On July 3, the Home narrowly handed the One Massive Stunning Invoice Act (OBBBA) with a 218–214 vote. In response to the nonpartisan Congressional Finances Workplace (CBO), the invoice will add an estimated $3.3 trillion to the finances deficit over the following 10 years. Trump signed the invoice the following day on July 4.

To assist pay for it, OBBBA cuts funding to Medicaid, SNAP (meals help), and clear power tax credit, whereas additionally elevating the federal debt ceiling by $5 trillion. Sadly, the CBO additionally estimated that 11.8 million folks may lose medical insurance protection due to the laws’s Medicaid cuts and different provisions.

A latest Quinnipiac College ballot discovered that 53% of registered voters oppose the invoice, whereas solely 27% help it. In different phrases, it’s deeply unpopular, however all we are able to do now’s study its implications.

When you have a job with well being and retirement advantages, and also you’re pursuing monetary independence or early retirement (FIRE), this invoice ought to work in your favor. Why? As a result of when taxes go down, your skill to avoid wasting, make investments, and construct wealth goes up.

Key Provisions of OBBBA That Have an effect on FIRE Seekers

For background, I helped kickstart the modern-day FIRE motion in 2009 after I launched Monetary Samurai and started sharing my journey to flee the finance business and retire early.

In 2012, I negotiated a severance bundle and haven’t returned to full-time work since. As an alternative, I’ve centered on writing for this web site, publishing books, and fatherhood. All the pieces I write relies on firsthand expertise as a result of cash is just too vital to go away to guesswork.

The highway to monetary independence is stuffed with twists and turns, so it’s vital to remain prepared for change. Listed below are the important thing tax and financial savings provisions from the OBBBA that may assist FIRE followers speed up their journey.

1. Barely Larger Threat Of Shedding Reasonably priced Well being Insurance coverage

Probably the most generally requested query for these contemplating early retirement is: Do I manage to pay for? A detailed second is: How will I afford medical insurance?

The U.S. is without doubt one of the few developed nations the place inexpensive well being care is intently tied to employment. When you retire earlier than age 65—when Medicare kicks in—you’ll must get medical insurance via the Reasonably priced Care Act (ACA) market.

Beforehand, in case your family earnings exceeded 400% of the Federal Poverty Degree (FPL), you have been ineligible for premium subsidies. That is referred to as the subsidy cliff. Nonetheless, after earlier laws, subsidies are actually primarily based on a sliding scale, and there may be now not a tough earnings cutoff at 400% FPL. This implies even higher-income early retirees should still qualify for subsidies—particularly if ACA premiums exceed 8.5% of their earnings.

That mentioned, relying on who you ask, between 10 and 16 million folks might lose medical insurance protection over the following decade. One main cause is the deliberate discount in enhanced ACA tax credit—significantly for these incomes greater than 400% of the Federal Poverty Degree (which is $124,800 for a household of 4 in 2025). On common, these enhanced tax credit have diminished premium funds by $705 per yr for eligible enrollees.

Different contributing components embody:

- A shorter open enrollment window (diminished from January 15 to December 15, beginning November 1), so keep organized

- New earnings verification necessities for these making use of for premium tax credit, and

- Restrictions on protection for DACA recipients.

25X Family Bills In Investments Is Uncomfortably Low

When you depend on medical insurance subsidies to make early retirement possible, attempt to maintain your earnings underneath 400% of the FPL. In any other case, you could face considerably larger premiums—or be compelled to work longer.

One workaround is to begin a small enterprise together with your partner or companions, permitting you to get group medical insurance and deduct the price from your small business earnings, successfully lowering your premiums by your small business’s marginal federal tax fee. Nonetheless, this strategy solely is sensible if the enterprise earns sufficient to justify the expense.

For context: when my spouse retired in 2015 and I may now not piggyback on her employer-subsidized plan, we started paying $1,680/month for a Gold plan for simply the 2 of us. At the moment, with a household of 4, we’re paying $2,500/month for a Silver plan. It’s a steep value, however one we’ve accepted as the value of economic freedom.

After not having a day job since 2012, I actually don’t consider having an investable internet price equal to 25X annual family bills is sufficient to comfortably retire early. You possibly can see the proof by males who declare FIRE and nonetheless stress their wives to work, or those that declare FIRE and nonetheless earn supplemental earnings, like me. You want a higher cushion if you wish to really feel comfy, one thing nearer to 35X annual bills or extra.

Earlier than you retire early, do the next:

- Estimate your whole family earnings post-retirement.

- Examine it towards the 400% FPL threshold to find out for those who qualify for ACA subsidies.

- Enter a practical annual healthcare value into your retirement finances and multiply it by 25X to 50X to make sure you have sufficient in investments.

- Go on a well being kick throughout your final working yr—get in one of the best form of your life to reduce future medical bills.

Right here’s the factor: at a 4% fee of return, you’d want $3,120,000 in investments to generate $124,800 a yr (400X of FPL for a family of 4). The $3,120,000 does not even embody the worth of your major residence, which may simply be price over $1,000,000.

So for those who and your partner retire early with two dependents, do you actually need well being care subsidies as multi-millionaires? Most would argue no. Some may even argue that accepting well being care subsidies with a seven-figure internet price is immoral.

2. Baby Tax Credit score Elevated

- The credit score will increase to $2,200 per youngster (up from $2,000), adjusted for inflation.

- Phases out beginning at $400,000 (MFJ) or $200,000 (others).

- Legitimate Social Safety numbers are nonetheless required.

As a dad or mum of two younger kids, reaching FIRE with out children is much simpler than doing so with them. Sustaining FIRE can be tougher after getting kids, as your largest bills—housing, healthcare, and training—are those most impacted by inflation.

This provides dad and mom just a little extra respiration room whereas elevating children, particularly in high-cost areas. A $200,000 to $400,000 earnings phaseout remains to be fairly beneficiant, even for these dwelling in high-cost areas.

3. 529 Plan Enlargement

- Now permits tax-free distributions for personal and spiritual Okay–12 education.

- Additionally covers postsecondary credentialing bills, aligning with the Lifetime Studying Credit score.

This may occasionally not really feel fully new, since we already know that as much as $10,000 a yr from a 529 plan can be utilized for personal Okay–12 training. Nonetheless, the OBBBA now firmly cements this flexibility into legislation.

For FIRE-minded dad and mom, attempt to contribute sufficient to match the present 4-year value of your goal faculty. If you may get there, the expansion of your 529 plan has an honest probability of maintaining with tuition inflation. Simply take into accout for these seeking to achieve free cash for faculty: a big 529 steadiness will seemingly scale back eligibility for need-based monetary help, although it gained’t have an effect on merit-based help.

4. SALT Deduction Cap Raised

- Will increase the SALT cap to $40,000 from $10,000, rising 1% yearly via 2029.

- Reverts again to $10,000 in 2030.

- Begins phasing down for incomes over $500,000.

When you reside in a high-tax state, this gives significant short-term aid. Elevating the SALT (State and Native Tax) deduction cap must also present a valuation increase to actual property in excessive value of dwelling cities.

As somebody who has lived in New York Metropolis and San Francisco since 1999, elevating the SALT deduction cap is useful to my household. The following metropolis we’re severely contemplating is Honolulu, which additionally has higher-than-average earnings taxes. Though Hawaii does have the bottom property tax fee within the nation.

5. AMT Aid Made Everlasting

- AMT exemptions are actually completely listed to inflation.

- 2025 figures:

- $88,100 (single), phased out at $626,350

- $137,000 (MFJ), phased out at $1,252,700

This protects extra upper-middle-class households from shock tax payments as incomes rise. The earnings figures for AMT exemptions look to be fairly beneficiant.

6. New “Trump Accounts” for Youngsters

- Tax-advantaged accounts for youngsters underneath 8.

- Contribute as much as $5,000/yr, grows tax-deferred till age 18, nonetheless, the contribution is not a tax deduction

- Can be utilized for faculty, first residence, or beginning a enterprise.

- Certified withdrawals might be handled as capital positive aspects and taxed on the relevant long-term capital positive aspects fee.

- A $1,000 authorities seed contribution (free cash) for qualifying children born between January 1, 2025–2029.

These accounts promote long-term saving and investing from an early age—a core worth of the FIRE motion. I’m simply unsure how the proposed $1,000 contribution per youngster born throughout this era might be funded. Nonetheless, any initiative that encourages folks to have extra kids and spend money on their future is a step in the best course.

I like to recommend that each FIRE dad or mum open each a custodial funding account and a custodial Roth IRA for his or her kids as early as attainable. The sooner you begin contributing—and inspiring your kids to earn earnings—the stronger their monetary habits and the higher their potential to construct lasting wealth.

Custodial accounts additionally make it simpler to purchase the dip. Even for those who’re hesitant to speculate for your self, it’s usually simpler to remain courageous while you’re investing to your kids’s future. So in whole, we are able to spend money on a 529 plan, custodial funding account, custodial Roth IRA, and “Trump Account” for every youngster. Time to get going!

7. Momentary Tip Earnings Deduction

- As much as $25,000 in ideas deductible from 2025–2028.

- Applies to non-itemizers in tipped industries.

- Nonetheless reportable for payroll taxes and state/native taxes.

When you’re facet hustling or in service work whereas build up financial savings, this can be a good perk. Though, I am unsure most individuals who earn ideas pay taxes on these ideas within the first place.

8. Momentary Time beyond regulation Pay Deduction

- Deduct as much as $12,500 (or $25,000 MFJ) of additional time pay from 2025–2028.

- Phases out at $275,000 (single) or $550,000 (MFJ).

This can be a nice tax break for these placing in further hours to flee the rat race sooner. To at the present time, I don’t know anybody who works 40 hours every week or much less and likewise needs to retire early. In truth, because the pandemic, extra individuals are working a number of distant jobs to double and even triple their earnings.

The 40-hour workweek is an outdated assemble. If you wish to earn greater than the common particular person, you’ll seemingly must work greater than the common particular person. And if additional time pays extra and is now much less taxed—nice! Because of the OBBBA, there’s now much more incentive to place in further hours and attain monetary freedom sooner.

9. Automotive Mortgage Curiosity Deduction (Momentary)

- Deduct as much as $10,000 in curiosity on U.S.-assembled autos (2025–2028).

- Phases out at $100,000 (single) or $200,000 (MFJ).

- RVs and campers excluded.

When you want a automobile however hate the thought of non-deductible debt, this provision takes a little bit of the sting out. That mentioned, hopefully everyone follows my 1/tenth rule for automobile shopping for and does not take out a mortgage to purchase a depreciating asset. Proudly owning an excessive amount of automobile is a high wealth killer in America.

If it is advisable purchase a automobile, you should definitely comply with my Home-to-Automotive Ratio components to remain on observe for FIRE. Intention for a ratio of a minimum of 20 for those who don’t wish to work without end. The typical American has a ratio of between 8 – 10, and your objective is to attempt to completely be above common.

10. Federal Property Tax Exemption Made Everlasting

- Exemption locked in at $15 million/particular person for 2026 and past, adjusted for inflation. That is up from $13.99 million/particular person in 2025.

Though the property tax solely impacts about 1% of households, this can be a good win for these within the Fats FIRE camp who’re searching for to create generational wealth. Capturing for a internet price equal to the federal property tax exemption threshold is one internet price goal to shoot for.

If the property tax exemption quantity wasn’t prolonged past 2025, it might have dropped in half beginning in 2026 and past. In that case, the “loss of life tax” would have ensnared much more households, particularly on account of inflation and the rise of threat belongings.

11. Social Safety Tax Deduction (Good For Conventional Retirees)

One of many extra well-liked provisions of the OBBBA is the $6,000 “senior deduction” for Individuals aged 65 and older. Whereas it doesn’t totally eradicate taxes on Social Safety, it does assist—by rising the share of seniors who owe no taxes on their advantages from 64% to 88%, based on estimates by President Trump’s Council of Financial Advisers.

In different phrases, round 14 million extra seniors are anticipated to see some aid from taxes on their Social Safety earnings.

However as at all times, not everybody advantages. The complete $6,000 deduction applies solely to seniors making as much as $75,000 as people or $150,000 for joint filers. The deduction then begins to part out, disappearing fully at $175,000 for singles and $250,000 for {couples}.

For context, the median earnings for seniors in 2022 was roughly $30,000. So whereas the senior deduction makes for nice headlines, the reality is that most seniors already pay little to no taxes on their Social Safety. As such, the precise profit could also be marginal for the standard retiree.

On condition that Social Safety is underfunded by about 25% and projected to expire of full advantages by 2034 if no adjustments are made to eligibility or payouts, increasing deductions now places much more pressure on the system. It’s nice for those who can gather the cash in the present day, however not so nice for future generations.

Enterprise Proprietor Wins That Help Monetary Independence Seekers

Top-of-the-line methods to attain monetary independence is by beginning a enterprise and constructing fairness. I dedicate a chapter to entrepreneurship in my USA TODAY bestseller, Millionaire Milestones: Easy Steps to Seven Figures. The crux of the chapter is how enterprise fairness can multiply as your income and earnings develop—in contrast to a salaried job, the place earnings is basically linear and tied to time.

1. 20% Cross-By means of Deduction Made Everlasting

- The Part 199A deduction lives on.

- Applies to earnings from LLCs, S corps, sole props.

- The proposed improve to 23% was minimize, however 20% stays locked in.

This can be a main win for entrepreneurs, freelancers, and facet hustlers—all pillars of FIRE technique. It’s unwise to solely depend on your day job to attain monetary independence. The extra earnings streams you’ve gotten, the higher.

3. Part 1202 Inventory Features Exclusion

- Retains the tiered QSBS guidelines:

- 50% exclusion for 3+ years

- 75% for 4+ years

- 100% for five+ years

- Will increase achieve exclusion cap to $15 million (from $10 million), inflation-adjusted.

The upper QSBS exclusion cap of $15 million is right for FIRE people investing in startups as angel traders. On the margin, this modification ought to encourage extra folks to spend money on early-stage firms, which is nice for the startup ecosystem.

It’s much like how householders can promote their major residence and exclude as much as $250,000 in positive aspects tax-free as people, or $500,000 if married submitting collectively. Figuring out there’s a beneficiant tax break on the again finish makes investing in a nicer residence—or a promising startup—all of the extra interesting.

The federal authorities continues to point out robust help for startups and small-business house owners. The 2012 JOBS Act was a serious step ahead, and this newest replace builds on that momentum. In consequence, traders ought to take into account allocating extra capital to personal companies—particularly since startups are staying personal longer.

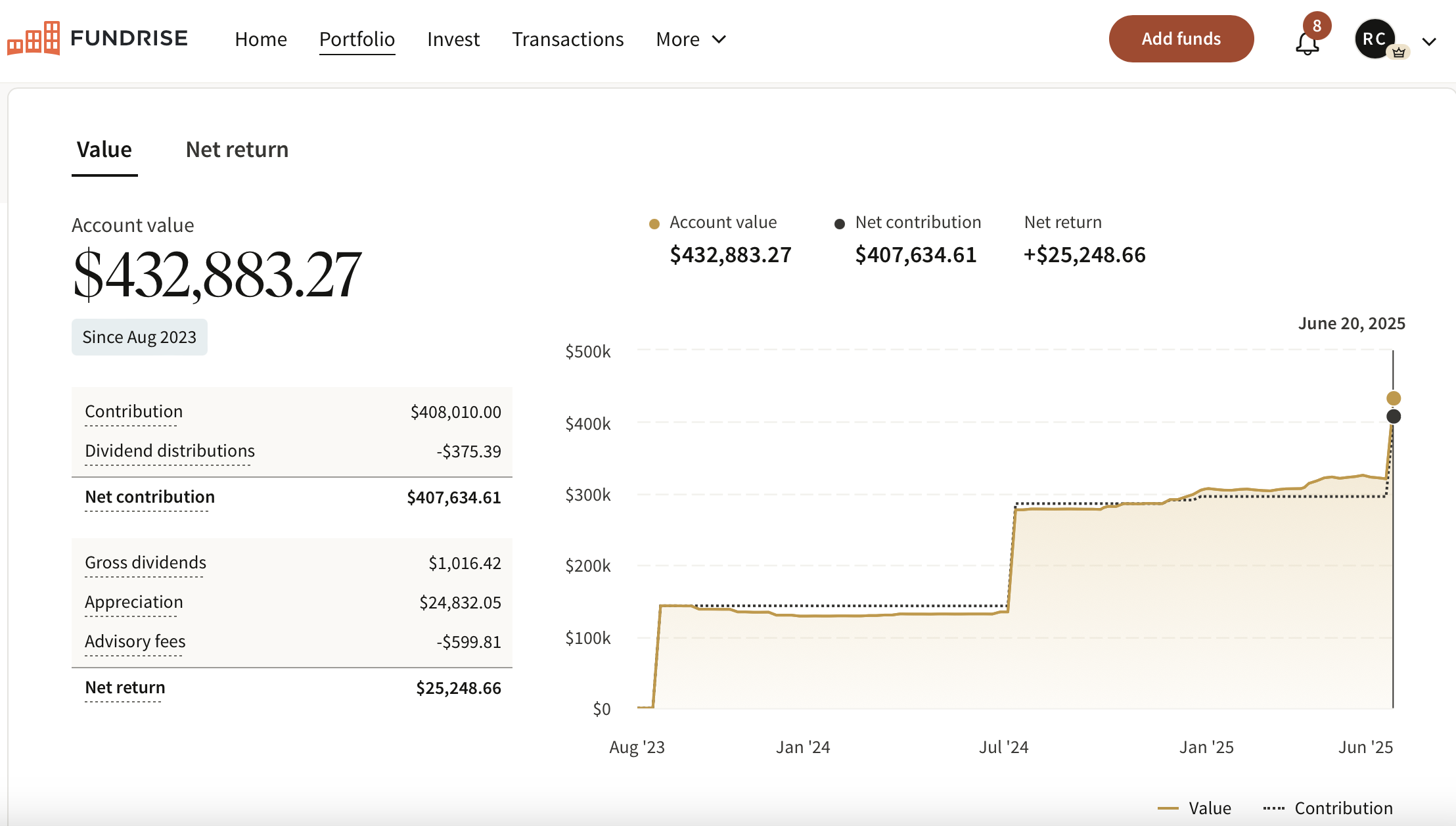

Personally, I’m methodically constructing my place in personal AI firms via Fundrise Enterprise, which owns stakes in OpenAI, Anthropic, Databricks, Anduril, and extra. Fundrise can be a long-time sponsor of Monetary Samurai, and our funding philosophies are intently aligned.

3. 100% Bonus Depreciation Made Everlasting

- Companies can write off asset purchases instantly.

- Part 179 expensing raised to $2.5 million, phase-out at $4 million.

This modification is nice for cash-flow-focused FIRE builders reinvesting in small companies, in addition to for CAPEX-heavy companies that require pricey tools. For the reason that pandemic, there’s been a noticeable pattern of personal fairness corporations buying conventional small companies—like dental practices, pressing care facilities, bodily remedy clinics, laundromats, development corporations, and health studios.

Since writing about FIRE in 2009, I constantly see folks the FIRE group retire from their day jobs and begin companies to see what they’re able to constructing on their very own. There’s one thing deeply rewarding about creating one thing from nothing.

OBBBA Helps FIRE Seekers At The Margin

Whereas it’s not an ideal invoice—and critics rightly level out its impression on the deficit and cuts to social packages—OBBBA gives a number of significant wins for these on the trail to monetary independence:

- Decrease taxes = extra capital to speculate to create extra passive earnings

- Expanded deductions = elevated flexibility

- New advantages for teenagers = multigenerational wealth constructing

- Enterprise aid = stronger money stream and reinvestment potential

The best benefit of the FIRE motion is the liberty of time and place. And with latest tax legislation adjustments providing a couple of extra incentives to avoid wasting and construct, the highway to early retirement simply bought just a little smoother.

That mentioned, don’t rely on the OBBBA—or the federal authorities usually—that will help you attain monetary freedom. Whatever the newest invoice or who’s in workplace, the duty falls on you. Give attention to what you possibly can management: your work ethic, consistency, saving fee, funding technique, and your urge for food for threat.

Typically the federal government might be a headwind in your path to FI. However for now, as a result of OBBBA, there’s a modest tailwind serving to you progress just a little sooner towards your objective.

Readers, what are your ideas on the One Massive Stunning Invoice Act? How does it impression your funds? Are there any provisions I didn’t point out that you just assume may assist speed up your path to monetary freedom?

Free Monetary Evaluation Provide From Empower

When you have over $100,000 in investable belongings—whether or not in financial savings, taxable accounts, 401(okay)s, or IRAs—you may get a free monetary check-up from an Empower monetary skilled by signing up right here. It’s a no-obligation option to have a seasoned professional, who builds and analyzes portfolios for a dwelling, evaluate your funds.

A recent set of eyes may uncover hidden charges, inefficient allocations, or alternatives to optimize—providing you with higher readability and confidence in your monetary plan.

The assertion is offered to you by Monetary Samurai (“Promoter”) who has entered right into a written referral settlement with Empower Advisory Group, LLC (“EAG”). Click on right here to be taught extra.

Diversify Your Retirement Investments

Shares and bonds are basic staples for retirement investing. Nonetheless, I additionally counsel diversifying into actual property—an funding that mixes the earnings stability of bonds with higher upside potential.

Take into account Fundrise, a platform that lets you 100% passively spend money on residential and industrial actual property. With virtually $3 billion in personal actual property belongings underneath administration, Fundrise focuses on properties within the Sunbelt area, the place valuations are decrease, and yields are typically larger.

As well as, you possibly can spend money on Fundrise Enterprise if you’d like publicity to personal AI firms like OpenAI, Anthropic, Anduril, and Databricks. AI is ready to revolutionize the labor market, eradicate jobs, and considerably increase productiveness. We’re nonetheless within the early phases of the AI revolution.

I’ve personally invested over $400,000 with Fundrise, and so they’ve been a trusted companion and long-time sponsor of Monetary Samurai. With a $10 funding minimal, diversifying your portfolio has by no means been simpler.

Be part of 60,000+ readers and subscribe to my free Monetary Samurai e-newsletter right here. You may also get my posts delivered to your inbox as quickly as they’re printed by signing up right here. Monetary Samurai started in 2009 and is the main independently-owned private finance web site in the present day. All the pieces is written primarily based off firsthand expertise.