It’s estimated child boomers will cross down greater than $80 trillion to their millennial and Gen X heirs over the subsequent 20 years.

That is going to be the best wealth switch the world has ever seen.

The timing of those transfers will probably be a hotly debated matter for a lot of households.

Child boomers have been born between 1946 and 1964, making them within the vary of 60-78 years previous. Let’s assume that places the ages of their kids someplace within the vary of 30-50.

The typical life expectancy for somebody within the 60-78 age vary is someplace within the neighborhood of 83 to 90.1

That may imply most kids receiving an inheritance will achieve this someday of their 60s. Clearly, not everybody will probably be within the lucky place of receiving an inheritance. If you’re in that place, rely your self fortunate.

Nonetheless, some younger individuals will favor to get the cash sooner fairly than later, after they have extra duties.

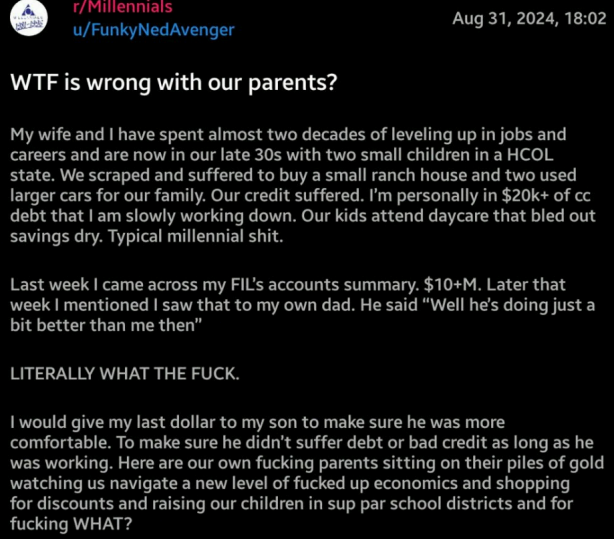

Right here’s one such instance from a Reddit submit:

This man is NOT joyful. His dad and mom and in-laws have hundreds of thousands of {dollars}. He’s struggling financially and wish to faucet into that inheritance early.

Look, I don’t know all the main points right here. Possibly the dad and mom are blind. Or possibly this man is unhealthy along with his funds and so they’re attempting to show him a lesson.

Whoever you facet with on this sort of factor, this story makes it clear there are some generational variations in how child boomers and millennials view household cash.

I wish to share some ideas on these generational variations.

These are overgeneralizations that don’t embody everybody from these teams however that is what I’ve noticed by means of my experiences with household, associates, friends, purchasers and readers with regards to cash variations between child boomers and millennials:

Child boomers. The dad and mom of child boomers didn’t have almost as a lot cash. Retirement was nonetheless a comparatively new idea for the Biggest Era. A lot of them died of their 60s or 70s as a result of they smoked and didn’t have the identical healthcare assets we now have in the present day.

The Biggest Era lived by means of the Nice Melancholy. There have been no handouts. They taught arduous work and the worth of a greenback. Though child boomers finally turned shoppers, shortage was the mindset drilled into them by their dad and mom.

Nobody actually talked about cash in household circles, and most child boomers most likely didn’t get a lot assist from their dad and mom.

To be truthful to in the present day’s younger individuals, the price of housing, childcare, and training was a lot decrease again then, so individuals didn’t want as a lot assist from their dad and mom.

If there was any household cash, the inheritance got here when the dad and mom handed away. I believe older generations view inheritance as one thing that happens after you die as a result of that’s the way it’s at all times been.

Millennials. Younger individuals face increased prices than prior generations in some ways, however we additionally lead extra extravagant life.

Millennials spend far more cash than child boomers on the similar age. We drive nicer autos and need greater, extra opulent homes (I blame HGTV). We journey greater than our dad and mom did. How many individuals do you know rising up who took household holidays to Europe? Now, it looks as if everybody does it. We additionally shell out more cash for higher expertise that makes our lives simpler. We pay up for comfort.

Millennials spend method extra on their children.

Daycare is the massive one, in fact. However there’s additionally journey sports activities which isn’t low cost. Youngsters put on a lot higher-quality clothes. I by no means had a pair of Jordans rising up. Now it looks as if each child has a number of pairs. Dad and mom don’t drive a station wagon or minivan anymore. Now it’s an $80,000 SUV although we now have fewer children than earlier generations.2

Each generations have a degree.

It’s costlier for younger individuals today however a few of these increased prices come from the truth that we’ve turned luxuries into requirements.

Child boomers may need had it simpler in some methods, however that they had their very own issues to take care of and didn’t have the identical way of life we’re accustomed to in the present day.

My solely answer right here is for households to speak about cash extra usually. In case you need assistance together with your funds, it’s best to ask for assist. Your dad and mom aren’t mindreaders.

If there may be an inheritance someplace down the road, child boomers ought to speak with their kids about it. Inform them your plans. Be clear.

Higher communication is the easiest way to keep away from an offended Reddit submit by a member of the family.

Michael and I talked in regards to the generational push and pull between millennials and child boomers and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Millennials Are Changing into Boomers

Now right here’s what I’ve been studying currently:

Books:

1The life expectancy for a 78 yr previous girl is roughly 90. For a 78 yr previous man it’s 88. For a 60 yr previous its 85 and 83, respectively.

2I’m at all times shocked to see the autos teenagers drive in our space today. None of my associates had good automobiles once we have been in highschool. Right this moment these children drive luxurious SUVs. It’s insane. Get off my garden please.