All through historical past, insurers have been pivotal in driving social change, enabling human progress, innovation, and prosperity. From seatbelts to vaccines and fire-retardant supplies, insurers have fostered quite a few improvements. These days, they face a brand new monumental problem: local weather change. 2024 has been one other file loss 12 months for insurers pushed by pure catastrophes linked to local weather change. Insurers are therefore searching for greener pastures. If executed proper, aiding companies of their transformation to scale back greenhouse gasoline emissions turns into a optimistic for insurers. They are often facilitators of the transition to a carbon-neutral future by exerting affect throughout the big variety of industries they finance.

There is a chance for insurers to safeguard their top-line and bottom-line whereas supporting clients on their web zero journeys. In Underwriting, that minimizes threat publicity and scope for regulatory fines by proactively responding to adjustments, and shoppers who successfully embark on the inexperienced transition are anticipated to carry larger gross sales within the mid to long run. In Investments, the case is even higher understood: 93% of buyers say that local weather points are most probably to have an effect on the efficiency of investments over the subsequent two to 5 years. Non-transitioning firms or those that begin transitioning too late are at risk of dropping an funding grade credit standing, whereas the outperformers – what we name ‘inexperienced stars’ are anticipated to profit from inexperienced applied sciences shift in a Paris-agreement-aligned world situation.

A brand new instrument for worthwhile portfolio decarbonization

Insurers want to have the ability to translate their investee and shoppers’ emission discount measures into monetary implications for applicable threat calculations, to decarbonize profitably on their very own finish.

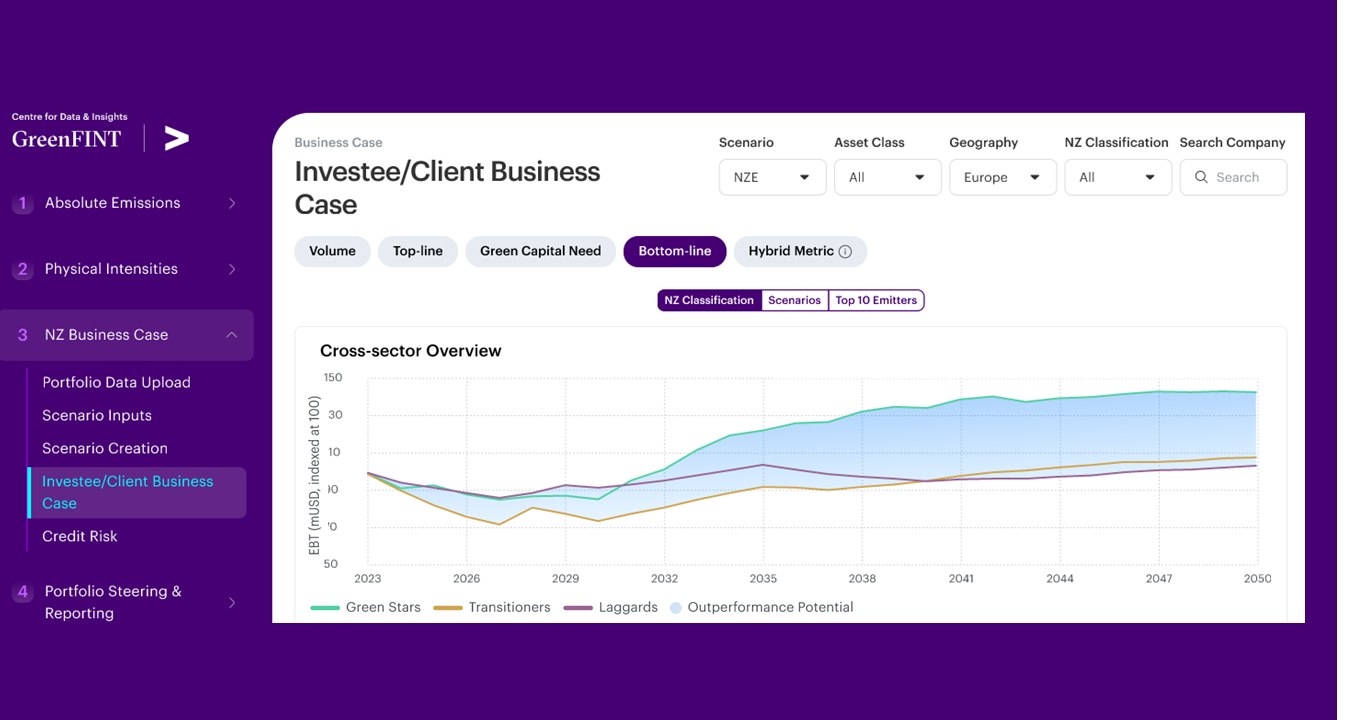

As we at Accenture are dedicated to fostering web zero enterprise practices we’ve launched the GreenFInT (Inexperienced Monetary Establishment Instrument ), also called the Worthwhile Portfolio Decarbonization Instrument. Evaluating pattern shopper portfolio dynamics up till 2050 for prime carbon intensive sectors, it reveals ‘inexperienced stars’ may outperform ‘local weather laggards’ by 30-40 proportion factors. The true worth of the instrument lies in familiarizing insurance coverage managers throughout funding, threat and pricing with setting assumptions for various world views, from a ‘scorching world’ situation to reaching the Paris alignment.

Enable me to delve into the instrument in larger element. The GreenFInT instrument caters to each the emissions measurement and reporting use circumstances (e.g., ESRS E1 quantitative KPIs for CSRD) in addition to to enterprise worth circumstances almost about decarbonization. The instrument applies local weather eventualities (e.g., 1.5°C, 2.4°C) to portfolio firms’ expertise combine, relying on their Web Zero pledges and transition plans. Variations in expertise combine, pledges, and plans translate into divergent profitability curves by way of required capital investments and variations in operational prices.

‘Inexperienced stars’ win out in the long run

For illustration, an insurer’s ‘inexperienced star’ shopper from the ability era sector with a SBTi verified Web Zero goal by 2040 has and could have a bigger share in renewables than a shopper labeled as ‘laggard’. With its proactive transition in the direction of web zero, the ‘inexperienced star’ shopper has preliminary excessive capital prices to finance the construct out of put in capacities from renewable vitality sources to satisfy its milestones whereas electrical energy costs are comparatively excessive – outlining a enterprise alternative for insurers because the shopper is in want of financing and insuring of the renewables constructed out. As compared, a ‘laggard’ firm had no and won’t have capital investments past standard substitute and upkeep prices of its energy vegetation. Then again, renewables have a lot decrease operational value in comparison with energy generated from nuclear vitality and pure gasoline. Thus, the ‘inexperienced star’ that has invested in renewables in a well timed vogue will profit from decrease operational prices whereas the ‘laggard’ could have larger operational prices from conventional vitality sources.

Let’s take an exemplary insurance coverage portfolio with 40 massive firm shoppers from 4 high-intensity sectors, particularly energy era, metal, actual property, and automotive, centered inside Europe. In a 1.5°C situation, the capital want for the web zero transition of those firms quantities to roughly 650bn USD 2023-2050 – in response to the GreenFInT modelling. Whereas within the mid-term up till 2030, the EBT margin of ‘laggards’ outperform ‘inexperienced stars’ by roughly 6 proportion factors, within the long-term, 2023-2050, ‘inexperienced stars’ outperform ‘laggards’ by 30-40 proportion factors (see graph under).

This forward-looking strategy – leveraging scientific sector carbon budgets vs. conventional forecasts based mostly on historic values – allows insurers to combine long-term eventualities (as much as 2050) into their present concerns. It is a most vital step in the direction of breaking the ‘tragedy of the horizon’. GreenFInT makes it potential to determine insurers’ investees and shoppers with reliable web zero commitments because the enterprise case evaluation can reveal who might not be capable to afford their web zero commitments. Constructing a trusted relationship with these firms as insurer or investor right now, is vital for a worthwhile decarbonization. Insights gained by GreenFInT may be useful to prioritize shoppers to interact with and a grounded dialog opener to raised perceive the shoppers’ transition plans.

Past a web zero enterprise case evaluation, GreenFInT additionally covers the accounting of Scope 3 Class 15 emissions in absolute phrases and bodily intensities in addition to goal setting and a ‘What-If’ functionality, enabling insurers to simulate results on their carbon footprint with changes to their portfolio.

The time to behave is now

Insurance coverage has constantly demonstrated resilience within the face of quite a few challenges, and the present push in the direction of decarbonization is not any totally different. By embracing the transition to web zero, insurers cannot solely safeguard their profitability but additionally play a pivotal function in fostering a sustainable future. The combination of science-based sustainability targets into underwriting and funding practices will allow insurers to drive vital change throughout numerous industries. As regulatory pressures and public expectations proceed to rise, insurers should act decisively to keep away from the dangers of inaction and greenwashing. The instruments and methods outlined present a transparent pathway for insurers to realize worthwhile portfolio decarbonization, guaranteeing long-term progress and belief in a quickly evolving panorama. The time to behave is now, and the alternatives for individuals who lead the cost are immense. For additional dialogue on implement these methods in your enterprise, please get in contact.