There’s an outdated story about Joseph Kennedy wherein a shoeshine boy began giving him inventory ideas whereas he was sitting in a chair getting his footwear buffed.

That was all he wanted to listen to. Kennedy instantly returned to his workplace and offered all of his inventory holdings. That was in 1929 proper earlier than the inventory market topped and had the worst crash in historical past.

I’m undecided how correct this story is, but it surely’s been posited that he made a killing by timing the market, which helped construct the Kennedy fortune.

The height earlier than the Nice Melancholy was chock-full of indicators of the highest. Professor Irving Fisher infamously acknowledged in October 1929 that inventory costs had reached “what appears like a completely excessive plateau.”

Inventory costs crashed greater than 80% from that decision.

The most important crashes all have indicators like this.

Listed below are some good ones from The Huge Quick on the housing market:

Subsequent, the newborn nurse he’d employed again in 2003 to care for his new twin daughters phoned him. “She was this pretty girl from Jamaica,” he says. “She says she and her sister personal six townhouses in Queens. I mentioned, ‘Corinne, how did that occur?’” It occurred as a result of after they purchased the primary one, and its worth rose, the lenders got here and instructed they refinance and take out $250,000–which they used to purchase one other. Then the worth of that one rose, too, and so they repeated the experiment. “By the point they had been achieved they owned 5 of them, the market was falling, and so they couldn’t make any of the funds.”

A good friend of Danny’s returned from an evening in town to report he’d met a stripper with 5 separate residence fairness loans.

Within the spring of 2007, Fed Chairman Ben Bernanke informed Congress that the subprime mortgage disaster was possible contained. That didn’t age properly.

Each time the present cycle takes a flip for the worst, there might be quotes, forecasts and investor actions that gained’t age properly both. That’s simply how this works.

Perhaps it’s one thing like this Barron’s cowl story from this previous week:

Anecdotes and journal covers don’t trigger something however one thing like this can go down with a sinking ship.

Traders have been looking for THE high for a lot of years now.

Finally somebody might be proper via dumb luck as a result of markets can’t go up eternally. One thing will trigger a downturn or monetary disaster ultimately. That’s how this method works. We will’t assist ourselves.

The issue is this stuff are extraordinarily troublesome to foretell prematurely.

In December 1996, Fed Chairman Alan Greenspan gave a speech that launched the time period ‘irrational exuberance’ into the monetary lexicon:

However how do we all know when irrational exuberance has unduly escalated asset values, which then develop into topic to sudden and extended contractions as they’ve in Japan over the previous decade? And the way will we issue that evaluation into financial coverage?

Markets across the globe plunged the following day. Many puzzled if Greenspan had referred to as the highest of a market that appeared overextended.

The S&P 500 was up greater than 20% on the 12 months when Greenspan made his feedback. It was up greater than 37% the 12 months earlier than. From 1980-1996, the S&P 500 was up almost 1,200% in whole or 16% per 12 months heading into Greenspan’s speak.

The bull market felt fairly lengthy within the tooth, within the ninth inning, on its final legs, you get the image.

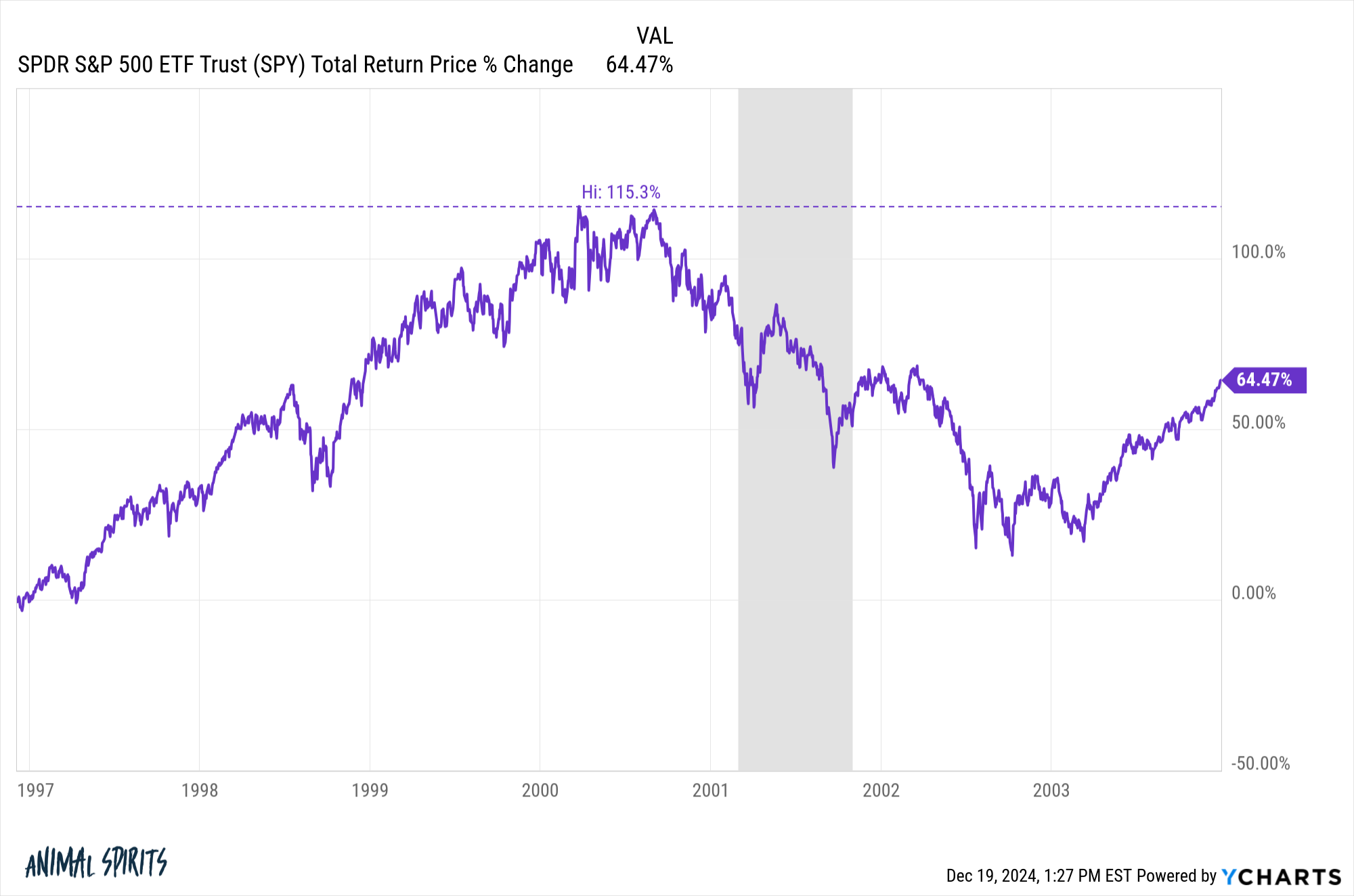

Following a minor hiccup within the days following Greenspan’s speech, the bull market continued:

From the day of his speech via March 2000, the S&P 500 was up 115% in whole. That’s an annualized return of greater than 26% per 12 months.

The market did crash ultimately, falling greater than 50% when the dot-com bubble lastly popped. However even on the lows of that crash in 2002 the market was increased than it was in 1996 when irrational exuberance was first uttered.

These are all excessive examples. I’m not saying we’re due for one more 1929, 2000 or 2007 peak that results in a monstrous crash or monetary disaster. I’m additionally not suggesting we’re establishing for one more dot-com-style melt-up.

These items may occur, in fact. You by no means know! However I don’t have the flexibility to foretell the timing or magnitude of booms and busts. Nobody does.

There are some warning indicators of hypothesis and over-heating within the markets proper now. We might be setting ourselves up for a comeuppance within the years forward.

Or issues may get even crazier.

It’s all the time onerous to inform how far the pendulum will swing or when it can begin swinging within the different course.

There are few certainties within the markets.

One factor I’m sure of — nobody has the flexibility to name tops (or bottoms).

Michael and I talked about indicators of the highest and the potential for issues to get even crazier on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

An Epic Bull Market

Now right here’s what I’ve been studying recently:

Books: