Commercial

Construct Your RIA Your Approach with Betterment Advisor Options

Betterment Advisor Options is the all-in-one custodial platform purpose-built for impartial RIAs. Get the know-how and help to serve extra shoppers, extra effectively, throughout investing, retirement, and money. |

As we speak’s Discuss Your E book is dropped at you by VanEck:

See right here for extra data on VanEck’s Goldminer technique

-

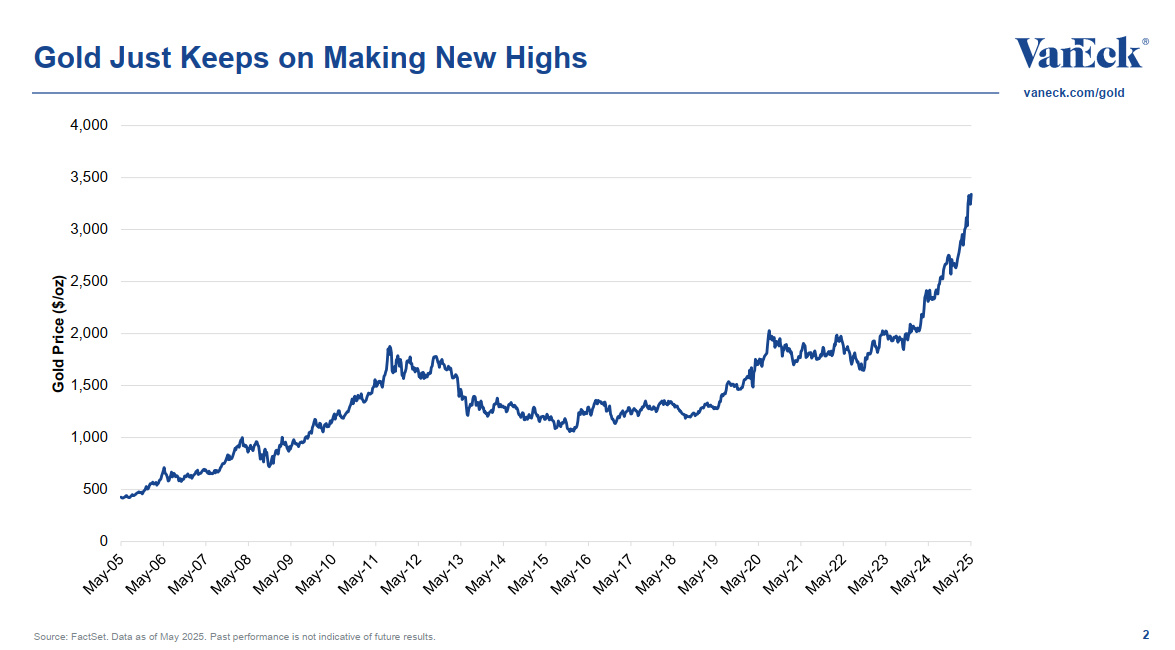

Gold making new all time highs

-

The distinction between investing in gold vs investing in gold miners

-

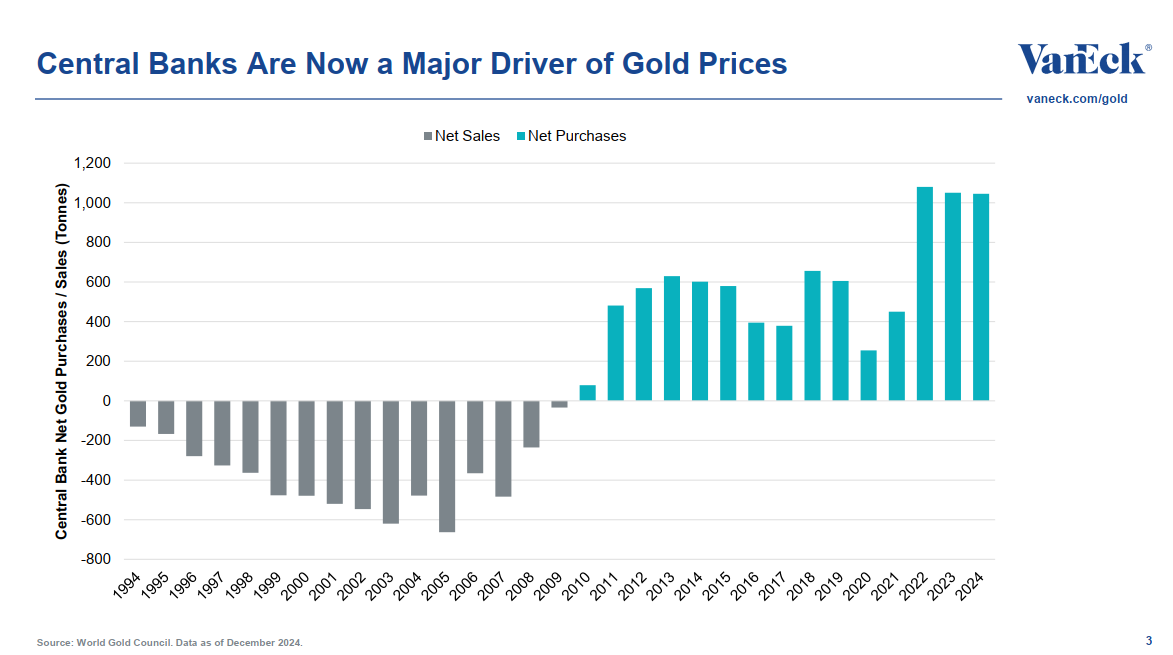

Central banks driving costs greater

-

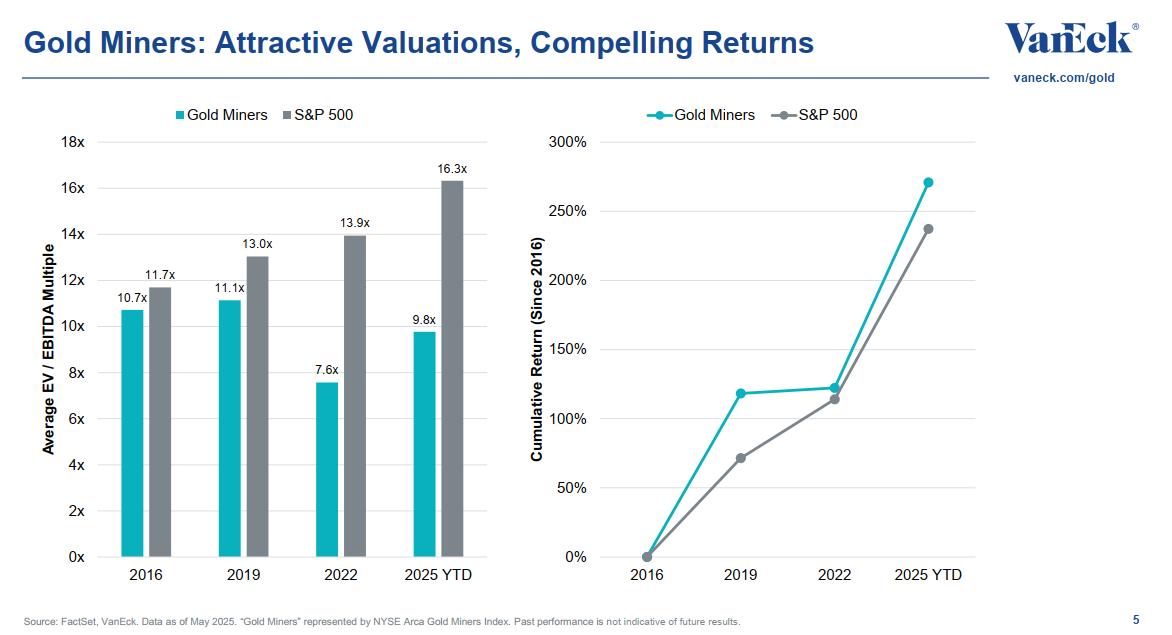

Gold miner valuation

-

Financial circumstances and gold miners

Try our t-shirts, espresso mugs, and different swag right here.

This isn’t a proposal to purchase or promote, or a suggestion to purchase or promote any of the securities, monetary devices or digital property talked about herein. The data offered doesn’t contain the rendering of customized funding, monetary, authorized, tax recommendation, or any name to motion. Sure statements contained herein could represent projections, forecasts and different forward-looking statements, which don’t replicate precise outcomes, are for illustrative functions solely, are legitimate as of the date of this communication, and are topic to vary with out discover. Precise future efficiency of any property or industries talked about is unknown. Data supplied by third occasion sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. VanEck doesn’t assure the accuracy of third-party knowledge. The data herein represents the opinion of the creator(s), however not essentially these of VanEck or its different staff.

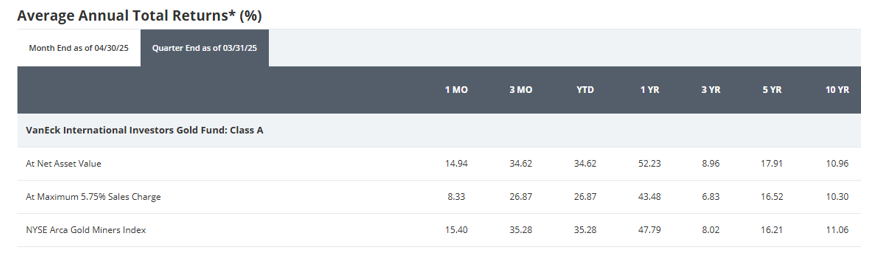

VanEck Worldwide Traders Gold Fund Standardized Efficiency

*Returns lower than one 12 months usually are not annualized.

The efficiency knowledge quoted represents previous efficiency. Previous efficiency is just not a assure of future outcomes. Funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when redeemed, could also be price roughly than their unique price. Efficiency could also be decrease or greater than efficiency knowledge quoted. Please name 800.826.2333 or go to vaneck.com for efficiency present to the latest month ended.

The “Web Asset Worth” (NAV) of a Fund is decided on the shut of every enterprise day, and represents the greenback worth of 1 share of the fund; it’s calculated by taking the full property of the fund, subtracting complete liabilities, and dividing by the full variety of shares excellent. Traders mustn’t count on to purchase or promote shares at NAV.

Bills: Class A: Gross 1.42% and Web 1.42%. Bills are capped contractually by 05/01/26 at 1.45% for Class A. Funding returns and Fund share values will fluctuate in order that traders’ shares, when redeemed, could also be price roughly than their unique price. Fund returns assume that dividends and capital beneficial properties distributions have been reinvested within the Fund at NAV.

Please notice that treasured metals costs could swing sharply in response to cyclical financial circumstances, political occasions or the financial insurance policies of varied nations.

You may lose cash by investing within the VanEck Worldwide Traders Gold Fund (INIVX). Any funding within the Fund must be a part of an general funding program, not an entire program. The Fund is topic to dangers which can embody, however usually are not restricted to, dangers related to energetic administration, commodities and commodity-linked devices, commodities and commodity-linked devices tax, derivatives, direct investments, rising market issuers, ESG investing technique, international foreign money, international securities, gold and silver mining firms, market, non-diversified, operational, regulatory, investing in different funds, small- and medium-capitalization firms, particular danger concerns of investing in Australian and Canadian issuers, subsidiary funding danger, and tax dangers (with respect to investments within the Subsidiary), all of which can adversely have an effect on the Fund. Rising market issuers and international securities could also be topic to securities markets, political and financial, funding and repatriation restrictions, completely different guidelines and rules, much less publicly accessible monetary data, international foreign money and change charges, operational and settlement, and company and securities legal guidelines dangers. Small- and medium-capitalization firms could also be topic to elevated dangers. Derivatives could contain sure prices and dangers equivalent to liquidity, rate of interest, and the chance {that a} place couldn’t be closed when most advantageous. Investments within the gold business may be considerably affected by worldwide financial, financial and political developments. The Fund’s general portfolio could decline in worth as a result of developments particular to the gold business.

An funding within the VanEck Gold Miners ETF (GDX) and VanEck Junior Gold Miners ETF (GDXJ) could also be topic to dangers which embody, however usually are not restricted to, dangers associated to investments in gold and silver mining firms, particular danger concerns of investing in Australian and Canadian issuers, international securities, rising market issuers, international foreign money, depositary receipts, micro-, small- and medium-capitalization firms, fairness securities, market, operational, index monitoring, licensed participant focus, no assure of energetic buying and selling market, buying and selling points, passive administration, fund shares buying and selling, premium/low cost danger and liquidity of fund shares, non-diversified, and index-related focus dangers, all of which can adversely have an effect on the Funds. Rising market issuers and international securities could also be topic to securities markets, political and financial, funding and repatriation restrictions, completely different guidelines and rules, much less publicly accessible monetary data, international foreign money and change charges, operational and settlement, and company and securities legal guidelines dangers. Micro-, small- and medium-capitalization firms could also be topic to elevated dangers.

Investing includes substantial danger and excessive volatility, together with doable lack of principal. An investor ought to think about the funding goal, dangers, expenses and bills of a Fund rigorously earlier than investing. To acquire a prospectus and abstract prospectus, which comprise this and different data, name 800.826.2333 or go to vaneck.com. Please learn the prospectus and abstract prospectus rigorously earlier than investing.

© Van Eck Securities Company, Distributor, a wholly-owned subsidiary of Van Eck Associates Company

Nothing on this weblog constitutes funding recommendation, efficiency knowledge or any suggestion that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular particular person. Any point out of a selected safety and associated efficiency knowledge is just not a suggestion to purchase or promote that safety. Any opinions expressed herein don’t represent or suggest endorsement, sponsorship, or suggestion by Ritholtz Wealth Administration or its staff.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investing in speculative securities includes the chance of loss. Nothing on this web site must be construed as, and is probably not utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product.