Let’s check out the checklist of all-time highs we’re at the moment experiencing:

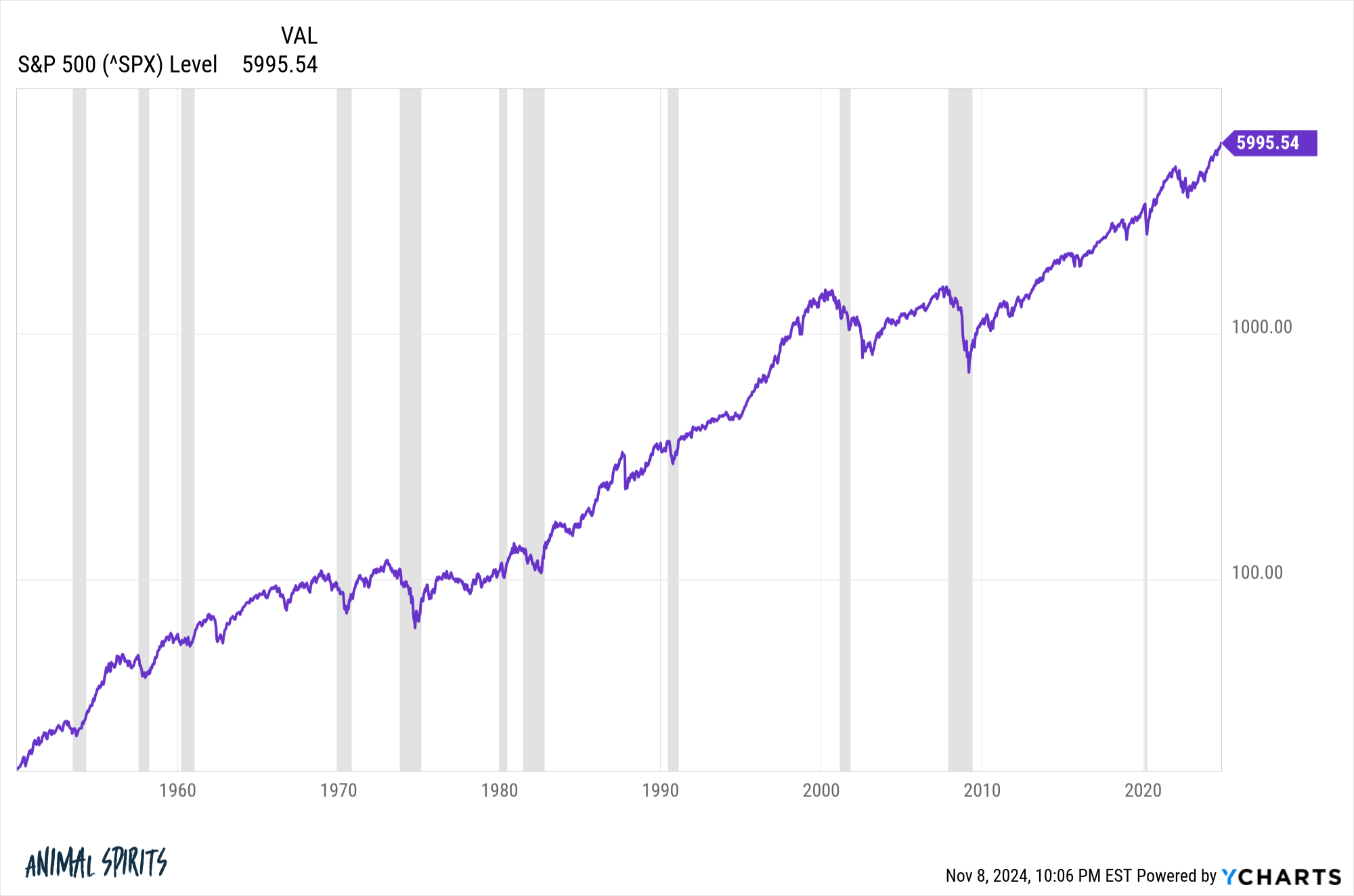

The U.S. inventory market has by no means been increased:

The S&P 500 bottomed in March 2009 at 666. It’s now shut to six,000. The Dow has gone from roughly 6,500 to just about 44,000.

What an unbelievable run.

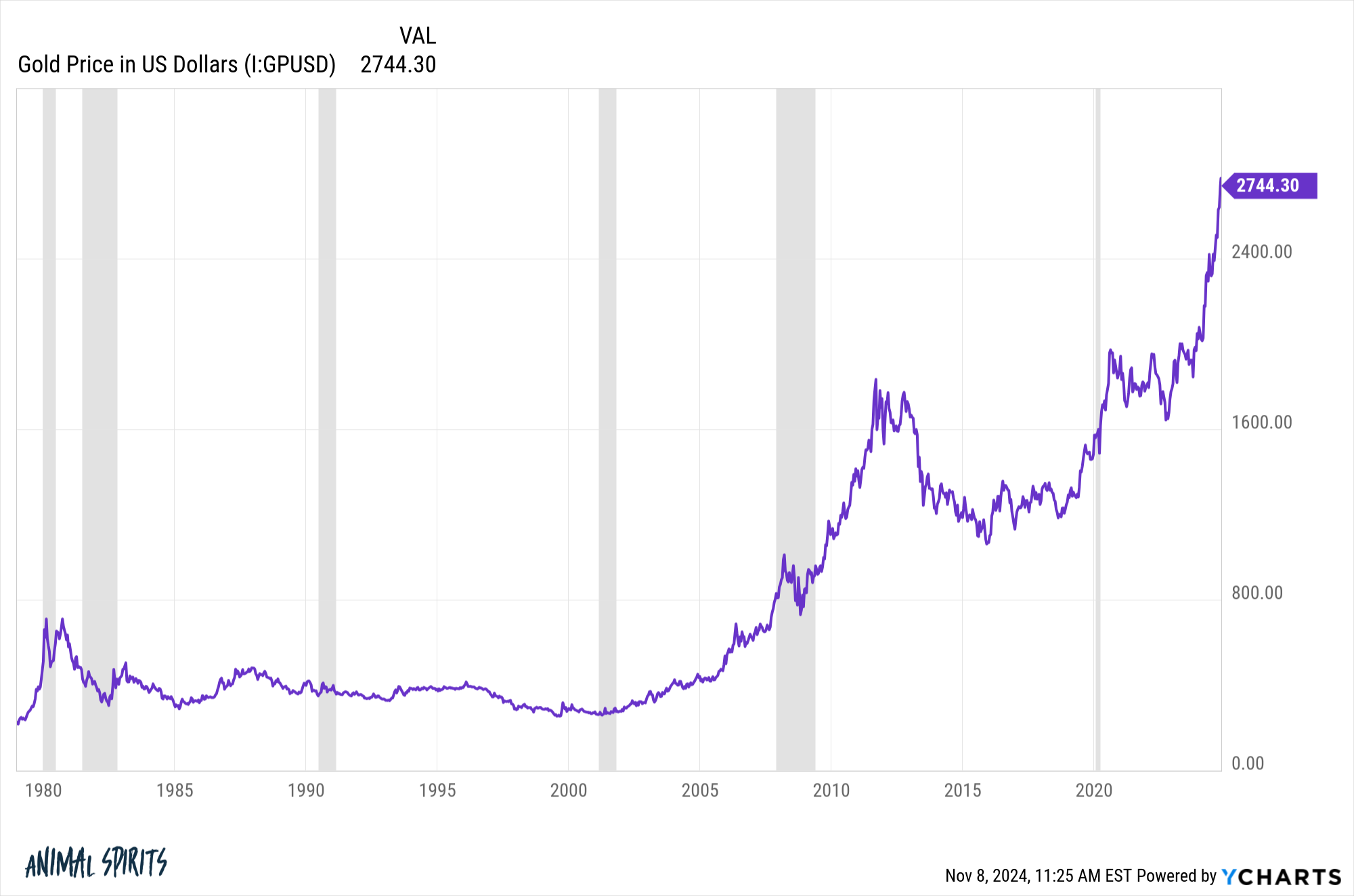

Gold can be at all-time highs:

It’s uncommon to see shares and the yellow steel concurrently taking off like this.

Bitcoin is there too, now buying and selling over $80,000.

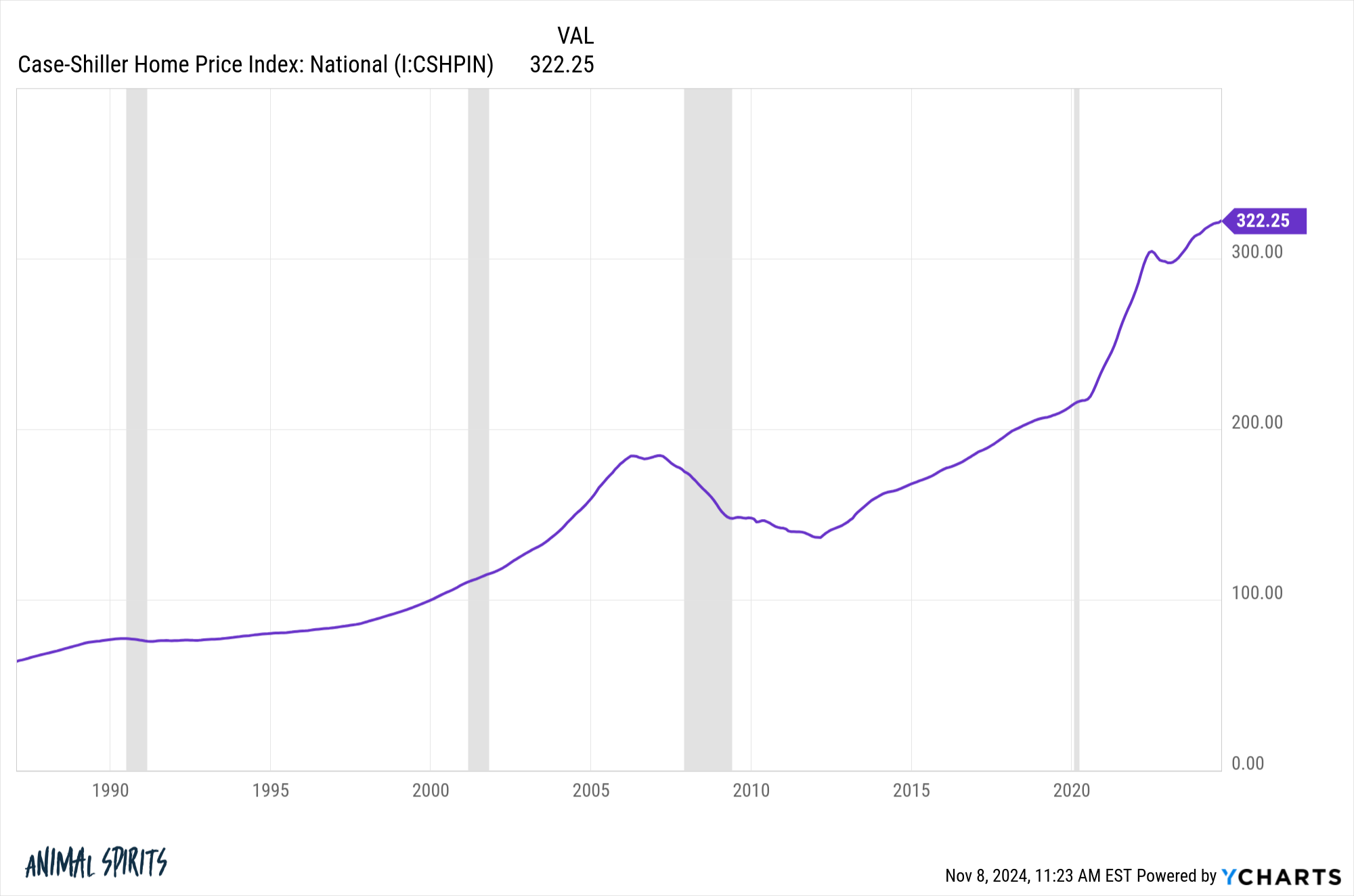

Housing costs are at all-time highs:

The truth that that is taking place with mortgage charges at 7% is one thing else.

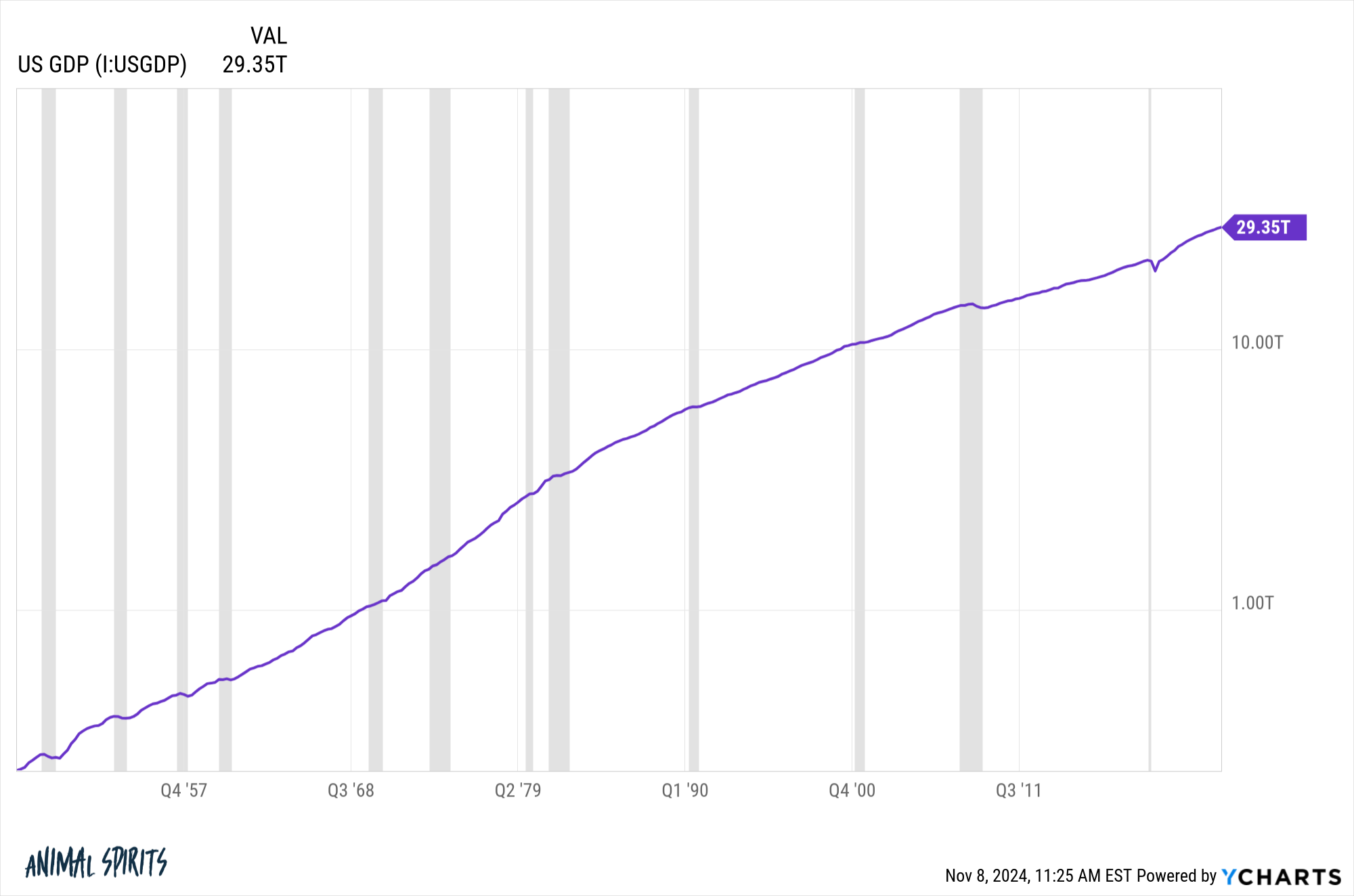

All of the monetary belongings are going nuts so it could make sense the U.S. financial system has by no means been greater:

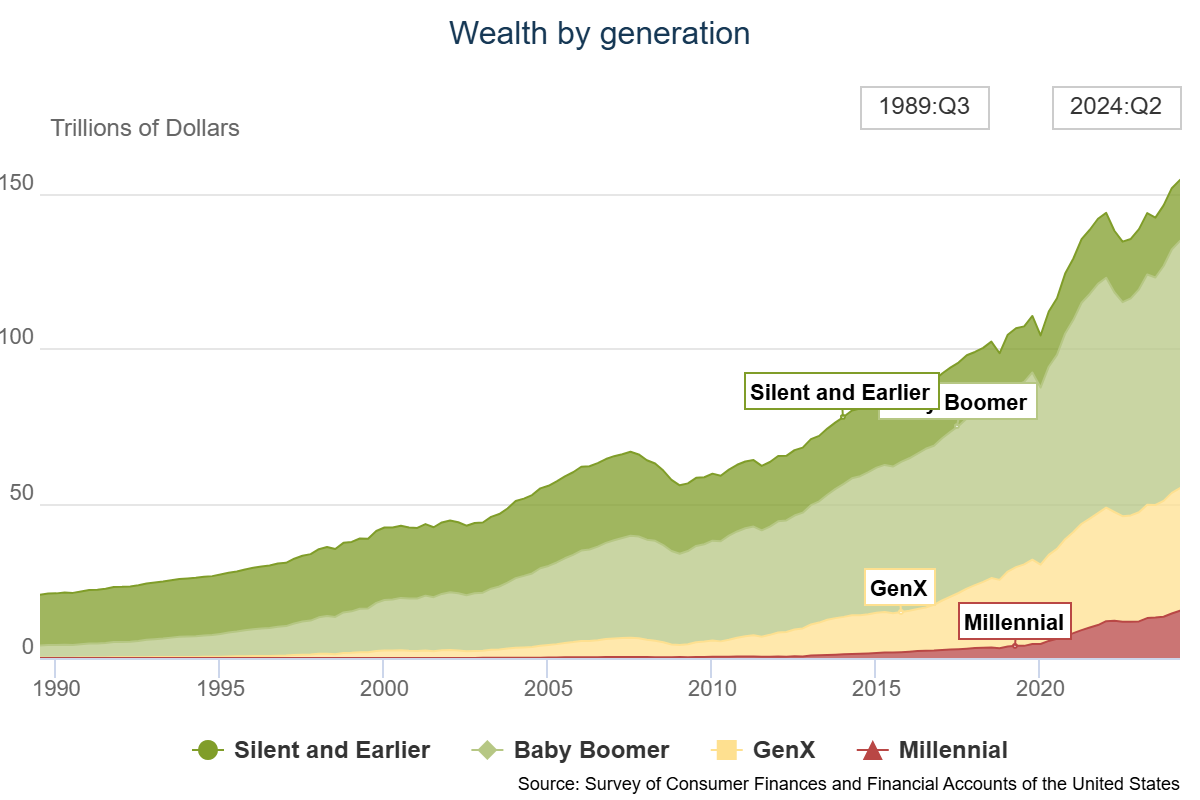

Family web value is there too at $155 trillion:

The largest shock all-time excessive to me personally is the Detroit Lions:

I by no means thought I’d see the day.

We’re enjoying higher than anybody within the NFL proper now (sorry Chiefs followers however you already know it’s true). We have now the very best offense within the league. We have now a boatload of thrilling younger gamers. We have now a coach who goes balls to the wall.

My solely fear is we’re peaking too early.

We needs to be the favorites within the NFC to succeed in the Tremendous Bowl.1

Go Lions!

This one is a little more subjective however it additionally looks like we’re at the moment at new all-time highs for hindsight bias following the election.

I’m at all times amazed at how rapidly the narrative machine adjustments after we all know the outcomes. Everybody is aware of the entire solutions when trying on the world by way of the rearview mirror.

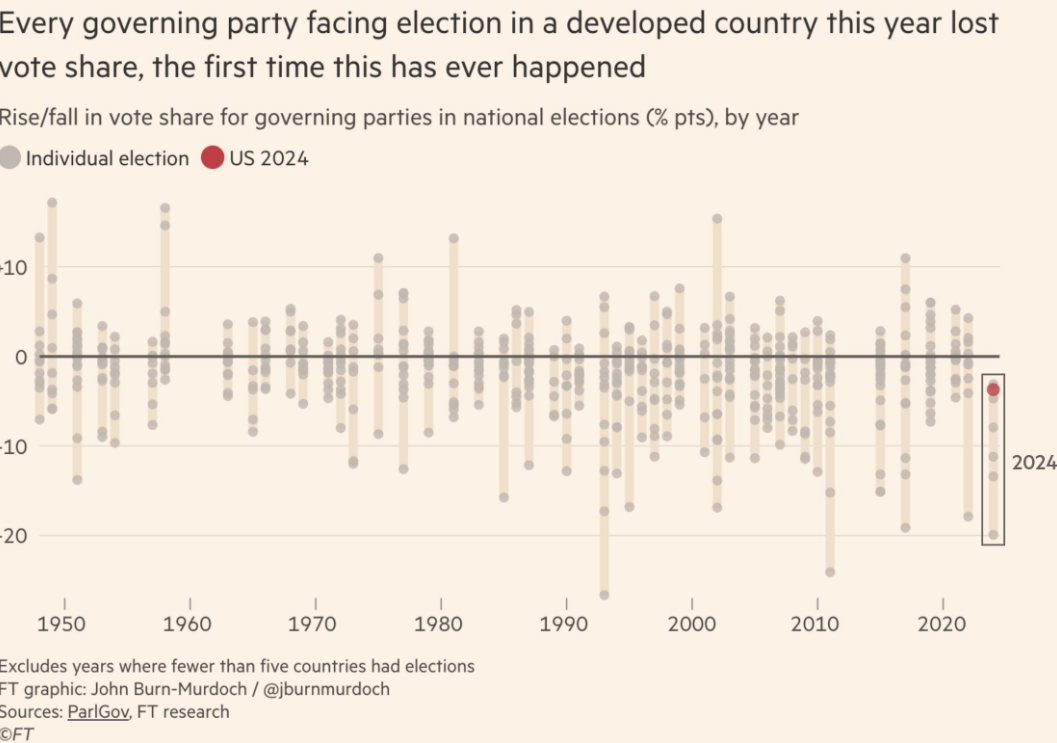

There are lots of causes Trump received and Harris misplaced. This one from John Burn-Murdoch at The Monetary Occasions makes essentially the most sense to me:

Incumbents across the globe misplaced floor. In actual fact, it was the primary time since WWII that each incumbent social gathering within the developed world misplaced vote share.

We are able to debate the rankings of the explanations for this shift — inflation, unpopular insurance policies, Covid hangover, and so forth. — however it seems like this was a world phenomenon.

The humorous factor is nobody was making the incumbent level forward of time however now everybody realizes it is smart.

Predictions are laborious, particularly concerning the future.2

Additional Studying:

The New Regular of Negativity

1I reserve the proper to delete this whole part if I jinx them by scripting this.

2With credit score to Yogi Berra.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here can be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.