.bh__table_cell { padding: 5px; background-color: #dddddd; }

.bh__table_cell p { colour: #222222; font-family: ‘Helvetica’,Arial,sans-serif !necessary; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#dddddd; }

.bh__table_header p { colour: #222222; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !necessary; overflow-wrap: break-word; }

Commercial

100 Capital Environment friendly Corporations. 1 Value-Environment friendly ETF.

Searching for a compelling different to market-cap weighted index funds? TMFE takes 100 high-conviction shares from The Motley Idiot, LLC analysts and weights them in keeping with three components: profitability, stability, and progress.**TMFE is distributed by Quasar Distributors, LLC. Fund is topic to dangers.Be taught extra about TMFE |

Right now's Animal Spirits is delivered to you by Innovator ETFs by CBOE:

See right here for extra info on Innovator's end result oriented ETFs

See right here for tickets to The Compound and Pals stay in Chicago!

Get a random Animal Spirits chart right here The Compound Podcasts:

On at the moment’s present, we talk about:

-

'I May Lose It All Tomorrow': The Merchants Leaning In to Wild Markets

-

Trump softens tariff tone amid empty cabinets warning, market stoop

-

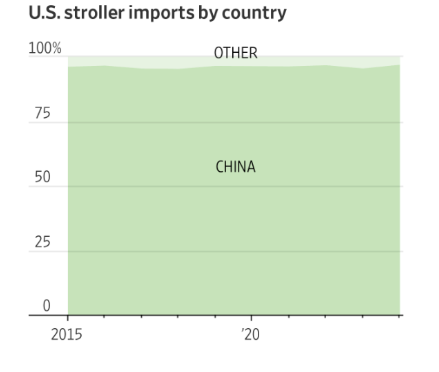

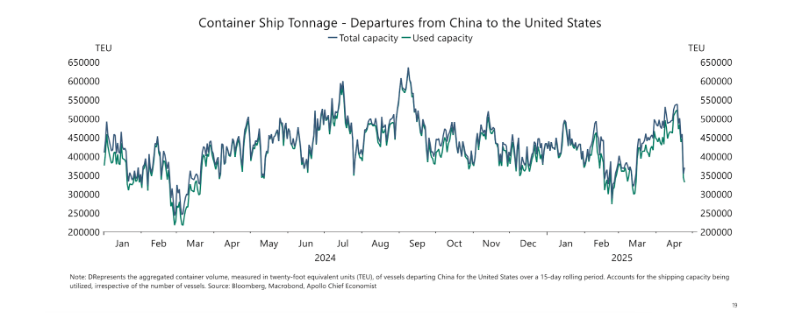

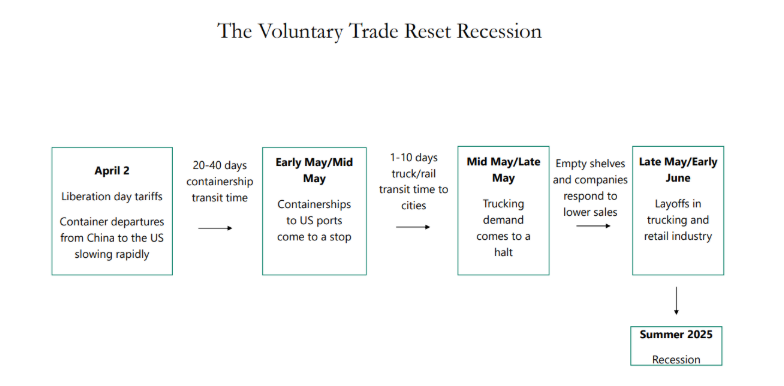

Cargo Shipments From China to U.S. Slide Towards a Standstill

-

People Are Downbeat on the Economic system. They Preserve Spending Anyway.

-

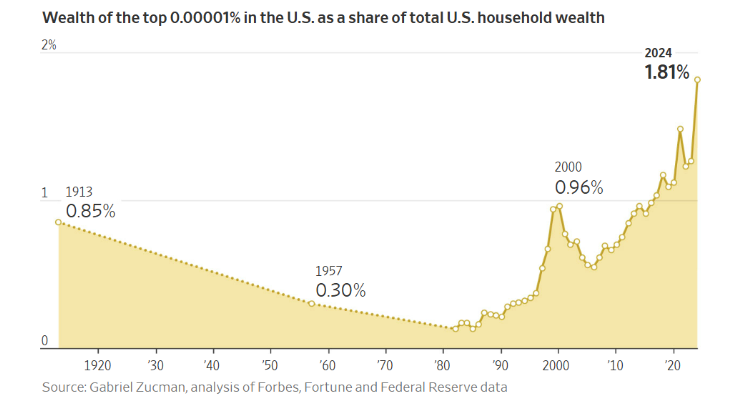

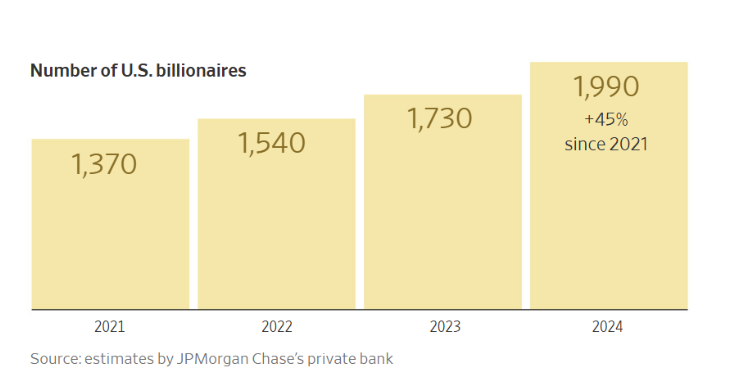

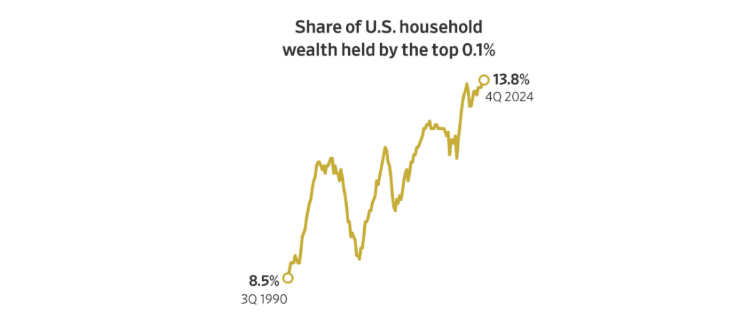

$1 Trillion of Wealth Was Created for the 19 Richest U.S. Households Final Yr

-

How 'Yellowstone' Turned a $3 Billion Franchise – and The place It Goes Subsequent

Charts:

Tweets:

The uncommon Zweig Breadth Thrust (ZBT) triggered at the moment.

Marty Zweig found this sign and it has an ideal monitor document (utilizing NYSE knowledge from NDR).

This sign has been 100% correct since WWII, with the S&P 500 increased 6- and 12-months later each single time. 19 for 19.

— Ryan Detrick, CMT (@RyanDetrick)

4:14 AM • Apr 25, 2025

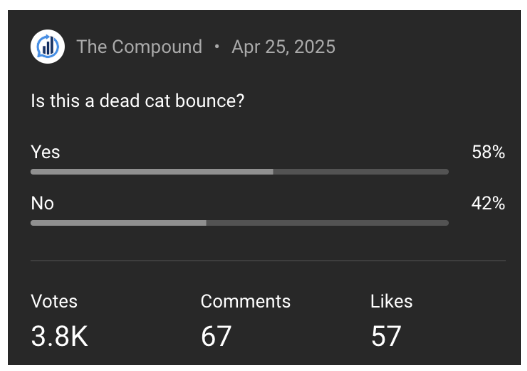

The S&P 500 is up at the very least 1.5% for 3 days in a row.

This is not stuff you see in bear market rallies or quick overlaying rallies. You see this earlier than instances of robust efficiency.

Larger 10 out of 10 instances a 12 months later and up 21.6% on common.

— Ryan Detrick, CMT (@RyanDetrick)

3:26 AM • Apr 25, 2025

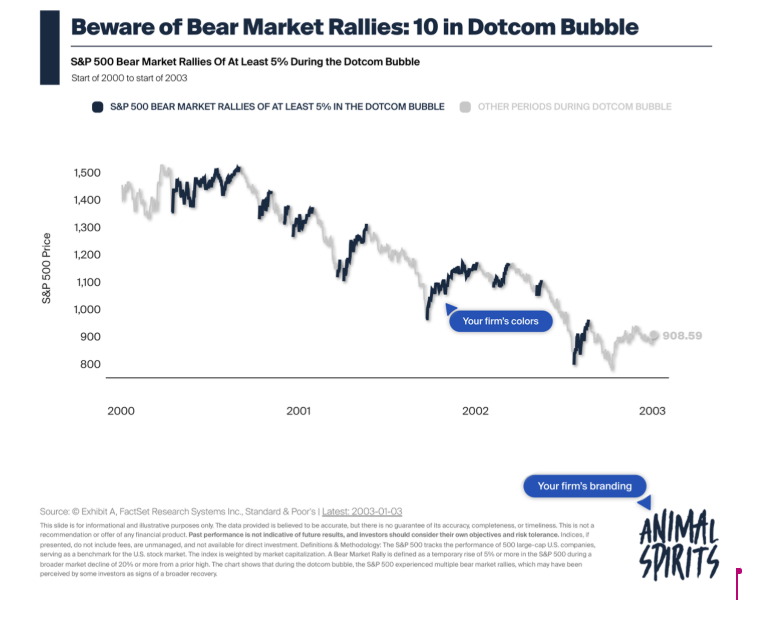

To say this another time, what we have seen the previous two weeks is not what you see in bear market rallies.

Greater than 70% advancers on the NYSE six instances over the previous 10 days. By no means decrease 6- and 12-months later for the S&P 500.

— Ryan Detrick, CMT (@RyanDetrick)

3:45 AM • Apr 25, 2025

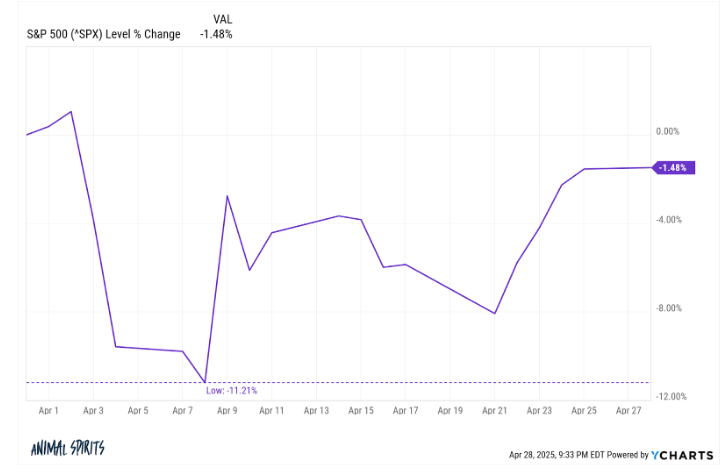

Up to now 15 buying and selling days the S&P 500 has seen runs of:

-12.1% (in 4 days)

+9.5% (1 day)

-5.5% (7 days)

+6.3% (3 days)

Like 4 months in lower than one

— Ben Carlson (@awealthofcs)

3:18 AM • Apr 25, 2025

NOTHING TO SEE HERE FOLKS

THIS IS COMPLETELY NORMAL AND HEALTHY

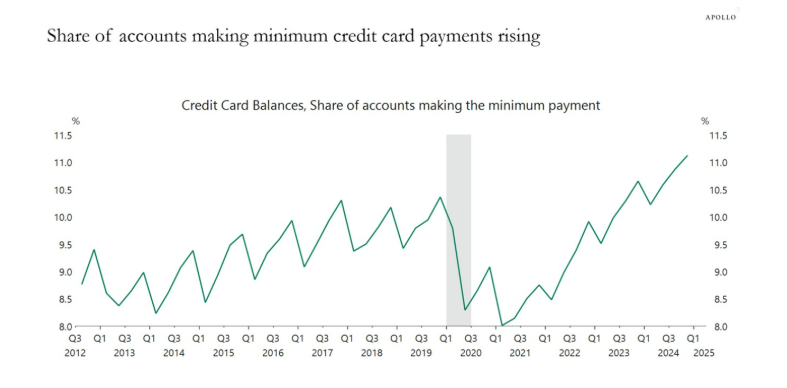

HAVE THEY CONSIDERED CUTTING AVOCADO TOAST OUT OF THEIR BUDGET

— Lance Lambert (@NewsLambert)

3:52 AM • Apr 23, 2025

Who else is worked up to see how we repair these issues? The USA’s “damaged” financial system:

#1 in whole wealth.

#1 in whole GDP.

#1 in GDP progress within the G7.

#1 in international company earnings.

#1 in GDP per capita within the G20.— Cullen Roche (@cullenroche)

2:39 PM • Apr 22, 2025

Suggestions:

Contact us at animalspirits@thecompoundnews.com with any suggestions, suggestions, or questions.

Observe us on Fb, Instagram, and YouTube.

Try our t-shirts, espresso mugs, and different swag right here.

Subscribe right here: