Supply: The School Investor

H&R Block gives easy-to-use software program for tax filers who need to full their taxes on-line or utilizing their desktop laptop. H&R Block on-line tax prep persistently ranks runner-up in annual listings of the most well-liked on-line tax preparation software program.

We rank it second for ease of use, however with decrease pricing than competitor TurboTax, it’s a more sensible choice for these in search of a high-end expertise on a decrease price range.

H&R Block gives a mix of premium providers, starting from:

- Self-service tax preparation on-line

- On-line tax preparation with professional help

- Full-service tax prep, the place you drop your tax types at an H&R Block workplace, and so they care for the remainder

The software program permits common individuals with out finance or tax experience to do their taxes independently at an inexpensive price. Customers can depend on a step-by-step tax submitting expertise with easy-to-understand guides.

H&R Block delivers a consumer expertise that makes tax submitting fairly easy. Nevertheless, it’s a premium product that may include a premium price ticket. Whereas it’s cheaper than TurboTax, you may nonetheless discover cheaper choices. Earlier than you begin in your taxes, make certain you recognize what to anticipate when it comes to price at checkout.

Take a look at our listing of the most effective tax software program to see how H&R Block compares to opponents, together with TurboTax and TaxAct. See this listing of H&R Block options if you’d like one thing completely different.

Word: On this H&R Block tax evaluate, we’re targeted on the net tax expertise. H&R Block additionally gives downloadable tax software program and in-person tax prep providers. For most individuals, on-line submitting is the best choice.

Bonus: Proper now, it can save you on H&R Block Tax Software program Merchandise should you enroll and begin by way of this hyperlink >>

|

Self-Ready, Assisted, or Full Service |

|

H&R Block On-line – Is It Actually Free?

H&R Block gives free Federal and State tax submitting for a restricted variety of filers the place you solely have these widespread tax types or conditions. Free submitting works for these types and desires:

- W-2 revenue

- Unemployment revenue

- Social Safety Revenue

- Retirement plan revenue

- Pupil Mortgage curiosity

- Youngster Tax Credit score

- Earned Revenue Tax Credit score

- Curiosity Revenue

- Restricted Funding Help

Anybody with extra complicated wants must improve to a paid tier. Fundamental curiosity and funding revenue are included within the free tier, so long as you don’t want so as to add a Schedule B.

In comparison with the competitors, H&R Block on-line gives probably the most sturdy free submitting applications. Nevertheless, H&R Block received’t be free for all customers. For instance, filers with Well being Financial savings Accounts (HSAs) or who’ve dependent care bills should improve to the Deluxe tier. Crypto merchants, most traders, and enterprise homeowners will want the Premium or Self-Employed tier.

You may also use the IRS Free File program, which gives free H&R Block and different tax software program by way of a partnership with the Free File Alliance. This program is just obtainable to these incomes $73,000 or much less yearly (adjusted gross revenue) and assembly the supplier’s standards.

See the total listing of the most effective free tax software program right here >>

What’s New For 2025?

Like all tax software program suppliers, H&R Block makes updates to satisfy new and evolving tax wants, comparable to questions on scholar mortgage forgiveness for with the ability to take part in this system.

Necessary updates for this yr embrace:

- Revised tax brackets, credit, and deductions on account of inflation

- Up to date 1099-Ok assist for on-line sellers

- New guidelines for inherited IRAs and emergency withdrawals from retirement accounts

Final yr, H&R Block added expanded assist for checking account curiosity and restricted funding wants within the free tier. Updates are additionally carried out to maintain up with the tax code. COVID reduction applications are principally over, however we’re nonetheless seeing a number of advantages associated to medical health insurance bought by way of Healthcare.gov or a state market below the Inexpensive Care Act (ACA).

And like many different on-line corporations this yr, there’s a large upsell push to get your to “allow them to deal with your taxes”. H&R block does have probably the most sturdy community of choices – from on-line DIY, to help, to digital tax prep, to drop-off at an workplace, and at last full in-office experiences. Nevertheless, this push is most evident in the beginning, once you’re requested to select immediately:

Screenshot of selecting strategy to taxes. Screenshot by The School Investor.

Does H&R Block Make Tax Submitting Straightforward In 2025?

H&R Block makes use of wise workflows to assist filers full their tax returns with minimal ache. It’s our second-favorite choice for ease of use, and extra inexpensive than TurboTax, which we rank as the simplest strategy to file on-line.

The next options make your tax prep easy so you may perceive what you’ve accomplished and what stays.

- Questionnaires

- Guided software program

- Navigation bars

- Constructed-in calculators

- Easy language

- Sturdy import choices

Claiming widespread credit just like the Earned Revenue Tax Credit score (EITC), the Youngster Tax Credit score, and the American Alternative Tax Credit score is a streamlined course of, although you’ll have to enter a number of further particulars to unlock these questionnaires.

The software program additionally makes dealing with pre-refunded credit (such because the Superior Youngster Tax Credit score) and pre-paid taxes (comparable to quarterly tax estimates) straightforward.

Our testing revealed just a few drawbacks. First, self-employed individuals should independently decide their most retirement account contributions. Second, restricted brokerage integrations in comparison with prime competitor Turbo Tax and restricted crypto integrations make the software program extra cumbersome for energetic merchants.

In comparison with all different tax software program, we discovered H&R Block the second best tax software program after TurboTax. Nevertheless, a singular additional benefit from H&R Block is that you would be able to go to an H&R Block brick-and-mortar location if you wish to convert to in-person tax preparation and assist (for an additional price).

H&R Block Prime Options

H&R Block is a premium tax software program with a protracted listing of notable options. These are among the most necessary options for typical customers:

Straightforward Navigation

H&R Block makes use of a question-and-answer navigation fashion to assist tax filers by way of their tax types. The questions are free from complicated {industry} terminology when attainable. When H&R Block makes use of jargon, it explains the phrases by way of “Learn Extra” bubbles or different hover options.

H&R Block Questions | Screenshot by The School Investor

Quick Questionnaires To Expedite Submitting

In the beginning of every main part (Revenue, Deductions, Credit, and many others.), H&R Block prompts customers with a brief questionnaire. The questionnaire narrows down the components of the software program related to every consumer. You may at all times return and evaluate different sections, but it surely’s good to save lots of time skipping areas you don’t want to fret about.

Add Tax Paperwork To Velocity Up The Course of

H&R Block is among the best on-line submitting software program platforms. It permits customers to add many types, together with 1099-NEC, 1099-MISC, 1099-INT, W-2 types, and way more. You may add a duplicate to H&R Block if the shape follows customary layouts. Except for TurboTax, most opponents don’t supply this characteristic.

Customers can take photos of supported types and add them utilizing the H&R Block cell app or drag and drop them into H&R Block utilizing their laptop. The software program reads the uploaded paperwork and fills out types for you the place attainable. (However you need to nonetheless double-check that it’s correct.)

Sturdy Depreciation And Expense Calculators

H&R Block software program accommodates easy-to-use calculators for mileage deductions, asset depreciation, and different bills. These make submitting straightforward for anybody who doesn’t need to calculate depreciation independently.

Small enterprise homeowners, aspect hustlers, and actual property traders ought to be capable of discover what they should get their taxes completed with out hiring an costly accountant.

Free Stay Chat Tech Help

H&R Block gives free reside chat tech assist on the Deluxe, Premium, and Self-Employed tiers. This isn’t the identical as answering questions on your taxes. It is just for questions on how one can use the software program.

It additionally gives restricted “tax steerage,” although this isn’t tax recommendation. The built-in free steerage helps customers discover credit, deductions, or different areas you’ll have missed. Like most opponents, it’s essential to pay an extra charge should you want extra assist from a human tax professional.

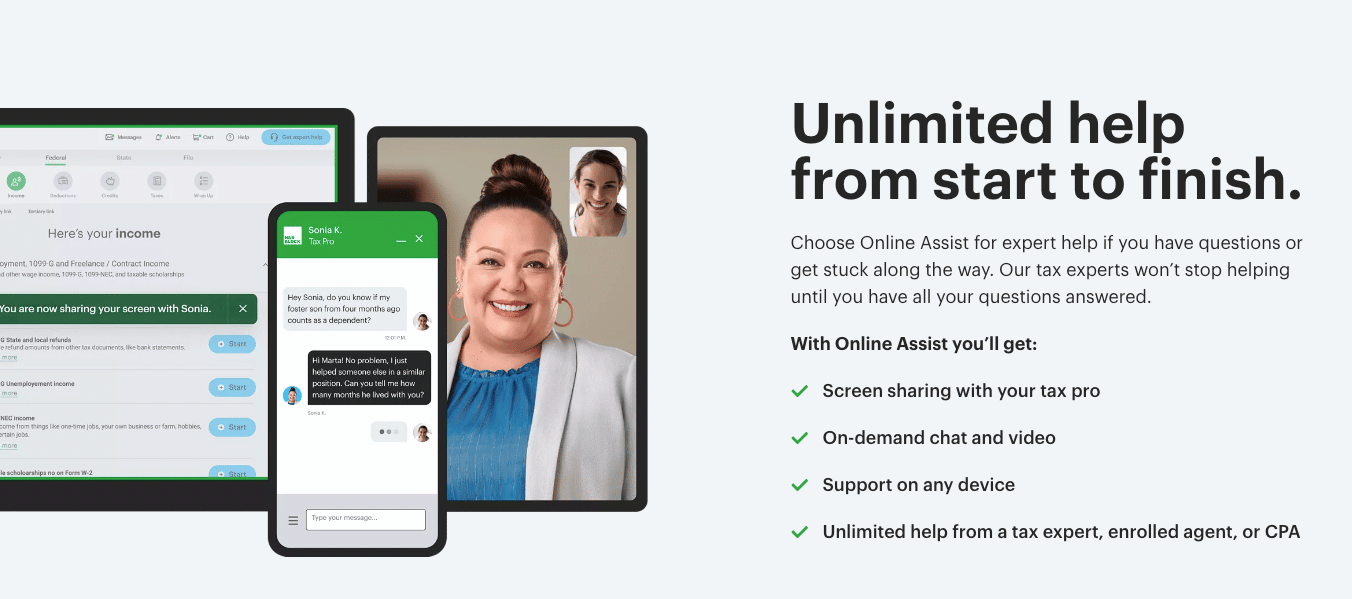

Choice To Improve For Tax Help

H&R Block’s On-line Help program permits filers limitless assist from tax-filing consultants. The add-on isn’t low cost, but it surely ensures that customers get the solutions they want from a professional tax professional. You may improve to plans the place you get:

- Limitless entry for all tax questions

- Skill at hand off your tax return to knowledgeable

- A hybrid expertise with on-line and in-person tax providers at a neighborhood H&R Block location, a singular characteristic you do not get with most different tax apps.

H&R Block Help Choices | Screenshot by The School Investor.

H&R Block Drawbacks

H&R Block has just a few notable drawbacks. Whereas the software program is barely much less intuitive and flashy than TurboTax, it’s straightforward to navigate and use. Probably the most vital drawbacks are associated to price and the few troubles we discovered under:

Cannot Calculate Self-Employed Retirement Account Contributions

Self-employed people have flexibility in contributing to their retirement accounts. Nevertheless, H&R Block doesn’t assist calculate the utmost contribution quantity for these filers, which may result in an costly tax error.

A tax filer could unwittingly contribute greater than the utmost quantity (or under-contribute), not realizing they’ve extra room to save lots of on taxes. This difficulty received’t have an effect on extra filers, however it’s a shocking oversight given the standard of different sections of the net app.

Paid Model Required To Report HSA Contributions

One in every of H&R Block’s pricing gotchas is said to HSA contributions. If in case you have a well being financial savings account (HSA), even whether it is by way of your employer, you’ll should improve to H&R Block’s Deluxe version.

Should you’re eligible, take a look at our favourite HSA accounts right here.

Restricted Monetary Establishment Integrations

H&R Block doesn’t embrace direct integrations with brokerages or crypto exchanges to calculate capital positive factors from buying and selling exercise. Because of this, traders could require further data to finish Schedule D types. Notably for energetic merchants, typing in all trades will be time-consuming, cumbersome, and susceptible to guide errors.

For some monetary establishments, the 1099 types can be sufficient for H&R Block to finish the shape entry for you, however that received’t at all times be the case. TurboTax helps direct integrations with many banks and brokerages to obtain tax data with out manually getting into the small print your self.

Audit Help Is not Included By Default

H&R Block’s Fear-Free Audit Help prices $19.99 along with the usual tax prep and submitting price. A number of corporations supply audit assist as an included characteristic reasonably than an add-on product for an additional charge.

Associated:

Ought to You Pay For Audit Help For Your Taxes?

H&R Block On-line Costs And Plans

H&R Block has been up to date to supply a pricing construction much like TurboTax, the place you pay extra for every further stage of assist and 4 underlying pricing tiers.

The On-line Help plans from H&R Block embrace limitless assist from tax professionals comparable to CPAs or Enrolled Brokers. These people can reply tax questions particular to your state of affairs.

Costs are considerably increased than final yr.

Bonus: Get 20% off H&R Block on-line by signing up by way of this hyperlink >>

|

Earned Revenue Tax Credit score, Youngster Tax Credit score, Social Safety Revenue, Pupil Mortgage Curiosity Deduction |

Itemizers, HSA contributions, Individuals with baby care bills |

Landlords, traders, Gig staff (lower than $5,000 in bills) |

||

Word: Costs are topic to alter, particularly because it will get nearer to the tax deadline. The sooner you begin, the upper your chance of locking in higher costs.

Costs for assisted and full-service submitting usually are not shared on-line earlier than signing up, and we don’t like this lack of transparency. Based mostly on pricing transparency, we solely advocate submitting on-line should you suppose you are able to do it your self and don’t have to improve.

How Does H&R Block Stack Up To The Competitors?

H&R Block gives a powerful set of functionalities by way of its free pricing tier and is a winner for individuals looking for free submitting in the event that they qualify.

The Deluxe Tier is H&R Block’s worst worth. Low-cost or free software program from opponents can usually assist filers itemize deductions and declare easy credit.

The Premium tier is the most effective worth for a paid product in comparison with H&R Block’s competitors. It helps rental properties, fundamental self-employment revenue and bills, and all inventory and crypto exercise.

Customers who don’t want H&R Block’s sturdy performance could discover that FreeTaxUSA or TaxSlayer gives the mandatory performance at decrease prices.

H&R Block usually costs itself close to the highest finish of the market, simply behind TurboTax. Filers in search of a deal on H&R Block ought to lock in costs as quickly as attainable to get the bottom attainable charges. Plus, you may obtain a reduction should you use this hyperlink.

|

Header |

|

|

|

|

|---|---|---|---|---|

|

$12.95 per further state |

||||

|

Dependent Care Deductions |

||||

|

Retirement Revenue (SS, Pension, and many others.) |

||||

|

Small Enterprise Proprietor (over $5k in bills) |

||||

|

DIY $69-129 Fed, $64 State |

||||

|

Stay Assisted $89-$219 Fed, $69 State |

||||

|

Full Service Begins at $129 Fed, $69 State |

||||

|

Cell |

* TurboTax Free Version: ~37% of taxpayers qualify. Kind 1040 + restricted credit solely.

Is It Secure And Safe?

Tax Prep corporations are prime targets for hackers looking for private data. H&R Block employs industry-standard encryption, multi-factor authentication, and web-browsing encryption to guard customers’ monetary data.

Nevertheless, the corporate will not be excellent. In 2019, the corporate suffered an information breach by which some buyer data was leaked. Whereas usually reliable, its cybersecurity historical past leaves one thing to be desired. Chances are you’ll need to look elsewhere should you’re ultra-concerned about knowledge safety.

Contact

One of many causes we like H&R Block is the numerous methods you will get assist, together with on-line, by telephone, or by having a tax preparer put together your tax return just about. You may also go to one in every of H&R Block’s many bodily areas.

To contact H&R Block by telephone, name 1-800-472-5625. To go to the workplace in particular person, you may schedule an appointment right here.

The place To Purchase

We advocate that everybody who makes use of tax software program use the net model reasonably than shopping for a disk or downloading and putting in it on a house laptop. You are extra more likely to lose your knowledge on your own home laptop, whereas should you use the net model, it’s at all times saved and accessible within the cloud in case your laptop crashes.

With that in thoughts, here is the place you should buy H&R Block Tax Software program.

H&R Block On-line: H&R Block on-line is often the simplest manner to purchase H&R Block tax software program. You can begin at no cost on-line, and the software program will assign you to the tier you could full your taxes. Or you may leap proper into whichever model you want. Plus, you may save 20% on H&R Block Tax Software program Merchandise should you undergo this hyperlink >>

Amazon: Amazon has rotating promotions for H&R Block the place you will get the total model of H&R Block at a reduction. Plus, they’re providing an Amazon 2% refund bonus should you choose to have your federal particular person tax refund buy an Amazon.com giftcard. Should you use the Amazon Prime Rewards Visa, you at all times get 5% money again on Amazon purchases, together with tax software program. Take a look at H&R Block on Amazon right here.

Retail Shops: H&R Block tax software program can also be obtainable in some retail shops, suchas Goal, Walmart, Costco, and Workplace Depot. It usually seems on retailer cabinets from late December by way of April.

H&R Block Promotions

H&R Block at present gives a 20% off promotion once you purchase instantly from H&R Block utilizing this hyperlink. Chances are you’ll pay extra should you purchase elsewhere.

Why Ought to You Belief Us?

The School Investor group spent years reviewing all the prime tax submitting choices, and our group has private expertise with nearly all of tax software program instruments. I’ve been the lead tax software program reviewer since 2022 and have in contrast many of the main corporations on {the marketplace}.

Our editor-in-chief, Robert Farrington, has been attempting and testing tax software program instruments since 2011 and has tried virtually each tax submitting product. Moreover, our group has created evaluations and video walk-throughs of all the main tax preparation corporations, which you’ll find on our YouTube channel.

We’re tax DIYers and need a whole lot, identical to you. We work laborious to supply knowledgeable and trustworthy opinions on each product we check.

How Was This Product Examined?

In our unique assessments, we went by way of H&R Block On-line and accomplished a real-life tax return that included W-2 revenue, self-employment revenue, rental property revenue, and funding revenue. We tried to enter every bit of knowledge and use each characteristic obtainable. We then in contrast the outcome to all the opposite merchandise we have examined, in addition to a tax return ready by a tax skilled.

This yr, we went again by way of and re-checked all of the options we initially examined, in addition to any new options. We additionally validated the pricing choices.

Is It Value It?

H&R Block On-line deserves to be on the shortlist for individuals who qualify at no cost submitting. It’s a premium software program, however the free providing is intensive. Additionally, the Premium version of the software program gives good worth for traders and gig staff.

Nevertheless, customers contemplating the center tier (Deluxe Tier) ought to consider carefully earlier than paying the value. Deluxe customers could discover a higher (and equally usable cut price) by contemplating TaxSlayer Traditional or FreeTaxUSA. These instruments are additionally an excellent different for self-employed individuals with depreciating enterprise belongings.

Landlords and others with depreciating belongings also needs to think about whether or not H&R Block is the fitting instrument for the job. TurboTax gives a superior consumer expertise for rental property homeowners, which is necessary given the complexity of property depreciation and different monetary wants.

H&R Block On-line FAQs

Listed here are some widespread questions on H&R Block on-line:

Can H&R Block On-line assist me file my crypto investments?

H&R Block On-line has directions that rigorously clarify how customers can file taxes on their cryptocurrency trades. Nevertheless, the software program treats it like different capital positive factors actions. There aren’t any particular integrations to make crypto submitting simpler.

Does H&R Block supply refund advance loans?

New for 2024 taxes (filed in 2025), H&R Block gives the Emerald Advance Mortgage for as much as $1,300. You will need to apply by 12/31/2024 should you’re on this providing.

Does H&R Block supply any offers on refunds?

Right now, H&R Block will not be promoting offers on refunds. Traditionally, the corporate has partnered with Amazon to supply boosted returns for individuals accepting refunds as present playing cards. This may occasionally return later within the season.

Do I’ve to make use of the self-employed tier for my aspect hustle?

Most aspect hustlers and folks with minimal enterprise bills can discover their tax legal responsibility utilizing the Premium stage. The Premium stage is cheaper than the Self-Employed tier however helps “simplified” bills, together with bills of lower than $5,000. Filers nonetheless get to say the Certified Enterprise Revenue Deduction on this tier.

Is H&R Block higher than TurboTax?

It relies upon. We discovered H&R Block to be higher for worth and superb for usability. TurboTax does supply one of many easiest-to-use interfaces, although, which may make tax submitting simpler and faster.

H&R Block On-line Options

Listed here are the principle options obtainable by plan stage.

|

Earned Revenue Credit score (EITC) |

||||

|

Pupil Mortgage Curiosity Deduction |

||||

|

Digital Doc Storage (As much as 6 Years) |

||||

|

Stay Tech Help (Telephone or Chat) |

||||

|

Small Biz Expense Deductions |

||||

|

Small Biz Asset Depreciation |