Right now’s Speak Your Guide is delivered to you by J.P. Morgan Asset Administration:

See right here and right here for extra info on J.P. Morgan Asset Administration ETF analysis

-

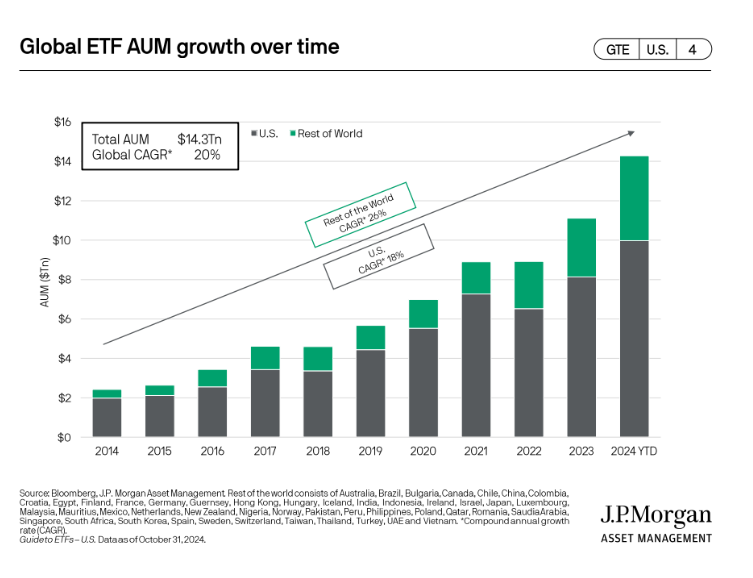

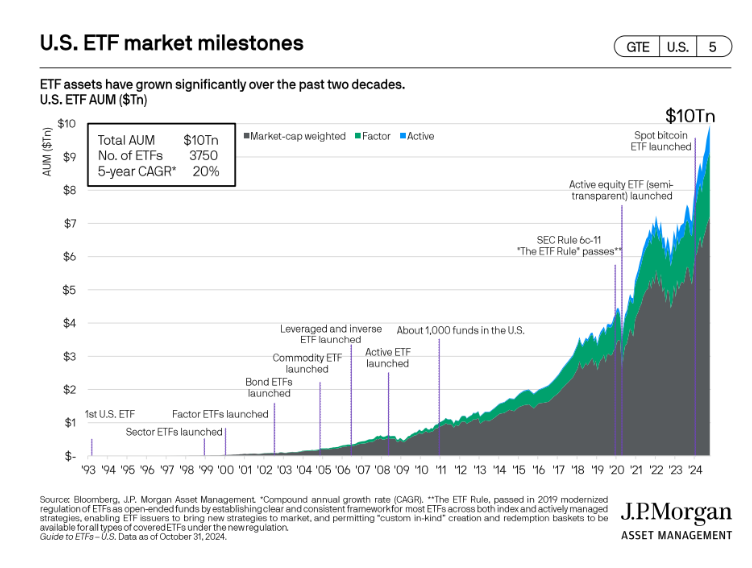

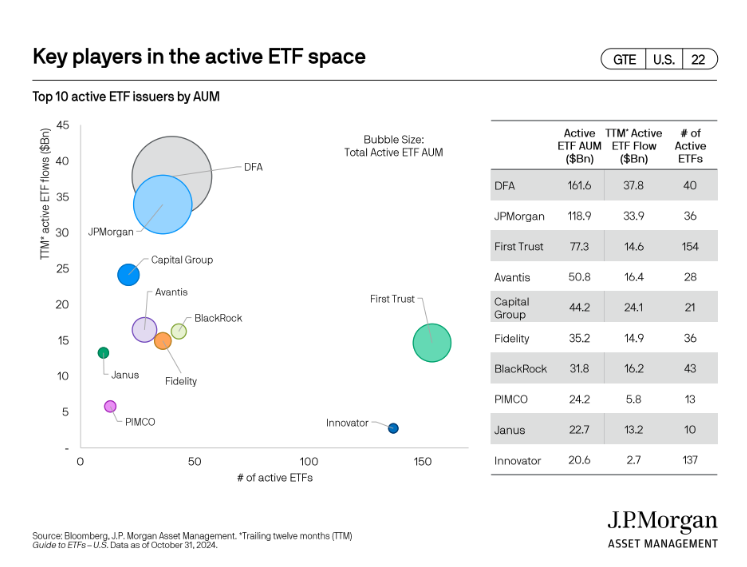

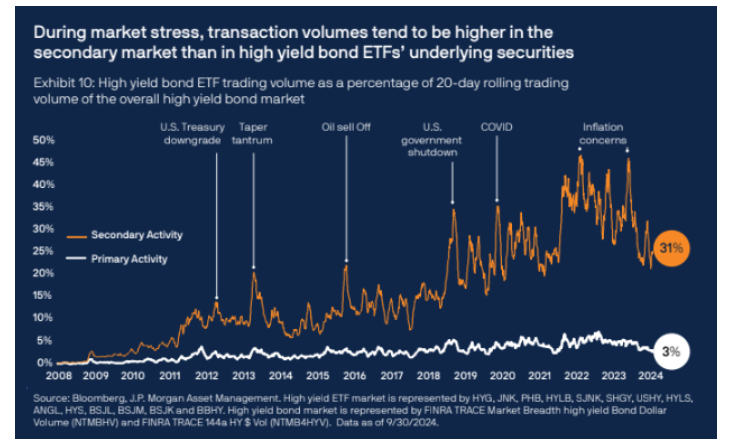

The place the ETF flows are coming from

-

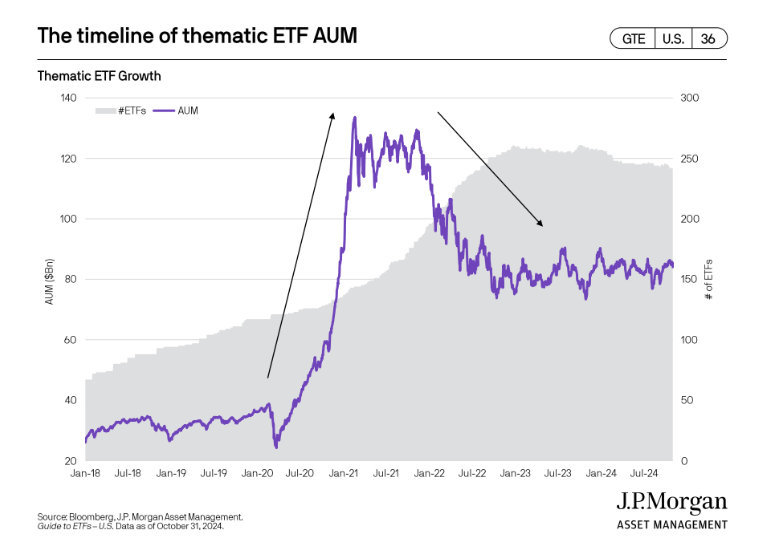

The expansion and decline of thematic ETF flows

-

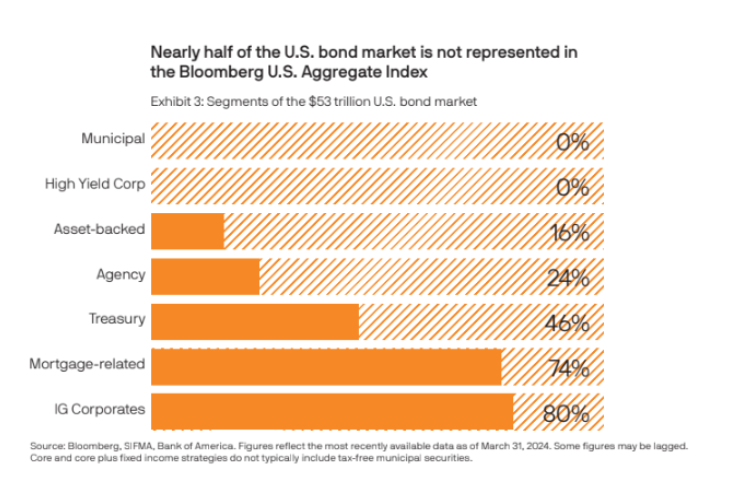

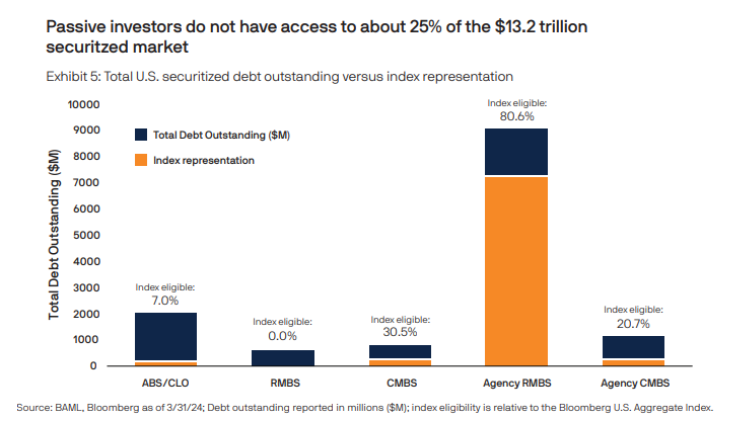

Why the AGG doesn’t embody quite a lot of bonds

-

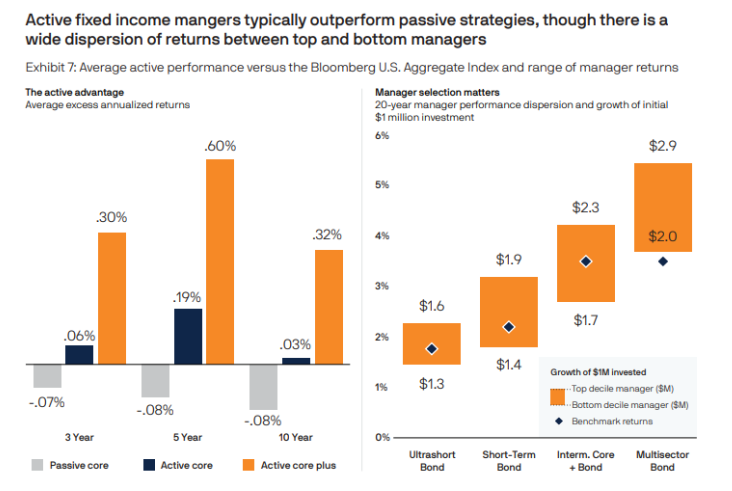

Why fastened revenue indices are simpler to beat than fairness indices

-

Ideas on non-public belongings throughout the ETF wrapper

J.P. Morgan ETFs are distributed by JPMorgan Distribution Providers, Inc. is a member of FINRA. J.P. Morgan Asset Administration is the model title for the asset administration enterprise of JPMorgan Chase & Co., and its associates worldwide. JPMorgan just isn’t affiliated with Ritholtz Wealth Administration LLC and The Irrelevant Investor.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Nothing on this weblog constitutes funding recommendation, efficiency information or any suggestion that any specific safety, portfolio of securities, transaction or funding technique is appropriate for any particular particular person. Any point out of a specific safety and associated efficiency information just isn’t a suggestion to purchase or promote that safety. Any opinions expressed herein don’t represent or indicate endorsement, sponsorship, or suggestion by Ritholtz Wealth Administration or its staff.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Administration, acquired compensation from the sponsor of this commercial. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investing in speculative securities includes the danger of loss. Nothing on this web site must be construed as, and is probably not utilized in reference to, a proposal to promote, or a solicitation of a proposal to purchase or maintain, an curiosity in any safety or funding product.

Traders ought to rigorously think about the funding aims and dangers in addition to expenses and bills of the JPMorgan ETF earlier than investing. The abstract and full prospectuses include this and different details about the ETF. Learn the prospectus rigorously earlier than investing. Name 1-844-4JPM-ETF or go to www.jpmorganETFs.com to acquire a prospectus. Supply: Morningstar.

JEPI AUM based mostly on 2023 World Actively Managed ETF AUM as of 11/30/24. Fairness Premium Earnings ETF JEPI RISK SUMMARY: The worth of fairness securities could fluctuate quickly or unpredictably as a result of elements affecting particular person firms, in addition to modifications in financial or political circumstances. These value actions could lead to lack of your funding. Investments in Fairness-Linked Notes (ELNs) are topic to liquidity threat, which can make ELNs tough to promote and worth. Lack of liquidity may trigger the worth of the ELN to say no. Since ELNs are in be aware type, they’re topic to sure debt securities dangers, similar to credit score or counterparty threat. Ought to the costs of the underlying devices transfer in an sudden method, the Fund could not obtain the anticipated advantages of an funding in an ELN, and will understand losses, which may very well be vital and will embody the Funds total principal funding. Investing includes dangers, together with lack of principal.

JPMorgan Distribution Providers, Inc. is a member of FINRA.