I just lately attended a charitable planning convention that introduced collectively the highest professionals from the charitable improvement sector with skilled attorneys, monetary planners and accountants who work with charitably minded purchasers. One of the crucial well-attended classes was a panel targeted on progressive methods to generate fast charitable presents past the usual methods, particularly through the use of non-cash property. The session description included a piece associated to an orderly course of for managing and maximizing life insurance coverage presents. As an unbiased life insurance coverage valuation and life settlement skilled with over 25 years of expertise within the business, I used to be glad to see this! For too lengthy, life insurance coverage has been a taboo topic that many charities shrink back from, or they’ve a one-step technique of instantly surrendering the coverage for the money worth with none evaluation. Nonetheless, with roughly 51% of the U.S. inhabitants proudly owning life insurance coverage,1 it’s just too massive of an asset class to omit from charitable planning discussions with donors, notably in gentle of the large alternatives.

Widespread methods to donate a life insurance coverage coverage embody:

(1) The unique proprietor adjustments the coverage possession and beneficiary to the charity. The charity can then resolve in the event that they want to proceed paying premiums or if they like to cancel the protection and obtain the money give up worth.

(2) The donor maintains possession of the coverage and makes the charity a partial or full beneficiary. This permits the donor to manage ongoing premiums and regulate the charitable contribution quantity, if desired.

Third Neglected Possibility

A 3rd and sometimes neglected possibility is for a coverage proprietor to think about a life settlement. The present coverage proprietor can promote the life insurance coverage coverage and obtain a buyout for a right away money cost larger than the money give up worth and fewer than the dying profit. The unique coverage proprietor or the charity that owns a donated life insurance coverage coverage can discover a life settlement possibility. Step one is to obtain a nonbinding appraisal of the life insurance coverage coverage that can point out worth. No medical examination is required for the insured, and there aren’t any necessities to proceed down the life settlement path if the vary of worth isn’t interesting. A charitable life settlement is likely to be an possibility when:

• There’s inadequate money within the coverage to pay the required premiums.

• The donor can not make premium funds.

• The charity has a necessity for the funds at this time.

• A coverage proprietor needs to donate the coverage for a deduction as a result of it’s not wanted.

A life settlement can unlock future premium {dollars} for different planning alternatives. If the donor exchanges the life insurance coverage coverage for money by means of a life settlement, the donor can reallocate these {dollars} to their charitable giving.

The charity can change an current donated coverage for money by means of a life settlement. This may be particularly helpful when insurance policies don’t carry out as projected or when the coverage was believed to be paid up. Sometimes, it’s dropped at consideration when there isn’t sufficient money worth and escalated premiums grow to be due. These challenges have induced some charities to cease accepting insurance coverage presents altogether.

Unlocking Unrealized Worth

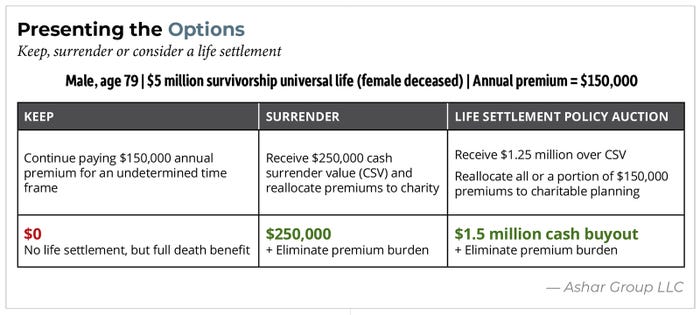

A life settlement can unlock unrealized worth within the life insurance coverage coverage. Right here’s one best-case situation instance of the way it can work:

A wealth advisor and legal professional had a 79-year-old shopper who had gifted away most of their wealth, in order that they not wanted their $5 million life insurance coverage coverage for estate-planning functions. The advisor and legal professional accomplished an evaluation of what money reserves could be wanted to pay premiums to maintain the protection or if it made extra sense to give up the coverage for the $250,000 of money worth. As a part of the evaluation, they’d an unbiased coverage valuation, which uncovered a life settlement worth of $1.5 million. This unlocked fast worth to the shopper that they may allocate to charitable planning objectives and unlock the $150,000 annual premium that had been budgeted for preserving the coverage. This grew to become a win-win because the shopper invested the extra $1.25 million (distinction between money worth and life settlement worth) and redirected $12,500 monthly of earlier premium {dollars} to a number of charities reasonably than paying for a life insurance coverage coverage they not wanted. The shopper was capable of witness how the charities benefited from the donations and was featured in a single charity’s publication and honored at a gala, which motivated different donors to make further presents. It was a win for all events.

Break-Even Evaluation

A charity’s monetary choices must be primarily based on an affordable course of and all obtainable information factors. Maintaining or promoting an current donated life insurance coverage coverage is not any totally different. There must be a crossover evaluation of when it is smart to proceed paying premiums on the present stage, scale back the dying profit, give up the coverage or think about a buyout in a life settlement. This break-even evaluation must be facilitated with the help of certified allied professionals (monetary advisors, attorneys, tax and life insurance coverage brokers who work carefully with charities) or an unbiased advisor who can alleviate this technical work from the charity and its workers. These professionals ought to have an in depth understanding of longevity, as that can instantly impression the projected time-frame for premiums to be paid. The longer the life expectancy, the extra premiums might be required sooner or later. The crew ought to have a course of for requesting present coverage data and illustrations.

Most significantly, when contemplating a life settlement, the charity and insured should verify the professionals’ expertise stage. Have they accomplished just a few transactions or 1000’s? Have they got entry to a database of comps for which comparable insurance policies are bought within the life settlement market? Does their course of yield the very best provide in the event that they promote the coverage?

Monitoring Donated Insurance policies

It’s essential for charities to observe their life insurance coverage insurance policies. Right here’s a real-life instance of what can occur in the event that they don’t.

In a dialog I had with a college basis, the top of deliberate giving shared that they’d over 20 life insurance coverage insurance policies donated through the years, and it had grow to be tough to report again to the CFO whether or not further premiums could be due and after they would count on to obtain the payouts. The annual statements have been filed every year, and the illustrated premiums have been paid primarily based on the unique illustration offered on the donation. This resulted in some very shut calls wherein insurance policies virtually lapsed because of the impression of the low rate of interest setting on coverage values. There have been even just a few tragic conditions wherein insurance policies have been surrendered attributable to restricted timing for exploring options to restructure the insurance policies so they may keep in power longer. The charitable planning crew relied on specialists to make suggestions about different hard-to-value property, equities, paintings and actual property. Why couldn’t they do the identical for all times insurance coverage? Doing so would assist keep away from the cancellation of donated insurance policies and protect relationships with donors who in any other case wouldn’t see the meant proceeds go to the charity.

Finishing the Evaluation

Monitoring and valuing life insurance coverage can save a charity thousands and thousands in pointless premiums or stop the charity from dropping out on future dying profit payouts. A well timed and ongoing evaluation can present selections to remain heading in the right direction or restructure the coverage so it lasts longer when vital, like when the insured resides longer than anticipated. Because of the multi-decade low rate of interest setting, many insurance policies didn’t ship the projections illustrated when the coverage was first issued. As well as, life expectancy assumptions have been incorrect, and wealthier purchasers lived longer than anticipated, which resulted in both extra premiums being due or insurance policies being canceled:

Life expectancy will increase repeatedly with earnings. A examine from 2016 of 1.4 billion de-identified tax data, from 1999-2014, discovered that the life expectancy hole between people within the high and backside 1% of the earnings distribution in the US is 15 years for males and 10 years for girls.2

Apply tip: Depend on allied professionals and consultants to comply with a course of that may reduce errors and determine enchancment areas. They’ll must have a powerful understanding of life insurance coverage product varieties and the professionals and cons of every plan. The important thing components embody maturity dates (lapse age), riders that could be included, the insurance coverage firm liable for paying the declare, the insurance coverage firm’s monetary power, how the coverage values are credited, anticipated premiums, affirmation of premium funds utilized and affirmation of proprietor and beneficiary designations.

Though usually simplistic, time period insurance policies additionally must be reviewed. Extra key components for time period insurance policies embody the kind of time period coverage, riders obtainable, stage time period interval, conversion dates and conversion choices. In contrast to the everlasting merchandise talked about above, the premium cost is important. If the premium cost is missed or paid too late, past the grace interval, the coverage will lapse. Everlasting insurance policies which might be seasoned and appropriately funded could not lapse with a single missed premium.

The fundamentals of the evaluation for all insurance policies ought to embody:

1. A present yr annual assertion

2. Life insurance coverage illustration(s) obtained from the insurance coverage firm. The illustrations ought to embody:

• A projection of present coverage efficiency with anticipated future premium

• A projection fixing for the premium to maintain the coverage in power to maturity

• A projection fixing for a decreased dying profit to maturity paying the anticipated premium

• A decreased paid-up quote/illustration (complete life solely)

• Affirmation of the beneficiaries

Well being is essentially the most important information level figuring out a life insurance coverage coverage’s score when a coverage is issued. When monitoring a coverage, an ongoing well being information level helps charities resolve how you can preserve the insurance coverage all through the donor’s life. In contrast to most funding automobiles, the return is a shifting goal due to the life expectancy/longevity of the donor(s). In line with the Brookings Institute, males born in 1940 who’re within the high 10% of mid-career earnings earners can count on to have a mean life expectancy of 12 years longer than their counterparts at decrease earnings ranges.3 As a charitable planner, would it not be useful to know that the shopper you’re working with has a life expectancy of roughly a decade longer than standardized mortality tables point out? Would it not impression the way you consider a possible donation of life insurance coverage? Would it not have an effect on the way you handle your portfolio of donated life insurance coverage insurance policies? How do you create a legitimate plan in the event you don’t understand how lengthy you’re planning for? Do your donors have goal information that give them a variety of how lengthy they could dwell? In the event that they knew that vary, would it not change your conversations with them?

A place to begin in figuring out the donor’s well being is to make use of the preliminary insurance coverage firm’s underwriting score as a baseline. Nonetheless, in some instances, the underwriting could have been achieved 10-to-40 years in the past. In that case, and the dimensions of the life insurance coverage coverage is critical, it could be smart to enlist a 3rd occasion to do a non-invasive well being analysis with the donor’s consent. This doesn’t require a medical examination like when acquiring a newly issued life insurance coverage coverage. As soon as the essential coverage evaluation and longevity information level are decided, a possible inner fee of return may be calculated for the charity. The allied professionals can evaluate the present coverage standing with the unique present settlement and illustration (if obtainable). A coverage may be “on monitor” or “off monitor.” A CFO can evaluation such a data when analyzing suggestions associated to life insurance coverage.

Underperforming Insurance policies

A coverage is probably not performing as meant as a result of:

• The preliminary design was poor, or the unique crediting fee modified.

• The donor hasn’t made the agreed-on presents/premiums.

• The donor didn’t take note of the insurance coverage coverage for a chronic time.

• The insurance coverage firm made adjustments to its inner coverage expenses.

• There have been vital adjustments to the insurance coverage service’s monetary scores.

Potential cures for underperforming insurance policies embody:

Lowering the dying profit. This may be an efficient method to prolong coverage longevity. Sometimes, it will scale back the interior value of insurance coverage, and the anticipated annual premium will enable the coverage to increase the lapse age.

Growing the premium. This treatment could entail an uncomfortable dialog with the donor of the coverage; nonetheless, it’s the best method to prolong coverage longevity.

Having the charity pay the elevated premium. This treatment is reserved for specific conditions. For instance, a donor has a really brief life expectancy, and the coverage is about to lapse.

Surrendering the coverage. This treatment happens after evaluating the above choices if the donor is in good well being and is not prepared or capable of pay premiums and the charity has a use/want for fast money worth. A life settlement evaluation must be achieved earlier than any give up takes place.

Changing the coverage. That is an possibility if the donor continues to be in average-to-good well being. Often, a brand new insurance coverage coverage available in the market may scale back or get rid of the premium with an Inside Income Code Part 1035 tax-free change. A professional life insurance coverage agent must be consulted for this feature.

Life Settlement

If the charity decides to go forward with a life settlement, it would liquidate the coverage for greater than the money give up worth however lower than the dying profit. This selection eliminates the longer term premium obligation. The charity receives a lump sum for the coverage. The life settlement market is very regulated. Licensed sell-side advisory corporations can information the charity by means of the method. Their prime perform is to facilitate a coverage public sale with licensed buy-side advisors. That is much like a charity liquidating actual property, paintings or different property in an public sale. The sell-side advisors have a fiduciary duty to generate the very best worth for the charity.

“Presenting the Choices,” p. 45, illustrates the charity’s choices to maintain, give up or promote a donated coverage (that’s, proceed with a life settlement).

Demonstrating Stewardship

When charities deal with life insurance coverage as an asset reasonably than an administrative legal responsibility, it may well create engagement alternatives with current and potential donors that transcend the usual marketing campaign (that’s, campaigns that ask for money, ruling out donors who’ve illiquid property however could possibly donate their life insurance coverage insurance policies). The life settlement possibility may be particularly interesting to donors who’ve illiquid property. Charities ought to create a scientific course of when accepting life insurance coverage presents. They need to leverage instruments and assets that uncover alternatives that can be utilized in newsletters, web sites and conventional mail campaigns.

Charities must doc:

• The variety of life insurance coverage insurance policies which were donated to their group

• The place the life insurance coverage data is saved and itemized for future evaluation

• Whether or not a break-even evaluation has been accomplished periodically on every coverage to verify it performs as anticipated

• The person liable for confirming premium funds and updating coverage values

• Whether or not there are insurance policies with maturity danger which have a excessive chance of the insured outliving the coverage

• The kind of return they’ll count on from any given coverage

• Whether or not they’re holding insurance policies with monetary scores that will be thought-about junk bonds

• How they’re speaking with donors about their life insurance coverage presents

• The present protocols to make sure new insurance coverage presents carry out as projected

• Whom their donors work with for all times insurance coverage valuation

Donor Outreach

Charities can add significant academic content material to their newsletters or think about sending a private letter to their high donors. Think about a state of affairs wherein a donor has named the charity as a partial beneficiary, and the charity is unaware. As a substitute of the donor canceling the coverage if their monetary state of affairs adjustments, there could possibly be a chance for the charity to finish a life settlement. The charity can then share a profitable final result in a publication or at their annual gala highlighting the donor and their capacity to see how the charity is benefiting from the proceeds of the life settlement whereas they’re residing.

Apply tip: At tax time, donors are sometimes unaware that an Inside Income Service Type 8283 appraisal is required for any life insurance coverage donated to charity. Moreover, the donor is liable for acquiring and submitting the Type 8283 value determinations. Any life insurance coverage donation valued at greater than $5,000 should have an appraisal accomplished by an authorized appraiser. The charity may embody a one-page memo in its publication that outlines the IRS necessities. This is a wonderful method to foster current relationships and attain out to potential new donors the charity hasn’t contacted just lately.

Advantages for Charities

Charities can differentiate themselves in a crowded market by exploring the alternatives that exist when viewing life insurance coverage as an essential non-cash asset class to debate with their essential donors {and professional} advisors. There are alternatives for elevated charitable contributions and relationship-building with allied professionals, notably amongst monetary planners and life insurance coverage professionals. There’s additionally the flexibility to extend and deepen stewardship engagement with essential donors.

Charities that already personal insurance policies must be proactive to hunt recommendation about alternatives or points. By treating life insurance coverage like different property and monitoring its efficiency, they’ll decide if it’s finest to maintain, give up or promote an current life insurance coverage coverage. Allied professionals have an incredible alternative to incorporate a life insurance coverage valuation and longevity evaluation of their coverage evaluation course of for charitably minded purchasers. By way of proactive training, the charitable market will proceed to comprehend vital development by incorporating life insurance coverage and life settlements into their general giving methods.

Endnotes

1. LIMRA 2024 Life Insurance coverage Truth Sheet, www.limra.com/siteassets/newsroom/liam/2024/2024-life-insurance-fact-sheet.pdf.

2. Raj Chetty, Michael Stepner, Sarah Abrahams, et al., “The Affiliation Between Revenue and Life Expectancy in the US, 2001-2014,” Journal of the American Medical Affiliation, 315 (14), 1750-1766 (2016).

3. Barry P. Bosworth, Gary Burtless and Kan Zhang, “What rising life expectancy gaps imply for the promise of Social Safety,” Brookings (Feb. 12, 2016), www.brookings.edu/articles/what-growing-life-expectancy-gaps-mean-for-the-promise-of-social-security/#:~:textual content=Worsepercent20stillpercent20ispercent20thatpercent20thepercent20gappercent20has,benefitspercent20providedpercent20topercent20lowpercent2Dpercent20andpercent20highpercent2Dearningspercent20workers.