Aggressive stress, elevated capital availability (even with present charges), and the evolving enterprise panorama (thanks partly to the pandemic) have created a chance for impartial insurance coverage brokers (IAs) to get inventive to develop and stay impartial within the insurance coverage business.

As such, many IAs have sought out company networks that present advantages traditionally tougher to come back by as a standalone enterprise / company. For carriers, understanding the function of company networks and why they’re essential will probably be vital for the efficient use of this distribution construction. Figuring out why companies be part of and change networks may also assist carriers make strategic decisions for the longer term.

We are going to now discover these subjects together with the advantages of company community participation and the way carriers ought to reply to this rising distribution pattern.

To kick issues off, let’s talk about the aggressive stress and elevated capital availability that’s more and more inflicting companies to hunt out networks.

The “loss of life” of the agent has been significantly exaggerated

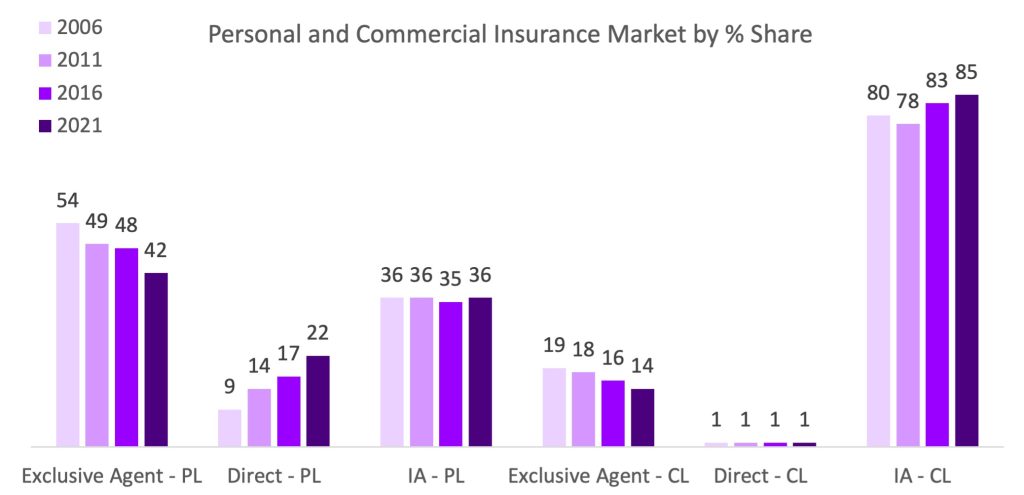

For twenty years, the business has centered on the influence of direct and different distribution, resembling insurance coverage embedded into the acquisition technique of a automobile and different point-of-sale gives. Our analysis exhibits that IAs stay the dominant channel, particularly in industrial strains.

Supply: Impartial Insurance coverage Brokers & Brokers of America

It’s our perspective that IAs will proceed to develop their market share and broaden their relevancy as exposures improve in complexity and industrial working preparations proceed to evolve. In brief, the “loss of life” of the agent has been significantly exaggerated.

Evolving landscapes and operational calls for add stress

Whereas IAs stay dominant, a number of forces proceed to influence this channel, together with:

- Personal fairness funding: Company consolidation is quickly rising pushed by personal fairness funding, and regardless of the rate of interest hike slowing a number of the M&A market, the deal pipeline stays wealthy and capital stays accessible for goal companies

- Change in work atmosphere: The digital or hybrid work atmosphere requires higher capabilities than ever earlier than for companies to function, retain good expertise, and so forth., which is each a talent and functionality hole for a lot of company homeowners

- Continued competitors for expertise: Regardless of the expansion of different staffing fashions (e.g., momentary or gig staff, digital workforces), IAs are challenged to safe and retain the expertise they should run their enterprise; additional, the common age of producers and account administration workers exceeds 50, indicating youthful expertise isn’t becoming a member of the insurance coverage workforce at a enough fee for the approaching waves of retirement

- Prospecting has “gone digital”: The need for IAs to be “open for enterprise” on all channels a prospect or buyer chooses makes the necessity for an internet presence vital. As such, the need for digital advertising capabilities have elevated considerably, leaving IAs searching for steering on how one can execute one of the best digital technique

When mixed, these elements have modified the taking part in area and shifted engagement fashions throughout the business. The efficiency hole between small- to mid-sized impartial companies and bigger company/brokerage roll-ups has widened with bigger gamers utilizing their capital to purchase enhanced capabilities required to outperform the competitors.

Company networks degree the taking part in area for IAs

Merely put, networks assist bridge the hole created by these elements for brokers that wish to be aggressive whereas remaining impartial. Many networks provide totally different capabilities (e.g., advertising, coaching, expertise) and supply entry to elevated compensation (by means of pooling premiums to beat entry gates for elevated base and variable compensation) in alternate for a payment. This construction permits small and mid-sized IAs to compete on a extra degree taking part in area with bigger standalone companies and company roll-ups. Moreover, community constructions have supplied a compelling different for EA’s to get one of the best of each worlds – they’re able to get alternative of carriers whereas additionally receiving the enterprise and operational assist they want from their community. This has supplied an alternate for historic EA expertise rising the pool of viable IAs reinforcing the worth networks are including.

These benefits imply networks are solely rising in reputation. There are practically 40,000 impartial companies in america as of 2022, a rise of 4,000 from 2020. It isn’t shocking to us, given 2/3 of companies have <$500k in income and will reap advantages from becoming a member of up with different companies, {that a} tremendous majority of companies are in an company community. Our survey of 500 IAs throughout the U.S. exhibits that over 70% of companies take part in one of many roughly 150 networks.

And what’s the value for carriers?

That’s one of many burning questions. What does this speedy enlargement of networks and their rising energy within the market imply for the business? What concerning the ensuing influence on complete value of distribution?

Whereas the rise of company networks is basically constructive for IAs, there’s a excessive value for carriers. To interact with networks and stability the advantages vs. prices, carriers will want a deeper understanding of key IA challenges and why they’re becoming a member of networks.

What’s driving companies to affix networks?

A typical false impression is that impartial brokers (IAs) be part of networks solely to extend income. The reality is that these networks provide extra advantages past income and could be useful to carriers too.

The drive for companies to affix networks is multi-layered. Figuring out why companies be part of networks can assist carriers make strategic decisions for the longer term. For a deeper understanding of the important thing motivations, we should contemplate the challenges and targets of companies.

At present’s key challenges and targets for insurance coverage companies

Evergreen challenges of standalone IAs have gotten exacerbated by operational calls for described earlier on this submit. We see this throughout 4 dimensions:

- Talent: The skillsets wanted to handle the enterprise come on the expense of skillsets wanted to develop the enterprise. Additional, companies have had issue maintaining with tech abilities required to accumulate and serve clients digitally

- Scale: Smaller measurement makes it troublesome for companies to draw and retain expertise and obtain leverage with carriers

- Scope: Whereas a key worth proposition for companies is their breadth of product, many smaller companies lack capability to grasp a big number of merchandise and types; additional their smaller worker base means they will’t have specialised roles and should deploy generalist mannequin

- Capital: Investing in capabilities and instruments that may allow differentiated talent, scale, or scope requires capital that’s out of attain for a lot of IAs

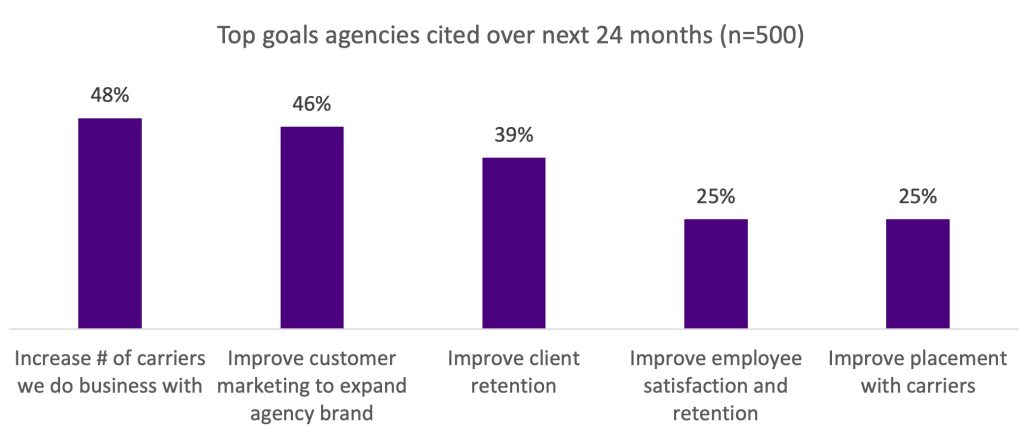

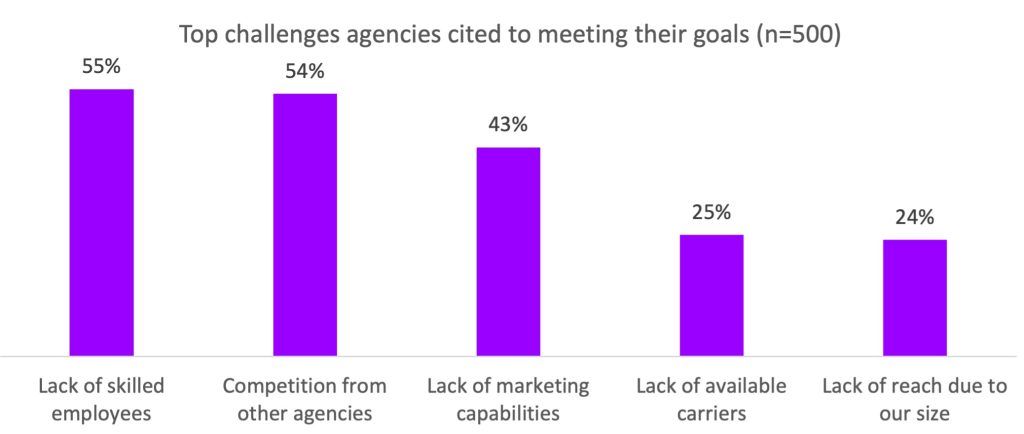

So, we weren’t stunned once we requested companies about their targets and challenges that the dearth of expert staff (talent), competitors from different companies (scale, scope, and capital), and lack of promoting capabilities (talent, capital) have been the highest three challenges stopping companies from attaining their principal targets of development and elevated retention.

Company networks have moved in as a useful possibility to deal with these challenges and targets.

High three causes impartial insurance coverage companies be part of company networks

Our analysis discovered that networks delivered on three major targets: Expertise, Advertising and marketing sophistication, and Service entry and breadth.

1. Construct expertise:

IAs usually lack the dimensions and assets for efficient recruiting, coaching, and worker improvement. Greater than 55% of our respondents say discovering staff with the precise skillsets is a major problem. Companies additionally face extra challenges in offering aggressive compensation and advantages, coaching, and workers improvement.

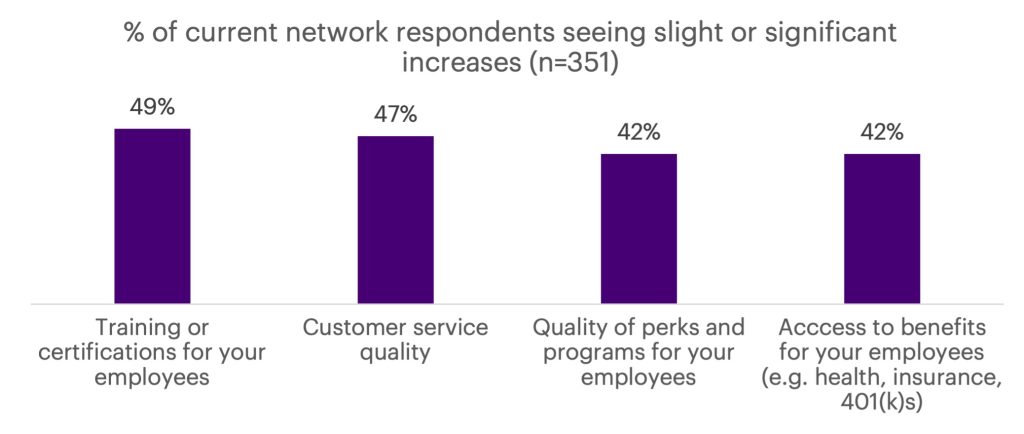

Community members from our survey noticed enhancements to their expertise issues in each the experiences they have been in a position to ship to their clients (e.g., service high quality attributable to upskilling or entry to customer support capabilities) in addition to advantages that allowed for additional upskilling and retaining of staff.

2. Entry extra advertising capabilities:

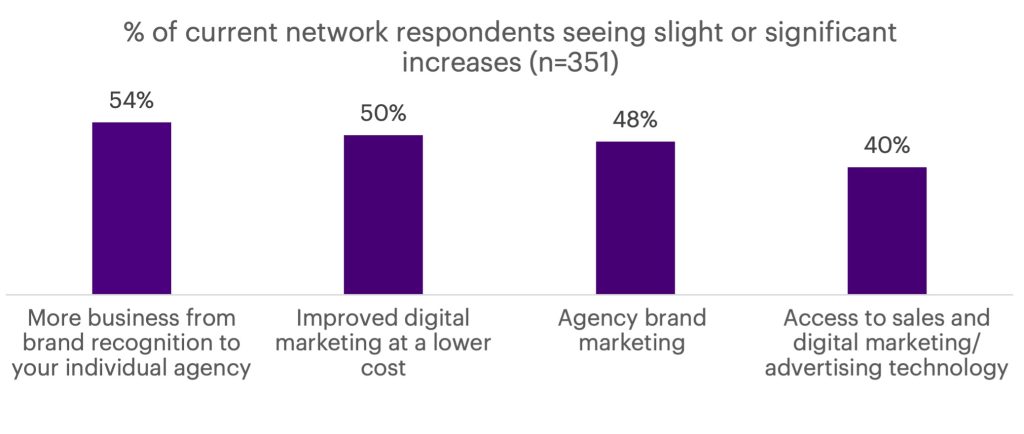

With at this time’s “at all times on, at all times open” tradition, an internet presence is important. The digitally pushed market has elevated advertising complexity for IAs. As with the opposite themes, brokers who belong to associations say they’ve benefited from becoming a member of, however alternative for enchancment stays. Roughly 50% of survey respondents say constructing extra advertising capabilities is each a near-term precedence and a problem for his or her companies in driving extra development.

A rise in IA model consciousness was highlighted by impartial brokers that have been a part of networks because of the reference to their nationwide community model. Moreover, IAs inside networks have been in a position to entry cheaper digital advertising and higher expertise for advertising.

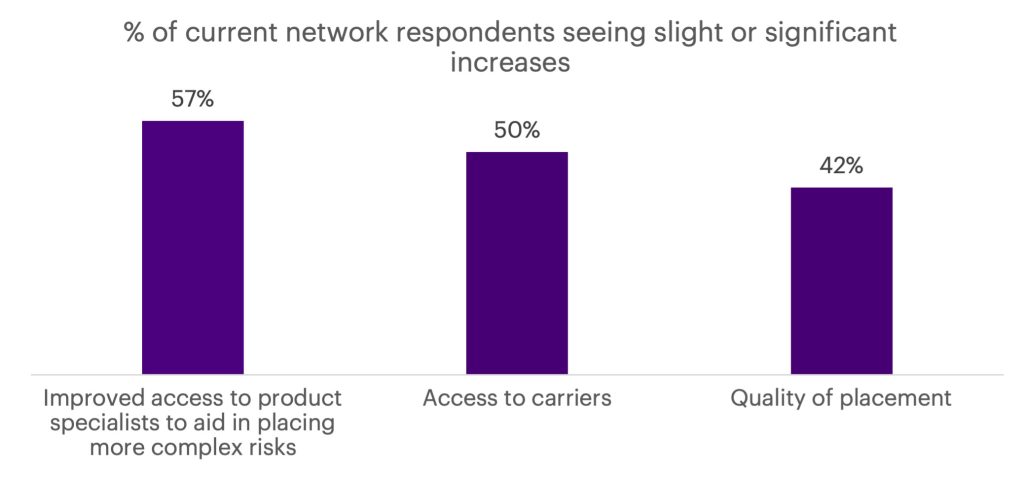

3. Enhance provider entry and breadth:

We discovered that 48% of IAs wish to improve the variety of carriers they do enterprise with. One other 25% of IAs spotlight the dearth of obtainable carriers, and 23% say the dearth of aggressive merchandise stay limitations to assembly their targets. Given the significance to the IA channel’s worth proposition of the flexibility to put enterprise with a number of carriers throughout a spectrum of product choices and worth factors, this presents vital alternatives for networks and carriers alike.

In actual fact, 91% of our respondents agree company networks permit for smaller companies to have higher placement or servicing choices. Companies say they’re able to acquire entry to extra carriers by way of their networks and that they’ve entry to specialists for complicated dangers.

Contemplating these findings, at this time’s participation fee of IAs in networks isn’t a surprise. In response to the participation fee, carriers should decide one of the best methods to have interaction and leverage networks to satisfy their very own targets.

4 methods carriers can unlock advantages by means of company networks

Whereas networks have been largely constructive for IAs, they’ve induced a rise within the complete value of distribution for carriers who’re paying extra, in some instances, for enterprise they already had on the books. To defend profitability, carriers should take a look at methods to maximise their very own advantages from company networks.

Let’s take a look at 4 methods to do that:

1. Create compensation plans that profit each companions

To maximise the dimensions of networks and keep away from overpaying for efficiency not aligned to the provider’s targets, carriers can create easy and clear base & variable compensation applications for companies that drive desired company conduct. For instance:

- Join will increase in community entry charges (overrides) to will increase in mutually helpful outcomes for a pay-for-performance method.

- Require the community to offer the manufacturing companies throughout the community with a portion of the entry payment—not simply the variable compensation or revenue share fee.

2. Handle the talent and expertise gaps

Companies want assist to develop abilities and expertise which might be vital for his or her enterprise. Whereas networks fill a number of the gaps, carriers ought to contemplate creating partnerships during which companies can use expertise and non-carrier particular methods to enhance effectivity. For instance:

- Digital advertising coaching for workers

- Self-service consumer capabilities that scale back operational workload

- Use of generative AI to rapidly and precisely reply to an company’s request the primary time

3. Complement, don’t replicate

There are a whole bunch of company networks vying to offer capabilities and advantages to the 40,000+ IA market. Carriers ought to contemplate the capabilities supplied to brokers by the community and the place the provider can fill the hole. This requires understanding the networks which might be most influential within the provider’s distribution technique and what they supply to their companies. Carriers can then take a deeper take a look at the place they will step in to enrich their capabilities.

4. Choose winners and associate

As a result of networks can be utilized as a significant path for development within the context of a broader distribution technique, carriers ought to establish the set of networks that may assist their enterprise targets. Moreover, creating an engagement mannequin suited to that community associate and aligning on how they are going to collectively present for company wants will probably be essential steps for achievement.

Company networks are a drive inside insurance coverage distribution that’s large and getting larger. These networks present tangible advantages to companies that assist them meet their targets and handle challenges. Carriers are already partnering with these networks at this time, and by acknowledging how carriers can complement and incent networks, carriers can use company networks as a significant lever to realize their targets, in service of their broader Complete Enterprise Re-invention.