Brian and Michael, each 34, dwell with their two cats in central Connecticut. Michael works as a venture coordinator for a state behavioral well being company serving younger folks and has a facet job as an advocate and incapacity management coordinator. Brian is a high quality assurance supervisor for a state-run hospital. The couple’s been collectively since 2013 and appears ahead to celebrating their 10-year anniversary in November. Whereas Brian and Michael have achieved rather a lot, they really feel as if their debt and lack of house possession is holding them again. They’d like our recommendation on learn how to unlock this subsequent degree of adulting and, crucially, learn how to be completely debt-free.

What’s a Reader Case Research?

Case Research handle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn by their state of affairs and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, try the final case research. Case Research are up to date by contributors (on the finish of the submit) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

Want Assist With Your Cash? Ebook a Monetary Session With Liz!

Cash is terrifying for lots of people and many people don’t know the place to start out.

That’s the place I are available.

I demystify private finance and break it down into manageable steps.

I clarify:

learn how to confidently handle your cash by yourself

I assist folks work out learn how to make their cash allow them to dwell the life they need.

Monetary Tune-up

$1,500

For people who find themselves financially savvy and need a second opinion on their cash trajectory.

✶ Most In style ✶

Full Monetary Session

$3,500

For folk who want a whole monetary plan & evaluation of their monetary future. No prior cash expertise required!

Advanced Monetary Session

$5,500

For folk with complicated monetary conditions, together with a couple of rental property and/or a small enterprise.

Unsure which package deal is best for you?

Ebook a free 15-minute name with me to debate.

Want Assist With Your Cash? Ebook a Monetary Session With Liz!

Cash is terrifying for lots of people and many people don’t know the place to start out.

That’s the place I are available.

I demystify private finance and break it down into manageable steps.

I clarify:

learn how to confidently handle your cash by yourself

I assist folks work out learn how to make their cash allow them to dwell the life they need.

Monetary Tune-up

$1,500

For people who find themselves financially savvy and need a second opinion on their cash trajectory.

✶ Most In style ✶

Full Monetary Session

$3,500

For folk who want a whole monetary plan & evaluation of their monetary future. No prior cash expertise required!

Advanced Monetary Session

$5,500

For folk with complicated monetary conditions, together with a couple of rental property and/or a small enterprise.

Unsure which package deal is best for you?

Ebook a free 15-minute name with me to debate.

The Objective Of Reader Case Research

Reader Case Research spotlight a various vary of monetary conditions, ages, ethnicities, places, targets, careers, incomes, household compositions and extra!

The Case Research collection started in 2016 and, up to now, there’ve been 103 Case Research. I’ve featured of us with annual incomes starting from $17k to $200k+ and web worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous folks. I’ve featured ladies, non-binary of us and males. I’ve featured transgender and cisgender folks. I’ve had cat folks and canine folks. I’ve featured of us from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured folks with PhDs and folks with highschool diplomas. I’ve featured folks of their early 20’s and folks of their late 60’s. I’ve featured of us who dwell on farms and folk who dwell in New York Metropolis.

Reader Case Research Pointers

I most likely don’t must say the next since you all are the kindest, most well mannered commenters on the web, however please notice that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The aim is to create a supportive atmosphere the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with optimistic, proactive recommendations and concepts.

And a disclaimer that I’m not a educated monetary skilled and I encourage folks to not make severe monetary choices primarily based solely on what one individual on the web advises.

I encourage everybody to do their very own analysis to find out the perfect plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Michael, right now’s Case Research topic, take it from right here!

Michael’s Story

Hello, Frugalwoods! I’m Michael, my accomplice is Brian and we’re each 34. We’ve two kittens and dwell in central Connecticut. I work as a venture coordinator for a state behavioral well being company that serves younger folks, and my facet job is as an advocate and incapacity management coordinator. I’m obsessed with my work since I’m a mind damage survivor and have had psychological well being challenges. Brian works as a high quality assurance supervisor for a state-run hospital. We’ve been collectively since 2013 and can rejoice our 10-year anniversary this November.

Michael and Brian’s Hobbies

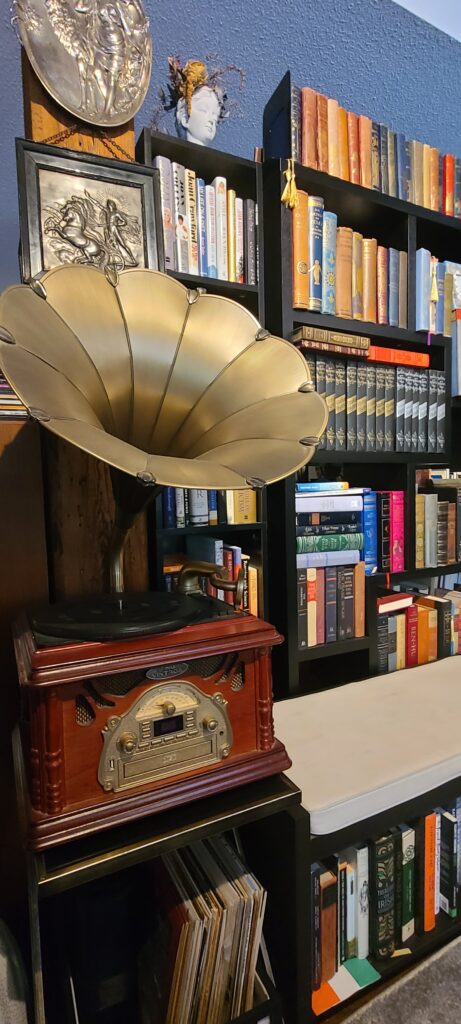

I really like books (each studying and accumulating) and revel in cooking and studying about meals, drawing, watching television and flicks, and the occasional online game. When he isn’t having fun with quiet time at house with us, Brian enjoys spending time outside operating, climbing, gardening, attending neighborhood occasions and touring. He’s additionally a lifelong learner and advocate who enjoys watching documentaries, attending webinars, visiting museums after which sharing the knowledge he learns with others.

Initially from the Boston space, Brian comes from a big Irish Catholic household and spends many weekends touring to spend time with them. After struggling by his secondary and undergraduate research, Brian is raring to attain educational success in a possible future graduate diploma program.

A few of our main targets embrace proudly owning a house, getting married, beginning a enterprise, attaining athletic success and leaving a long-lasting legacy.

What feels most urgent proper now? What brings you to submit a Case Research?

Lots occurred this previous 12 months and we really feel like we’re simply now making it to the opposite facet. We had two main life occasions:

- We misplaced Rex, our pricey cat of practically 8 years, to most cancers.

- Our condominium constructing was bought to a brand new firm that didn’t renew anybody’s lease.

We went from having fun with a comfortable, 600 sq ft studio condominium (at $945/month) to navigating the 2022/2023 rental market. We spent 3.5 months scrambling to discover a new place to dwell, packing up our lives and uprooting ourselves from what had been our blissful house for the previous eight years–all whereas caring for 2 new kittens with tummy hassle–it was rather a lot!

Again in August 2022, our life regarded completely completely different–our plan at the moment was to maneuver right into a home after we had been prepared, together with our cat Rex. We had been forecasting a capability to re-enter the housing market in late 2023 previous to our unplanned veterinary and transferring bills.

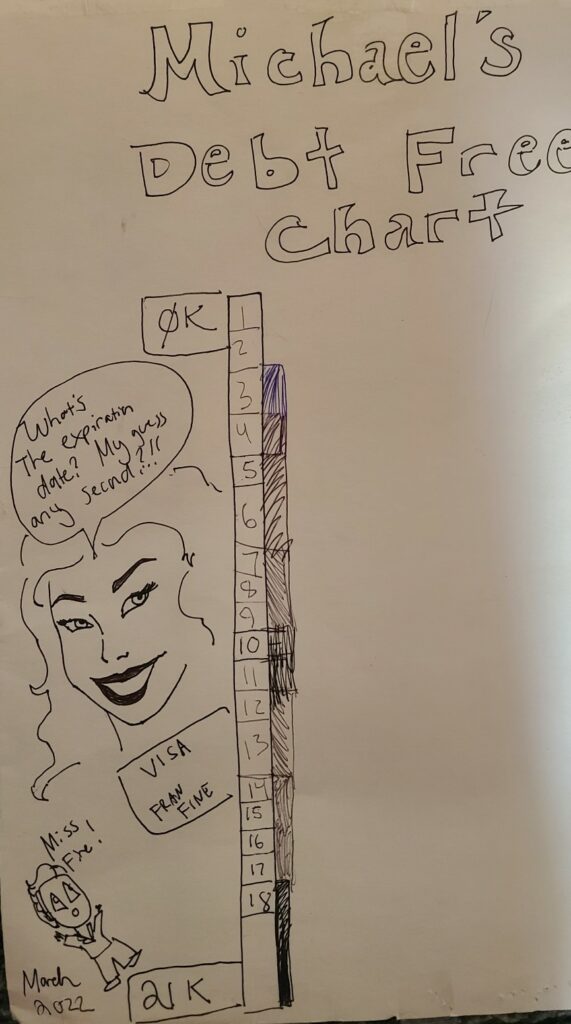

Our Debt

Brian paid off all of his pupil loans a number of years in the past (a complete of $58,000 ) and has been promoted in his job. He made profession modifications from company to non-public non-profit and most lately to the general public sector (with the state). Whereas he was initially proof against making use of, Brian now acknowledges that had it not been for my encouragement to use for his present state job, he’d be incomes considerably much less, wouldn’t have such beneficiant advantages (i.e. healthcare for all times and a pension) and our lifestyle wouldn’t be as snug.

Whereas he at the moment has no pupil mortgage debt, Brian has important client debt and minimal liquid financial savings. His long run investments are underfunded and never as various as he would really like, which poses the chance of not having ample retirement revenue after we are of retirement age. That is particularly regarding to us given the precarious standing of Social Safety within the present political local weather. Mind additionally views not proudly owning actual property as a vulnerability within the present housing/rental market.

Brian needs to have the ability to benefit from the chance to “purchase low” and is worried about not being in a monetary place to take action when the housing market turns. Brian’s client spending is exorbitant; that coupled along with his lack of financial savings makes him worry that he won’t be able to attain his life targets or present for our household as we become old, on condition that he might not have time to make up for earlier monetary errors and irresponsible spending. Brian feels that skilled assist is required to make sure our particular person and shared targets are achievable and don’t grow to be goals without end deferred.

I’ve great bosses and management at my present jobs, however am feeling referred to as to pursue alternatives alone as effectively. I need to commit time going ahead to discover how I can use my pursuits and expertise in significant and enriching methods, resembling by organizing, cooking, teaching, and so forth.

What’s the perfect a part of your present life-style/routine?

Our Hobbies

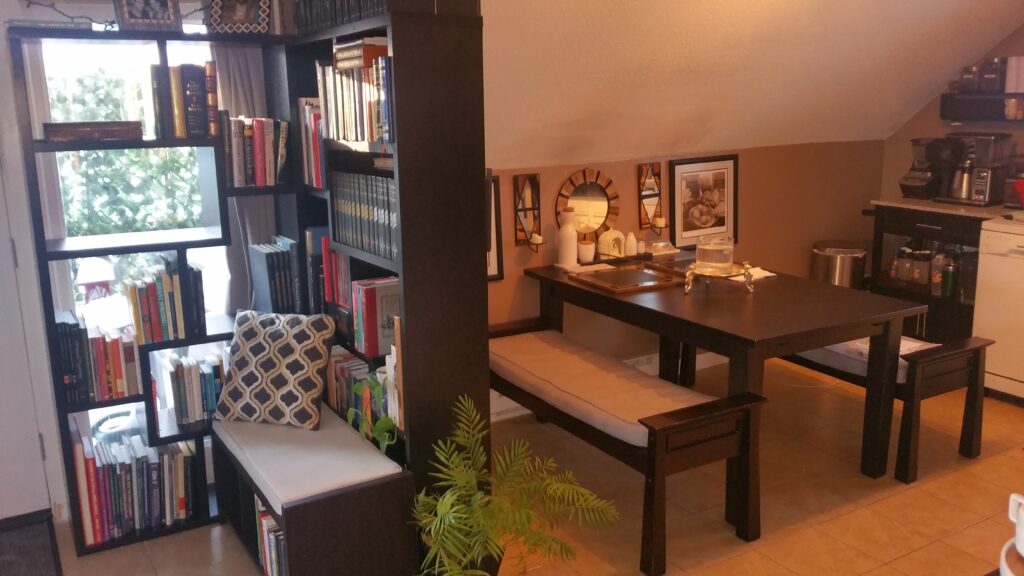

Now that the transfer is over, Brian has been having fun with operating in his free time. Our new area permits us to have a house library/media room with encompass sound, which is nice for having fun with TV and flicks collectively. The house workplace additionally offers us area to every do quiet work on the pc collectively.

Our House

We dwell comfortably in an expensive two-bedroom, two-bathroom condominium in a refurbished mill. Whereas we’d favor to dwell someplace extra rural, our condominium appears to be like out over a quiet non-public parking zone to a forested river parcel, which offers extra privateness. The constructing has exceptional industrial structure that we get pleasure from in our condominium, together with outsized home windows and ledges, 12 ft ceilings, uncovered wooden boards and help beams, varied bolts, pulleys and different industrial units from when this was a working mill. Whereas we liked our former area, our new area provides us room to breathe and offers (virtually) ample area for our massive assortment of non-public belongings (we favor to name them treasures).

The brand new area additionally offers me with an actual house workplace (I used to be beforehand relegated to a small nook desk in our studio condominium) in addition to a eating room/bar, library/media room, galley kitchen and separate bed room. Beforehand all of those (apart from the one lavatory) had been in the identical room. Whereas not as cozy, this house feels extra formal and age-appropriate. The constructing is quiet with respectful neighbors, there’s a donut store throughout the road, I can see the hospital I work at from the parking zone and we’re proper off the freeway, so hitting the street for a day journey or to journey to see household is a synch.

What’s the worst a part of your present life-style/routine?

Michael – feeling disgrace at my monetary state of affairs. I used to be briefly debt-free after years of being in debt, then spent a good quantity with the condominium transfer and so many issues up within the air. Fortunately, it isn’t catastrophic however I want I’d made completely different decisions. Additionally, being at house a lot is like infinite chocolate cake – nice at first, however will be isolating! I must construct in additional walks exterior.

Brian – feeling disgrace at my monetary state of affairs. I really feel means behind my friends and relations – financially, professionally, academically, athletically, socially. I don’t like that I lack a transparent plan on learn how to handle my cash successfully. I do know I’m not saving sufficient. I additionally really feel like I lack the monetary self-discipline to perform fundamental signifiers of maturity. I really feel as if I’m a supply of disappointment to my household. Additionally, I dislike not having our personal land – I need to have a backyard and a few earth to name my very own.

The place Brian and Michael Wish to be in Ten Years:

- Funds:

- In accordance with Michael:

- Debt free inside 1 12 months for Brian, 6 months for me.

- A snug financial savings quantity and elevated retirement contribution.

- I’m giving myself the aim to make $20-30k extra inside a 12 months, and have taken some preliminary steps and despatched out some purposes.

- Cash for journey, expertise/pastime upgrades and our different pursuits.

- In accordance with Brian:

- Debt free.

- 18 months of dwelling bills in liquid financial savings.

- Adequately vested in my retirement.

- With various belongings.

- Working carefully with a monetary advisor and CPA.

- With a superb credit score rating.

2. Way of life:

- In accordance with Michael:

- In a house – doesn’t must be large, however nature is a should for us.

- We’re considering of staying in central CT however are open to southeast CT the place I grew up, or the Rhode Island/CT border.

- Brian’s job is totally in individual so that’s the deciding issue except he transfers to a distinct place; however, there are extra alternatives in central CT.

- In accordance with Brian:

- Proudly owning our personal properties (major residence and second house) with in-law area for our mother and father to dwell with us part-time and indoor/outside area to entertain.

- Married.

- Belonging to a rustic membership.

- In a position to journey someplace as soon as every year.

- Proudly owning an electrical automobile.

- Having assist round the home for ourselves and our mother and father.

- Being concerned in our communities.

3. Profession:

- Brian sees himself rising in his present position and attaining an government degree place inside the subsequent 5 years. He would additionally wish to take over his father’s enterprise and proceed being concerned in civic affairs (i.e. operating for public workplace, and so forth.).

- Inside ten years, I would really like to have the ability to present part-time consulting companies.

Brian and Michael’s Funds

Revenue

| Merchandise | Variety of paychecks per 12 months | Gross Revenue Per Pay Interval | Deductions Per Pay Interval | Web Revenue Per Pay Interval |

| Brian’s job | 26 | $3,929 | Taxes – $1,000.23 advantages & retirement (403b, 457, pension, med/dental/imaginative and prescient/life insurance coverage)– $569.63 | $2,344.36 |

| Michael’s Principal Job | 26 | $1,717 | well being, imaginative and prescient and dental insurance coverage: $50.84 401k contributions: $171.68 HSA: $134.61 Taxes: $293.97 TOTAL deductions: $651 |

$1,066 |

| Michael’s 2nd job | 26 | $798 | Taxes – $94.60 | $703.61 |

| Michael – public talking / consulting *final calendar 12 months* | Sporadic | $2,000 | ||

| Brian – assist with household enterprise seasonally (tax prep help) | Annual | $500 | ||

| Annual total: | $167,544.00 | Annual whole: | $109,455.42 |

Mortgages: none

Money owed

| Merchandise | Excellent mortgage stability | Curiosity Fee | Mortgage Interval/Payoff Phrases | Month-to-month required cost |

| Brian’s Visa (SCU) | $16,057 | 0% till November 2023 (17.99% after) | The aim is to scale back this as a lot as attainable earlier than November | $302 month-to-month minimal cost |

| Michael’s Visa Platinum | $9,700 | 10.99% curiosity | Michael pays at the very least $1,400 monthly for an estimated 6 month payoff (except you suggest we cut back our financial savings as a way to pay it off quicker!) | $174.03 month-to-month minimal cost |

| Brian’s Visa Platinum (Navy Federal) | $2,503 | 0.99% till November 2023 (17.74% after) | Brian will snowball this primary to pay it off | |

| Whole: | $28,259 |

Belongings

| Merchandise | Quantity | Notes | Curiosity/kind of securities held/Inventory ticker | Title of financial institution/brokerage | Expense Ratio (applies to funding accounts) |

| Michael’s 401k | $36,992 | My 401k by work. I contribute 10% and my firm matches 4%. I’m totally vested. Ought to I improve my contributions? | Vanguard Goal Retirement 2055 | Vanguard | 0.08% |

| Brian’s 401k (previous job) | $19,305 | ||||

| Brian’s Pension Fund | $8,953 | Assuming we calculated it appropriately on the state retirement calculator… In 2054 after 35 years of service, it reveals a month-to-month payout of $4,150. | |||

| Michael’s Financial savings Account | $7,000 | That is my emergency fund | Navy Federal Credit score Union | ||

| Brian’s 457 | $5,886 | ||||

| Brian’s 403b | $3,389 | ||||

| Brian’s HSA | $3,093 | ||||

| Michael’s HSA | $2,100 | Well being Financial savings Account | |||

| Brian’s IRA | $1,325 | ||||

| Brian’s financial savings | $1,000 | Sharon Credit score Union (SCU) | |||

| Brian’s Vacation Financial savings | $1,000 | ||||

| Brian’s Shares | $852 | ||||

| Brian’s FSA | $356 | ||||

| Whole: | $91,250 |

Autos

| Car make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| 2007 Mercedes C280 | $4,582 (KBB non-public celebration worth) | $175,000 | Sure |

| 2007 Subaru Outback | $2,824 (KBB Personal celebration worth) | $175,000 | sure |

| Whole: | $7,406 |

Bills

| Merchandise | Quantity | Notes |

| Lease | $2,000 | |

| Michael – CC Debt cost | $1,400 | Estimated 6 month debt payoff at this cost fee |

| Brian – automobile repairs, gasoline, practice fare (8 month common) | $1,064 | Brian has had main automobile restore points over the past 12 months |

| Brian – Debt cost | $600 | |

| Pet meals, litter and vet | $517 | prescription pet meals wanted , vet is averaged out over final 8 months |

| Groceries | $469 | Principal grocery retailer, 8 month common |

| Electrical energy | $235 | That is the common; it is dependent upon season. We simply switched to a 3rd celebration provider, however CT has tremendous excessive charges regardless. |

| Consuming Out | $200 | |

| Brian – items | $200 | |

| Michael – House items | $200 | |

| Michael – private care | $150 | consists of therapeutic massage for ache reduction |

| Michael – Remedy/Teaching | $150 | |

| Brian’s automobile insurance coverage | $134 | |

| Web | $107 | |

| Brian – trip/journey/gasoline | $100 | |

| Michael’s automobile insurance coverage | $99 | USAA |

| Brian – charity | $75 | |

| Michael – items | $60 | |

| Michael – books | $50 | |

| Brian – clothes | $40 | |

| Telephone | $30 | 2 cell traces with Mint Cell (might swap in Oct to USA Cell because of name high quality). |

| Brian – private care | $30 | |

| Fuel | $27 | For Water heater |

| Michael – Video games | $25 | |

| Renters insurance coverage | $22 | USAA |

| Subscription | $20 | Amazon |

| Michael Fuel | $20 | Michael works from house, so his automobile shouldn’t be used usually |

| Brian – medical | $10 | |

| Michael – Life insurance coverage, quick time period incapacity, long run incapacity – | $0 | Included in Michael’s job advantages – 45k life insurance coverage, and quick and long run incapacity |

| Month-to-month subtotal: | $8,035 | |

| Annual whole: | $96,414.36 |

Credit score Card Technique

| Card Title | Rewards Sort? | Financial institution/card company |

| Michael – Visa Platinum | N/A | Navy Federal Credit score Union |

| Brian | N/A | Navy Federal Credit score Union |

| Brian | N/A | Sharon Credit score Union |

Brian and Michael’s Questions for You:

- Debt reimbursement – Is there a beneficial system?

- House shopping for – As a tough estimate, we predict that is at the very least 2-3 years away. Any suggestions or ideas?

- Retirement and financial savings – What proportion of every paycheck do you suggest committing to retirement, financial savings, and so forth?

- Ought to Brian pursue a masters diploma? We’re nervous about buying new pupil debt after he paid all of his off. Is a specialised or extra common graduate (masters degree) diploma extra marketable/advantageous? Govt masters vs. conventional? On-line vs. in-person?

- I’m inquisitive about learn how to be content material – as somebody with a penchant for “extra,” these previous 6 months have taught me what’s actually vital and that I must do extra soul looking out. I’d love to listen to different folks’s ideas on this!

- How would you prioritize the next by way of the present political and financial local weather: debt reimbursement; house possession; authorized marriage; graduate degree schooling; liquid financial savings; diversification of belongings; tax legal responsibility discount?

Liz Frugalwoods’ Suggestions

I need to begin off by saying that Brian and Michael are in fine condition! Brian, specifically, appears disheartened about their progress in direction of maturity, however I’ve to say, I don’t share his dismal outlook. I believe Brian assumes that everybody else his age has it collectively, however I can guarantee him that they don’t.

A LOT of individuals his age have the aim to attain what he and Michael have already got:

- A loving, long-term partnership

- Pets!

- A secure, spacious, beautiful condominium (that isn’t shared with roommates) in a metropolis they get pleasure from

- A wonderful profession and wage

- Time and area to pursue significant hobbies

- An in depth reference to household

Past that, the whole lot else is particulars. I don’t say that to reduce Brian’s considerations, however somewhat, to place them in perspective and to say that spreadsheet issues–resembling debt–are simply that: spreadsheet issues. I’ll brainstorm and description methods for Brian and Michael to repay their debt and improve their retirement investments. However on the finish of the day, the really vital issues in life are already in place for these two. I would like them–and everybody else–to maintain that in thoughts.

Sure, managing your cash does lower stress and nervousness. Sure, managing your cash does open up new choices and prospects on your life. Nonetheless, it’s vital to keep in mind that whereas cash makes life higher and simpler, it doesn’t clear up life for you. I believe we are able to all cite loads of sad wealthy folks as proof. So sure, it’s vital to appropriately handle your cash and sure, it’ll provide you with a greater retirement; however keep in mind that cash is only one part of a well-lived life.

Step #1: Monitor Your Spending

Earlier than delving into Michael and Brian’s particular questions, I need to encourage them to start out rigorously monitoring their spending. As they reported right here, their annual web revenue is $109,455 and their annual spending is $96,414. Since their web revenue accounts for all of their pre-tax retirement contributions and their spending consists of their debt repayments, they need to have $13,041 leftover yearly, which they might use to pay down their debt.

To get a deal with on whether or not or not they’ve this extra yearly, I encourage Michael and Brian to enact an expense monitoring system. I exploit and suggest the service from Empower (previously Private Capital) as a result of it’s free and straightforward to make use of. Alternately, they’ll use pen and paper, obtain their financial institution and bank card statements or create their very own spreadsheet system. No matter works for them each and no matter they’ll keep on with is okay. It doesn’t matter the way you observe you spending, it solely issues that you simply do. Till Michael and Brian know the place each greenback goes, it’ll be powerful for them to articulate how they need to change their spending.

Michael’s Query #1: Debt Compensation Methods

I do know that Michael and Brian are down on themselves about having debt, however I don’t see it as some ethical failing. Debt occurs; what issues is the way you take care of it.

Moreover, their debt load isn’t all that important. Let’s check out it once more right here:

| Merchandise | Excellent mortgage stability | Curiosity Fee | Mortgage Interval/Payoff Phrases | Month-to-month required cost |

| Brian’s Visa (SCU) | $16,057 | 0% till November 2023 (17.99% after) | The aim is to scale back this as a lot as attainable earlier than November | $302 month-to-month minimal cost |

| Michael’s Visa Platinum | $9,700 | 10.99% curiosity | Michael pays at the very least $1,400 monthly for an estimated 6 month payoff (except you suggest we cut back our financial savings as a way to pay it off quicker!) | $174.03 month-to-month minimal cost |

| Brian’s Visa Platinum (Navy Federal) | $2,503 | 0.99% till November 2023 (17.74% after) | Brian will snowball this primary to pay it off | |

| Whole: | $28,259 |

Is $28k in client debt nice? No, it’s not; but it surely additionally isn’t the tip of the world. Particularly not with Brian and Michael’s family revenue. I just like the technique they’ve outlined above because it focuses on eliminating debt earlier than mega rates of interest kick in. Debt shouldn’t be inherently “unhealthy,” however excessive rates of interest are unhealthy.

If it had been me, I would cut back all of my spending–beginning right now–as a way to repay this debt as rapidly as attainable.

Whereas I agree that the couple wants to avoid wasting extra into retirement and their emergency fund, I see these money owed as a precedence to get rid of as a result of it’ll save them cash in the long term.

Debt Payoff Suggestion #1: Cut back Spending ASAP

Michael and Brian have two variables they’ll modify right here: revenue and bills. They’ll earn extra as a way to repay their debt, they’ll spend much less or, for max impact, they’ll do each! I all the time recommend beginning with lowering spending as a result of it’s one thing you are able to do straight away. Rising revenue is equally efficient, but it surely’s sometimes a longer-term prospect. Plus, Michael famous that he already has his eye on growing his revenue this 12 months.

Decreasing spending additionally allows you to determine your priorities.

We’re what we spend and if we’re not spending on our highest and greatest priorities, we’re frittering away cash on issues that don’t matter to us. Therefore, lowering spending will assist Michael and Brian repay their money owed (within the close to time period) and be taught to spend mindfully (in the long run). I recommend they go on a short-term spending detox, which entails eliminating all Discretionary line gadgets and lowering all Reduceables.

Step one, which I’ve achieved for them under, is to outline all your bills as Fastened, Reduceable or Discretionary:

- Fastened bills are belongings you can’t change. Examples: your hire and debt funds.

- Reduceable bills are needed for human survival, however you management how a lot you spend on them. Examples: groceries and gasoline for the vehicles.

- Discretionary bills will be eradicated totally. Examples: journey, haircuts, consuming out.

Right here’s the categorization and urged new spending I’ve labored up for Michael and Brian:

| Merchandise | Quantity | Notes | Class | Steered New Quantity | Liz’s Notes |

| Lease | $2,000 | Fastened | $2,000 | ||

| Michael – CC Debt cost | $1,400 | Estimated 6 month debt payoff at this cost fee | Fastened | $1,400 | As soon as this debt is paid off, use the cash to repay the following debt and so forth |

| Brian – automobile repairs, gasoline, practice fare (8 month common) | $1,064 | Brian has had main automobile restore points over the past 12 months | Fastened | $1,064 | |

| Brian – Debt cost | $600 | Fastened | $600 | As soon as every debt is paid off, use the cash to repay the following debt and so forth | |

| Pet meals, litter and vet | $517 | prescription pet meals wanted , vet is averaged out over final 8 months | Fastened | $517 | |

| Groceries | $469 | Principal grocery retailer, 8 month common | Reduceable | $400 | |

| Electrical energy | $235 | That is the common; it is dependent upon season. We simply switched to a 3rd celebration provider, however CT has tremendous excessive charges regardless. | Reduceable | $235 | |

| Consuming Out | $200 | Discretionary | $0 | ||

| Brian – items | $200 | Discretionary | $0 | ||

| Michael – House items | $200 | Discretionary | $0 | ||

| Michael – private care | $150 | consists of therapeutic massage for ache reduction | Discretionary | $0 | |

| Michael – Remedy/Teaching | $150 | Discretionary | $0 | ||

| Brian’s automobile insurance coverage | $134 | Reduceable | $134 | ||

| Web | $107 | Fastened | $107 | ||

| Brian – trip/journey/gasoline | $100 | Reduceable | $0 | ||

| Michael’s automobile insurance coverage | $99 | USAA | Reduceable | $99 | |

| Brian – charity | $75 | Discretionary | $0 | ||

| Michael – items | $60 | Discretionary | $0 | ||

| Michael – books | $50 | Discretionary | $0 | ||

| Brian – clothes | $40 | Discretionary | $0 | ||

| Telephone | $30 | 2 cell traces with Mint Cell (might swap in Oct to USA Cell because of name high quality). | Reduceable | $30 | |

| Brian – private care | $30 | Discretionary | $0 | ||

| Fuel | $27 | For Water heater | Reduceable | $27 | |

| Michael – Video games | $25 | Discretionary | $0 | ||

| Renters insurance coverage | $22 | USAA | Fastened | $22 | |

| Subscription | $20 | Amazon | Discretionary | $0 | |

| Michael Fuel | $20 | Michael works from house, so his automobile shouldn’t be used usually | Reduceable | $20 | |

| Brian – medical | $10 | Fastened | $10 | ||

| Month-to-month Subtotal: | $8,035 | Proposed New Month-to-month Subtotal: | $6,665 | ||

| Annual Whole: | $96,414.36 | Proposed New Month-to-month Subtotal: | $79,980 |

The End result?

- Month-to-month web revenue: $9,121.28

- – Month-to-month spending: $6,665

- = Leftover: $2,456.28

Be aware that this month-to-month spending whole consists of the $2,000 they’re already plowing into debt reimbursement, which suggests they’d be capable of put a complete of $4,456.28 in direction of debt payoff each single month! Doing quite simple, back-of-the envelope math, which means they’d be fully debt-free inside 6.5 months! This doesn’t account for the rates of interest that’ll kick in come November, which’ll push the pay-off timeline out a tad, however not by an excessive amount of. Moreover, as every debt is paid off, they need to apply that erstwhile cost towards paying off the following debt.

Figuring out Priorities and Remaining Debt-Free

Michael and Brian alluded to a cycle of debt-payoff-debt as a recurring drawback for them and so I need to spend a while on this concept of remaining debt-free. They’re appropriate that in the event that they hold ricocheting between money owed, they received’t ever make actionable progress in direction of their long-term targets. It’s not a significant drawback to fall into debt a couple of times (after which pay it off in full), however it’s a drawback when it turns into a behavior. Brian and Micheal have the salaries to attain all the issues they articulated as long-term targets, however not in the event that they hold needing to dig themselves out of debt.

The aim for them is to discover a snug center the place they’ll relaxation.

At current, Brian and Michael are vacillating between feast and famine. They overspent, which resulted in debt, and now I’m suggesting they pull again into an austere, no-spend zone. My worry is that this famine interval will end in them boomeranging again into debt as a way to recuperate from this relative deprivation. In gentle of that, I would like Michael and Brian to deal with figuring out a tenable, long-term technique for dwelling inside their means.

To assist them determine this blissful medium, I encourage them to do the next:

- Begin monitoring each greenback they spend

- Schedule a month-to-month (and even weekly) cash date to evaluation their spending, progress and targets

- Take my free Uber Frugal Month Problem and focus on the prompts and workout routines collectively

Michael and Brian have already recognized their long-term life targets, now they should begin spending in accordance with these targets.

Moreover, I don’t recommend that they get rid of all discretionary spending without end–that’s no approach to dwell! As a substitute, I recommend they freely focus on which gadgets they need to add BACK into their funds after dwelling with out them for a number of months. Doing with out one thing for a time makes it fairly clear whether or not or not you “want” it in your life. I encourage them to do that soul looking out work earlier than/despite greater incomes. In the event that they don’t iron out this discrepancy between their revenue and bills, the issue could be very prone to proceed with a better revenue. Incomes extra doesn’t assist if it simply causes you to spend extra.

Michael’s Query #2: Shopping for a Home

I hear and perceive Michael and Brian’s want to be owners, however they’ve received to sort out a number of different monetary priorities first. Earlier than they begin socking away money for a downpayment, they should:

- Repay their debt and decide to remaining debt-free

- Save up an ample emergency fund

- Make investments totally for retirement

Since we’ve already mentioned learn how to obtain debt freedom, let’s spend a while on emergency funds and retirement.

Emergency Funds:

Your money equals your emergency fund and your emergency fund is your buffer from debt:

- An emergency fund ought to cowl 3 to six months’ value of your spending.

- At Brian and Michael’s present month-to-month spend fee of $8,035, they need to goal an emergency fund of $24,000 to $48,000.

Your emergency fund is there for you if:

- You unexpectedly lose your job

- One thing horrible goes flawed with your home that must be fastened ASAP

- Your automobile breaks down and should be repaired

- You’re hit with an sudden medical invoice

- Your canine will get quilled by a porcupine and has to go to the emergency vet

As you possibly can see, an emergency fund shouldn’t be for EXPECTED bills, resembling:

- Routine upkeep on a automobile, resembling oil modifications and brake pads

- Anticipated house repairs, resembling boiler servicing/chimney sweeping

- Deliberate medical bills

An emergency fund’s purpose for existence is to stop you from sliding into debt ought to the unexpected occur. It’s your individual private security web. That is additionally why it’s so crucial to trace your spending each month. Should you don’t know what you spend, you received’t understand how a lot it is advisable to save.

→Since an emergency fund is calibrated on what you spend each month: the much less you spend, the much less it is advisable to save.

At current, Michael and Brian have $9,000 in money, which might solely cowl just a little greater than a month’s value of their bills. This makes increase an emergency fund precedence #1 after they repay their debt.

Michael and Brian cited their transfer and vet payments as two sources of their debt, which is one more reason why I urge them to construct up their emergency fund. An sudden transfer and sudden vet payments are what an emergency fund is for. It’s there to assist ease difficult, costly intervals and forestall you from sliding into debt. Then, when you emerge from a interval of sudden spending, you re-stock your emergency fund in order that it’s there to help you the following time an sudden (however completely predictable) expense crops up. As a result of it’s all the time going to be one thing. This 12 months it is perhaps vet payments, subsequent 12 months it is perhaps automobile payments, the 12 months after it is perhaps your washer–we all know these items goes to occur, we simply don’t know when it’s going to occur. Having the money available to handle these “emergencies” is a vital a part of a wholesome monetary life.

Retirement

I’m going to skip round a bit and handle Michael’s query about retirement as a result of that’s one other precedence that comes earlier than house possession.

Investing for retirement is a long-term proposition as a result of:

- The IRS units a cap on how a lot you possibly can put into retirement accounts every year. Thus, as a way to take full benefit of their advantages, you need to begin early and contribute yearly.

- It takes many years on your cash to develop within the inventory market. Retirement accounts are invested out there and, historic return knowledge present us that we’d like a very long time horizon of investing for max development.

- There are tax advantages related to contributing to retirement accounts that must be taken benefit of yearly (you possibly can’t return and retroactively get these advantages; you need to contribute every year).

For these three causes, I recommend of us first have their retirement investing on lock earlier than saving up the money to purchase a home. You’ll be able to definitely do each directly, however it is advisable to remember that the advantages of retirement accounts re-start every year. You’ll be able to’t return and max out your 2019 retirement contributions–you need to do it every year.

Retirement Accounts Obtainable to Michael and Brian

Michael and Brian have a completely enviable variety of retirement accounts accessible to them! Because of Brian’s authorities job, he has entry to a 403b, a 457 and a pension, which is actually the triple crown of retirement. Michael requested how a lot they need to be contributing to retirement and my reply is all the time:

- The perfect factor to do is to max out your contributions yearly

- Should you can’t afford to do the max, the second smartest thing is to do as a lot as you possibly can

- The third smartest thing is to make sure you’re contributing sufficient to qualify for any match your employer provides

Right here’s the utmost quantity Michael and Brian are eligible to place into retirement every year:

| Merchandise | Annual Max Contribution Allowed | Advantages/Restrictions |

| 401k (Michael) | $22,500 | This contribution comes out of his paycheck pre-tax and grows tax-deferred, that means he received’t be taxed on the earnings till he begins to withdraw cash in retirement. You might want to be age 59.5 earlier than you possibly can withdraw cash with out a penalty. |

| 403b (Brian) | $22,500 | Similar as a 401k. |

| 457b (Brian) | $22,500 | In 457b plans, you’re allowed to withdraw cash penalty-free earlier than age 59.5 after you permit the employer who sponsors the plan. Therefore, if an individual plans to retire sooner than age 59.5, there’s an actual benefit to having a 457b. |

| Roth IRA (Michael) | $6,500 | Assuming they’re every submitting their taxes as “single,” their MAGI would make them every eligible for a Roth IRA. |

| Roth IRA (Brian) | $6,500 | You pay taxes on the cash you place right into a Roth IRA, however you don’t pay taxes whenever you withdraw the cash in retirement. A Roth IRA grows tax free. Additionally notice you can withdraw contributions you’ve made to a Roth IRA, with out penalty, at any time no matter your age |

| TOTAL ANNUAL AMOUNT: | $80,500 |

Since Michael and Brian have so many accounts accessible to them, they might technically stash away $80,500 per 12 months in tax-advantaged retirement automobiles. That may devour an excessive amount of of their revenue at this stage, however, it’s one thing for them to bear in mind for the longer term. Significantly as their incomes improve over time, this’ll be an excellent technique for them to make use of from a tax-advantaging perspective.

In the interim, I recommend they every work to extend their contributions to their office accounts (Michael’s 401k and Brian’s 457b) till they attain the annual allowed most.

Retirement Wildcards: Pension & Social Safety

It’s powerful for me to evaluate whether or not Brian and Michael are on observe for retirement due to these two wildcards. Brian’s pension sounds prefer it has the potential to be very beneficiant assuming:

- He stays with this employer for the variety of years required and makes all needed contributions

2. The employer doesn’t default on the pension

3. The pension is inflation-adjusted

If all of this stuff come true, it’s attainable his pension will present a really strong basis for his or her retirement. Moreover, we don’t understand how a lot every of them can count on to obtain in Social Safety, however that can provide one other layer of retirement safety. Social Safety is inflation-adjusted and, in my humble opinion, not possible to vanish primarily based on its recognition on either side of the aisle. Something can occur, which is why I by no means recommend that somebody rely ONLY on Social Safety or a pension. However, the mixture of those two issues bodes very effectively for Brian and Michael.

Notes on Investing

Brian and Michael didn’t embrace the place all of their investments are held, what they’re invested in or their expense ratios, so I’ll present the under as nudges for them to do extra analysis on all of their investments (401k, 403b, 457, shares, and so forth).

Issues to contemplate when selecting what to put money into:

- Your threat tolerance. Investing within the inventory market is inherently dangerous. Would you be extra snug with lower-risk, lower-reward choices, resembling bonds? Or higher-risk, higher-reward choices, resembling shares?

- Your age. How quickly do you anticipate withdrawing a proportion of this cash? That’ll inform how aggressive you need to be together with your investments.

- The charges related to the funds you’re contemplating. Excessive charges (a few of that are referred to as “expense ratios”) will eat away at your cash through the years. DO NOT do this to your self! For reference, the next three brokerages and funds are thought of to be low-fee funding choices:

- Constancy’s Whole Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Whole Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Whole Market Index Fund (VTSAX) has an expense ratio of 0.04%

Brian’s Previous 401k: Roll It Over

Brian ought to roll his previous 401k over into an IRA. “Roll over” simply means “transfer.” The rationale to do that is to place your self answerable for what it’s invested in. When you roll it into an IRA, you possibly can select the brokerage and the investments, which suggests you possibly can optimize for low charges and your private threat tolerance.

Employer-Sponsored Retirement Accounts

Whenever you’re invested in a retirement account by your employer, you possibly can solely select from the investments they provide. Ask HR for an inventory of accessible funds and brokerages; evaluation and choose from this record. Be aware that despite the fact that employers don’t all the time provide the easiest funds (or the very lowest expense ratios), it’s nonetheless value it to put money into tax-advantaged retirement accounts.

Michael’s Query #4: Ought to Brian pursue a masters diploma?

My opinion is to solely pursue a grasp’s diploma if it’s instantly associated to a important wage improve. In any other case, I wouldn’t spend the time or the cash. I personally have a grasp’s diploma that didn’t advance me professionally and, I can let you know now, there is no such thing as a level to all of the blood, sweat, tears and cash I poured into it. Zero level. DON’T DO IT except there’s a exact, printed, articulated, assured, direct, iron-clad correlation to creating extra money.

Pursuing schooling for enjoyable is one other dialog totally and I’m not in opposition to doing that, however, Brian didn’t state that as a aim. If he needs to grow to be debt-free, purchase a home and obtain the opposite targets he outlined, then spending money and time on a grasp’s diploma appears like an unhelpful detour to me.

Michael’s Query #5: How would you prioritize the next by way of the present political and financial local weather: debt reimbursement; house possession; authorized marriage; graduate degree schooling; liquid financial savings; diversification of belongings; tax legal responsibility discount?

Most of that is already answered above, so right here’s my fast rundown so as of precedence:

- Marriage: if you wish to get married, go for it! No must spend a ton of cash. Should you’re involved about this from a authorized perspective, get married on the courthouse tomorrow and save up for a celebratory celebration sooner or later sooner or later.

- Debt reimbursement

- Emergency fund (liquid financial savings)

- Retirement

- Save downpayment for a home

- Don’t go to graduate faculty

- Tax legal responsibility discount: max out all accessible retirement accounts (see above) and HSAs

- Diversification of belongings: fear about this after #1-7 are full. Learn JL Collins’ e-book, “The Easy Path to Wealth” to information you.

Abstract Of Suggestions:

- Cut back spending instantly as a way to repay all money owed as rapidly as attainable, ideally inside 6-8 months.

- Begin monitoring spending rigorously and have frequent conversations about priorities and aware spending.

- Take my free Uber Frugal Month Problem collectively to facilitate and information these conversations.

- Enact plans and guardrails to make sure you stay debt-free for the long-run. See-sawing out and in of debt shouldn’t be a tenable long-term technique.

- As soon as the debt is paid off, save up an ample emergency fund, the quantity of which must be calibrated off of your spending.

- After the debt is paid off and the emergency fund is stocked, decide how a lot you possibly can every put into your retirement accounts. Don’t fear should you can’t max them out straight away–set that as a long run aim and deal with doing what you are able to do now.

- Lastly, begin stashing away money for a downpayment on a home. Preserve this cash in one thing that earns curiosity, however is well accessible, like a high-yield financial savings account (such because the American Categorical financial savings account, which at the moment provides a 4.3% rate of interest).

Okay Frugalwoods nation, what recommendation do you’ve gotten for Michael and Brian? We’ll all reply to feedback, so please be happy to ask questions!

Would you want your individual Case Research to seem right here on Frugalwoods? Apply to be an on-the-blog Case Research topic right here. Rent me for a non-public monetary session right here.