On the Berkshire Hathaway shareholder assembly in 1997, Warren Buffett laid out the next state of affairs:

Think about you’ve been granted the extraordinary energy of figuring out the financial guidelines of society 24 hours earlier than being born. These guidelines will final many generations.

The one caveat is you don’t know the circumstances you’ll be born into.

You may’t select your gender, race, stage of intelligence, bodily attributes or the place you’ll be born. It might be the US or it might be Afghanistan. Your loved ones is likely to be wealthy or poor. You possibly can be wholesome as an ox or have bodily limitations.

What sort of society would you construct?

Buffett says this ovarian lottery is “an important occasion during which you’ll ever take part” as a result of it’s going to decide the place you reside, the place you go to high school, your monetary circumstances, and so on.

Some folks win the lottery whereas others draw the brief straw via no fault of their very own.

He then shared among the methods during which he gained the ovarian lottery:

When (Charlie Munger and I) had been born the chances had been over 30-to-1 in opposition to being born in the US. Simply profitable that portion of the lottery, huge plus. We wouldn’t be value a rattling in Afghanistan. We’d be giving talks, no person’d be listening. Horrible. That’s the worst of all worlds. So we gained it that manner. We gained it partially within the period during which we had been born by being born male.

And we gained it in one other manner by being wired in a sure manner, which we had nothing to do with, that occurs to allow us to be good at valuing companies. And you realize, is that the best expertise on the planet? No. It simply occurs to be one thing that pays off like loopy on this system.

Buffett was born into the suitable scenario, on the proper time, in a system that simply to occurred to be completely suited to his strengths.

Timing isn’t the one factor but it surely issues an incredible deal in lots of elements of life.

The Robber Barons of the Gilded Age had been all born in the identical decade — Andrew Carnegie (1835), Jay Gould (1836), John Pierpont Morgan (1837) and John Rockefeller (1839). Once they got here up within the enterprise world, it coincided completely with the post-Civil Conflict industrial increase.

The people who created the private pc for the plenty had been all born in the identical decade as effectively — Microsoft’s Invoice Gates (1955) and Paul Allen (1953) together with Apple’s Steve Jobs (1955) and Steve Wozniak (1950).

Should you began investing within the early Eighties, you got here right into a market at probably the most opportune occasions in historical past with extraordinarily low inventory market valuations and intensely excessive rates of interest (that had been about to go down).

Julian Robertson and Paul Tudor Jones each began their hedge funds in 1980. Stanley Druckenmiller based Duquesne Capital in 1981. Seth Klarman began Baupost Group in 1982. Jim Simons based Renaissance Applied sciences in the identical 12 months. Mitt Romney’s Bain Capital began in 1984, adopted by Steve Schwarzman’s Blackstone in 1985.

These are all supremely proficient people who labored onerous but in addition had fortuitous timing.

Luck and timing, each good and unhealthy, are a part of life.

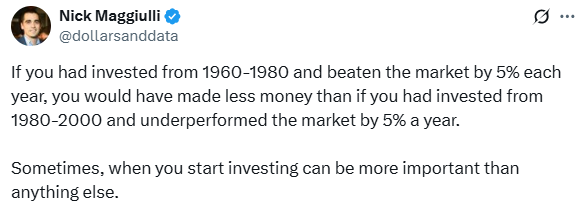

My colleague Nick Maggiulli has this mind-blowing inventory market stat he shares:

The very best buyers of the Sixties and Nineteen Seventies would have underperformed among the worst buyers of the Eighties and Nineties merely due to the market surroundings.

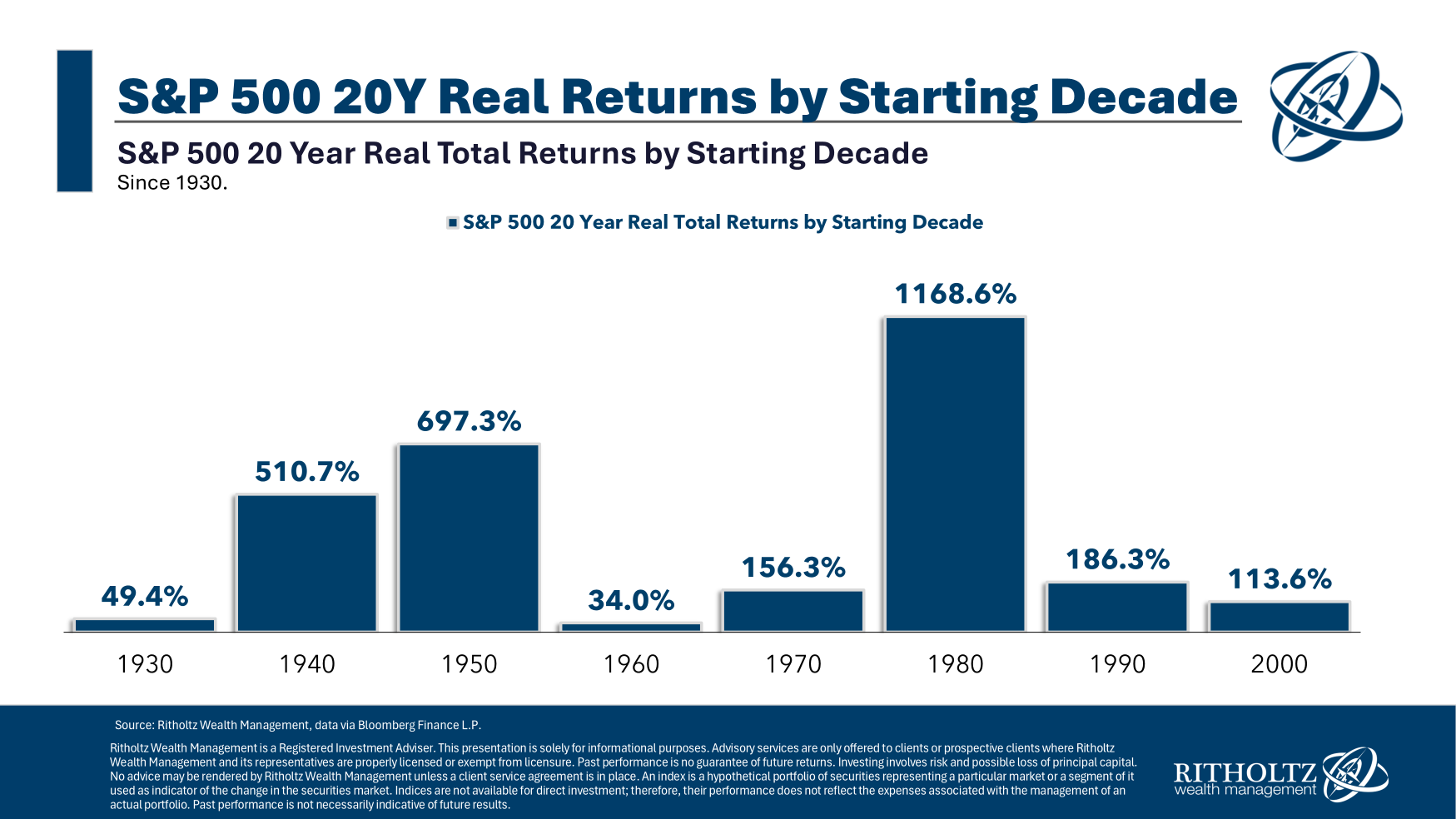

I regarded on the 20 12 months inflation-adjusted complete returns from the beginning of every decade going again to the Thirties:

Nobody controls when the market performs effectively or when it does poorly.1 It’s a roll of the cube.2

The identical is true of the housing market.

Should you purchased a home earlier than 2020 and refinanced at 3% through the pandemic you gained the housing market lottery. Should you had been pressured to purchase that very same home at this time at prevailing costs and mortgage charges, your month-to-month cost can be 2-3x increased.

The younger individuals who missed out on the housing bull market did nothing unsuitable. It was unhealthy timing. The individuals who purchased a house within the 2010s weren’t geniuses. They had been fortunate (me included).

Clearly, some folks make their very own luck, each good and unhealthy. Sure folks would achieve success no matter their surroundings.

However it’s value remembering some issues are fully out of your management. You may management your effort and the way onerous you’re employed. A variety of the opposite stuff is out of your fingers.

You may’t educate expertise and you may’t educate timing.

It is a lesson I attempt to educate my youngsters in the case of sports activities. You might be who you’re in the case of your genetics. Some folks inherently have extra bodily presents.

The 2 issues I inform them are an important in the case of enjoying sports activities:

1. Do your greatest.

2. Have enjoyable.

Typically issues work out completely for you.

Typically life isn’t honest.

That’s life.

Additional Studying:

The Upside of Gratitude

1It’s value noting that the luck concerned on this a part of the equation additionally has to do with the place you’re in your investing journey. Should you began periodically saving through the durations of poor returns that’s truly an excellent factor going ahead. The individuals who save for 20 years straight through the Sixties and Nineteen Seventies had been rewarded with increased returns within the Eighties and Nineties after years of build up their portfolio.

2The newest 20 12 months interval from 2005-2024 noticed complete actual returns of +339%.