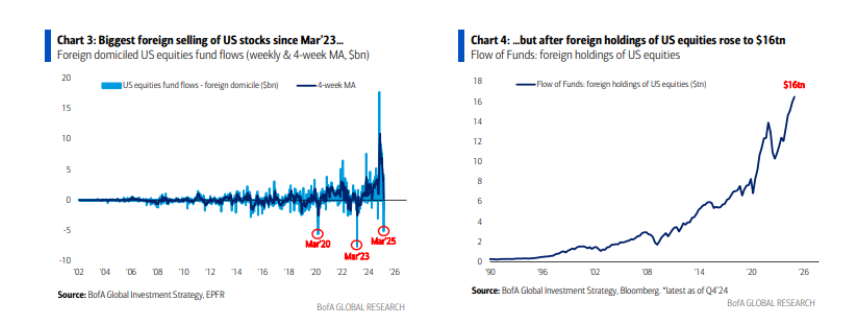

American households have by no means been extra uncovered to the danger of a inventory market selloff. On the finish of final yr, they held $38 trillion in listed equities. Inventory wealth now runs to 170% of disposable revenue, greater than double the long-term common pic.twitter.com/ueNhsWpplD

— Mike Hen (@Birdyword) March 19, 2025

US households personal shares.

UK, Euro Space not a lot. pic.twitter.com/4jwmE0hlm7— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 19, 2025

19 shares within the Russell 1,000 have been “100-baggers” over the past 25 years (for the reason that 3/24/00 Dot Com peak).

Monster Beverage $MNST is the one 1,000-bagger.

It is from all Tech. Apple $AAPL sits between a farm provide retailer $TSCO and an auto elements retailer $ORLY. pic.twitter.com/hbJd1dwQhu

— Bespoke (@bespokeinvest) March 24, 2025

New scorching sauce taste simply dropped: VistaShares with a submitting for a Animal Spirits ETF (ANIM) and a 2x Animal Spirits ETF (WILD) which is able to maintain the 5 fastest-growing 2x single inventory ETFs. pic.twitter.com/CeRuq1YDgS

— Eric Balchunas (@EricBalchunas) March 18, 2025

Here is the common intraday path of the S&P on Fed Days by Fed Chair. If the buying and selling day ended at 2:45 PM ET, Powell can be the 2nd greatest in historical past. Nevertheless it does not… pic.twitter.com/TnP9XjeEmr

— Bespoke (@bespokeinvest) March 19, 2025

Homebuilder incentives are one of many harder historic knowledge units to trace persistently. Right here’s what Lennar $LEN (the second greatest builder in America) has publicly reported on this metric since 2009.

For the latest quarter by means of February, incentives hit 13%. pic.twitter.com/RIMFx8oQ55

— Rick Palacios Jr. (@RickPalaciosJr) March 23, 2025

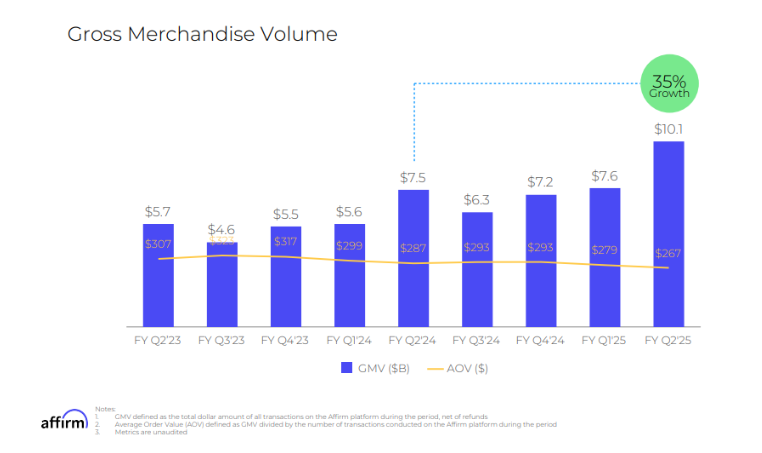

what do you imply you have got $11k in “doordash debt” pic.twitter.com/pu1h8GqdZg

— adam 🇺🇸 (@personofswag) March 20, 2025

We’re promoting pad thai in installments to prepared consumers on the present honest market value https://t.co/9cA6hQDbYg pic.twitter.com/p2fZU419G7

— Axial Wanderer (@EricWollberg) March 20, 2025

“They’re known as Chimichanga Default Swaps” pic.twitter.com/uXNu85dSJw

— 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 (@EffMktHype) March 21, 2025

The center class is shrinking as a result of many individuals are getting too wealthy to stay center class pic.twitter.com/dEK9ArL2nv

— Chris Freiman (@cafreiman) March 23, 2025

Comply with us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Nothing on this weblog constitutes funding recommendation, efficiency knowledge or any suggestion that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular individual. Any point out of a selected safety and associated efficiency knowledge shouldn’t be a suggestion to purchase or promote that safety. Any opinions expressed herein don’t represent or indicate endorsement, sponsorship, or suggestion by Ritholtz Wealth Administration or its workers.

The Compound, Inc., an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities entails the danger of loss. Nothing on this web site ought to be construed as, and is probably not utilized in reference to, a suggestion to promote, or a solicitation of a suggestion to purchase or maintain, an curiosity in any safety or funding product

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here might be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.