As we speak’s Animal Spirits is delivered to you by YCharts and Material:

See right here for YCharts restricted time deal for the YCharts platform

Go to meetfabric.com/spirits for extra data on life insurance coverage from Material by Gerber Life

Get a random Animal Spirits chart right here

On as we speak’s present, we talk about:

Hear right here

Suggestions:

Charts:

Tweets/Bluesky:

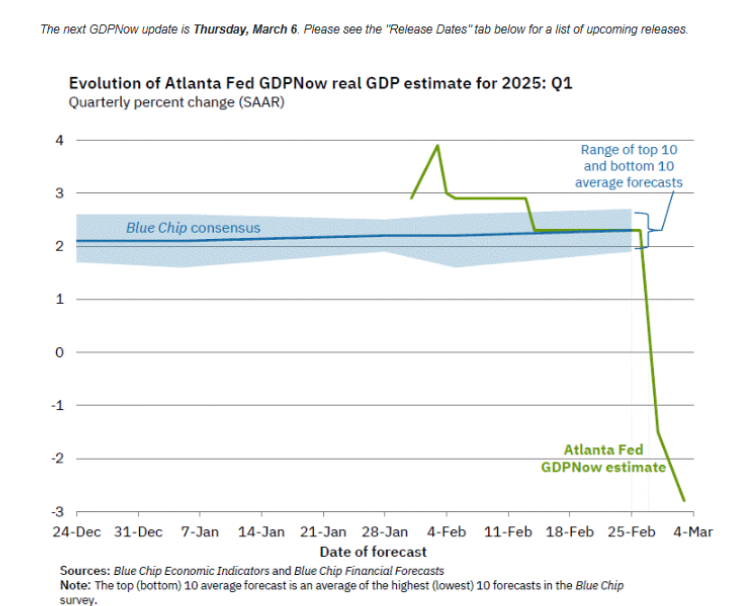

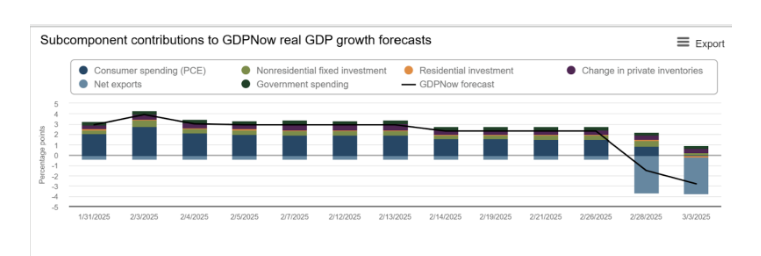

Until all of us get up from this collective tariffs nightmare, the truth is recession. Recession with inflation, which known as stagflation. It is the worst form of recession, as a result of folks lose their jobs and costs keep excessive together with rates of interest.

— Daryl Fairweather ⛅ (@FairweatherPhD) March 4, 2025

Goal: “In gentle of ongoing client uncertainty & a small decline in February Web Gross sales, mixed with tariff uncertainty….the Firm expects to see significant YoY revenue stress in its Q1 relative to the rest of the yr…” $TGT pic.twitter.com/lf5CrFCydP

— The Transcript (@TheTranscript_) March 4, 2025

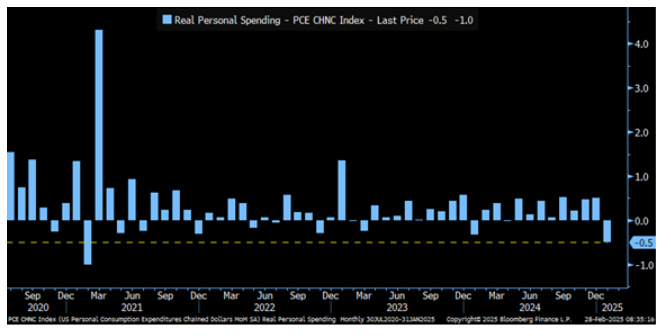

Actual private spending fell by probably the most since 2021. pic.twitter.com/s0sYzuaLuk

— Kathy Jones (@KathyJones) February 28, 2025

Individuals saved 4.6% of their after-tax revenue in January, up from 3.5% in December.https://t.co/eDZgP9dKNk

— BEA Information (@BEA_News) February 28, 2025

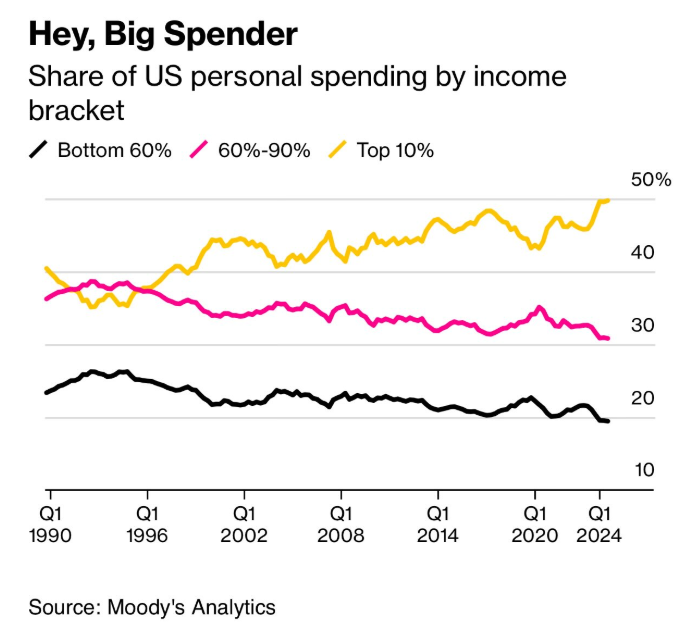

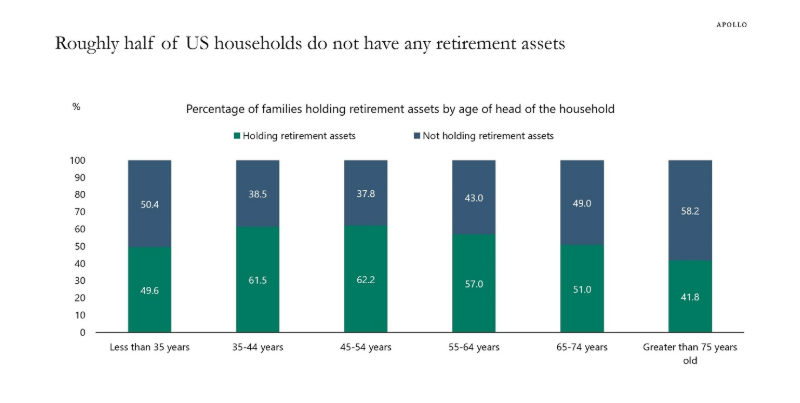

1. Trump is extra widespread with younger folks than previous folks. Most younger folks don’t personal shares or properties (aka they’re asset-light).

2. Trump can be extra widespread amongst working and center class people. Most of those people are additionally asset-light.

It stands to motive {that a} fall…

— Chamath Palihapitiya (@chamath) March 3, 2025

DoorDash has turned the nook to profitability and nonetheless continues to develop its order quantity.

Whole orders are actually up 735% during the last 5 years.$DASH pic.twitter.com/fqdVuYwCeP

— FinChat (@finchat_io) February 11, 2025

No one introduced a tax or a spending program. Perhaps it’s best to wait to seek out out what’s really being proposed. https://t.co/TNBFxoYVjz

— David Sacks (@DavidSacks) March 3, 2025

Appropriate. I bought all my cryptocurrency (together with BTC, ETH, and SOL) previous to the beginning of the administration. https://t.co/dN6nuGQUtu

— David Sacks (@DavidSacks) March 3, 2025

Noticed the Trump assertion as we speak, similar as everybody else —

I imagined a Strategic Reserve can be simply Bitcoin. That makes probably the most sense to me.

Many crypto property have deserves, however what we’re speaking about right here is not a US funding portfolio — we’re speaking a few reserve, and… https://t.co/YwLBBCt55y

— Hunter Horsley (@HHorsley) March 3, 2025

U.S. pending house gross sales have fallen to a brand new all-time low pic.twitter.com/dxKfa5OA8n

— Kevin Gordon (@KevRGordon) February 27, 2025

Netflix has taken the largest hit. eMarketer’s evaluation (see chart under) makes that abundantly clear. For the reason that first quarter of 2024 (i.e. when Prime Video launched advertisements), Netflix CPMs have fallen greater than these of Prime Video, Disney+, Max, Peacock and Hulu. pic.twitter.com/k9xh0aZDOZ

— Kourosh (@kouroshshafi) February 25, 2025

Observe us on Fb, Instagram, and YouTube.

Try our t-shirts, espresso mugs, and different swag right here.

Subscribe right here:

Nothing on this weblog constitutes funding recommendation, efficiency knowledge or any advice that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular particular person. Any point out of a specific safety and associated efficiency knowledge isn’t a advice to purchase or promote that safety. Any opinions expressed herein don’t represent or indicate endorsement, sponsorship, or advice by Ritholtz Wealth Administration or its workers.

The Compound, Inc., an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investing in speculative securities includes the danger of loss. Nothing on this web site ought to be construed as, and will not be utilized in reference to, a suggestion to promote, or a solicitation of a suggestion to purchase or maintain, an curiosity in any safety or funding product

This content material, which accommodates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.