Right here’s an e-mail that got here to our Animal Spirits inbox this week:

Lots of people are questioning the identical factor.

The general value degree is up greater than 20% this decade. Wages have roughly saved up however that’s on combination. Those that have seen their wages rise quicker than common are offset by these whose incomes haven’t saved tempo.

Expertise will assist deliver down the costs of sure items. Simply take into consideration how less expensive flat-screen TVs have gotten over time.

However the one method we’re prone to expertise broad-based value declines is throughout a horrible economic system with heavy job losses.

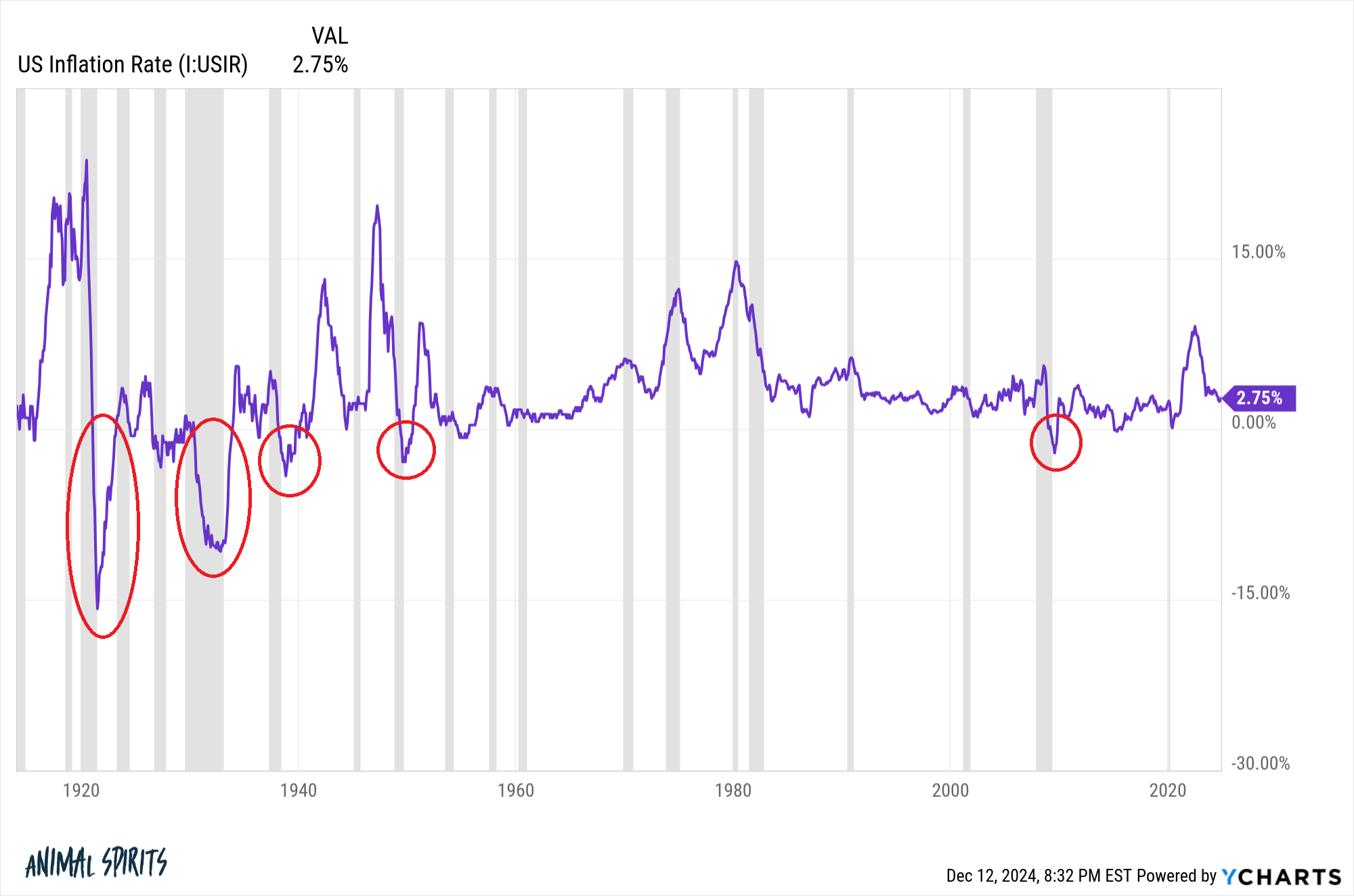

Even then it won’t be as a lot aid as some would love. Throughout the Nice Monetary Disaster the biggest year-over-year deflation was -2.1%:

Previous to that quick bout of deflation it’s a must to return to post-WWII days to see an prolonged interval of falling costs. The final extreme deflation in america occurred due to the Nice Melancholy and Melancholy of 1920-1921.

The recurring theme right here is downright terrible financial environments are the reason for falling costs. Deflation is unhealthy for the economic system as a result of companies and households delay consumption since folks count on costs to be decrease tomorrow than they’re at the moment.

Decrease consumption. Decrease revenues. Fewer jobs. Decrease development. Not enjoyable.

Watch out what you would like for.

This isn’t to say inflation is an effective factor, simply the lesser of two evils.

So that you hedge in opposition to inflation to the very best of your talents.

Listed here are Ben’s three greatest inflation hedges:

1. An excellent job. Inflation statistics are useful in understanding traits within the general economic system however are imperfect measures for households.

Your family inflation price is private. It is determined by the place you reside, how you reside, how a lot you spend, what you spend your cash on and, most significantly your job.

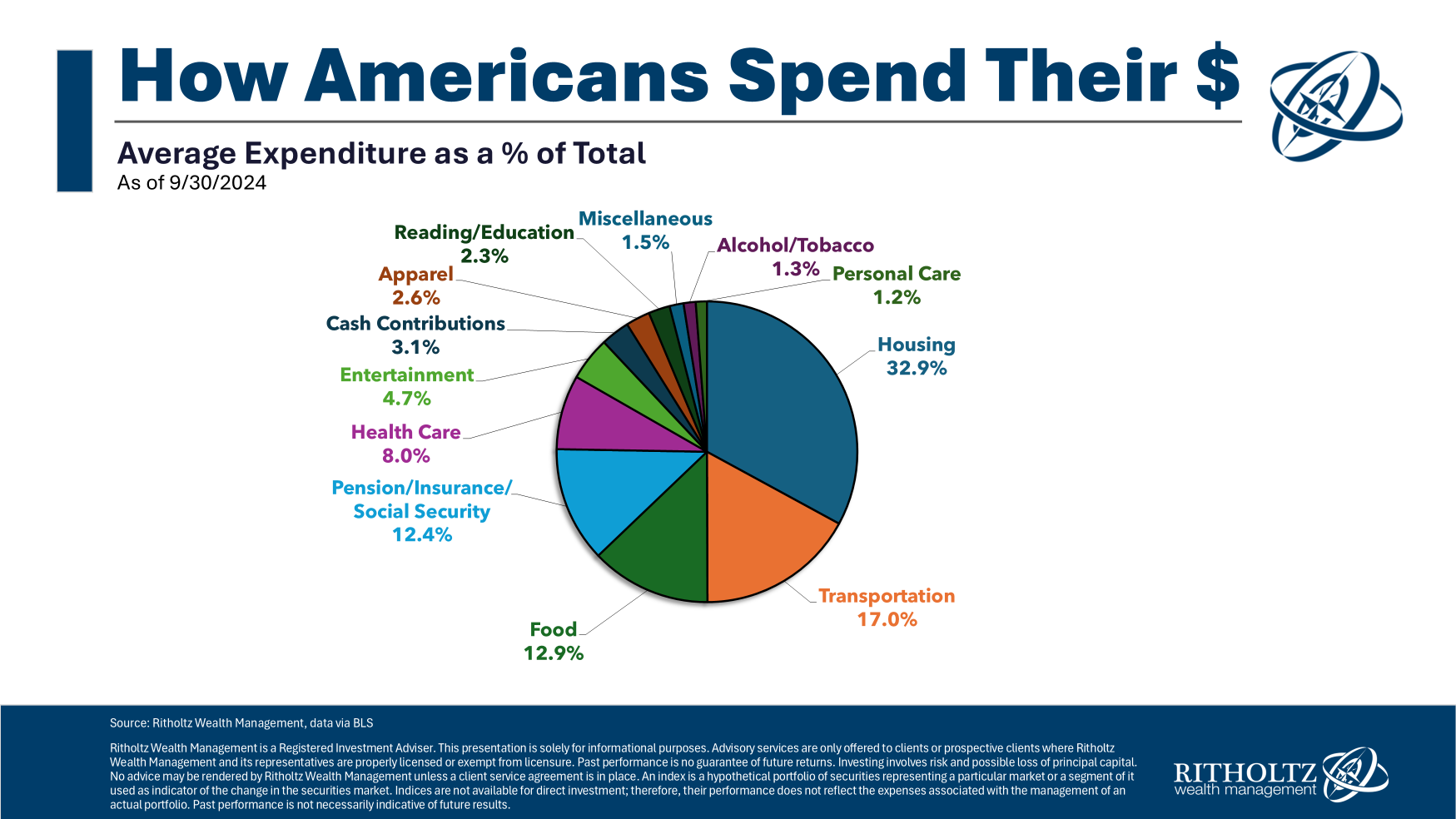

Wage development is private similar to the inflation price. Nobody’s revenue trajectory matches these averages:

![]()

The power to develop your revenue within the face of rising costs is your greatest hedge in opposition to inflation. One of the best profession recommendation I’ve ever acquired is to change into indispensable to whoever I work for.

Simpler mentioned than finished however that helps make sure you’re paid a good wage and have the power to barter a better wage.

2. A set-rate mortgage. Individuals deal with the value of eggs, gasoline and bacon however the two greatest spending classes by far are housing and transportation:

These two classes alone make up half of all family consumption.1 This is the reason a hard and fast price mortgage is such an excellent deal.

To paraphrase Wooderson from Dazed and Confused, “That’s what I like about these mounted price mortgages, man, I earn more money, the cost stays the identical.”

You earn extra money as you progress in your profession. That makes the mounted cost simpler to abdomen from a budgeting perspective over time. You may also write off the curiosity you pay on the mortgage as a deduction for tax functions. Plus, inflation eats into the worth of your cost slowly however absolutely over time.

Housing costs usually go up however are inclined to do even higher than different asset lessons when inflation surges as the price of constructing new houses will increase (larger wages, larger materials prices, and so on.).

3. Shares for the long term. Generally the inventory market struggles with a burst of inflation over the quick to intermediate-term however shares for the long term are nonetheless your greatest funding hedge in opposition to the silent killer of inflation.

Over the previous 100 years or so the U.S. inventory market has overwhelmed the inflation price by practically 7% per 12 months. Dividends have grown greater than 2% quicker than the annual inflation price. Inflation-adjusted earnings development has are available at round 3% per 12 months.

Money-like investments may help when inflation and charges are rising within the short-term however the inventory market stays your greatest guess for beating inflation over the long-term.

Michael and I talked about this e-mail and a few ideas on inflation on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Inflation is the Lesser of Two Evils

Now right here’s what I’ve been studying recently:

Books:

1It’s additionally price noting a automobile is a horrible hedge in opposition to inflation. It goes down in worth instantly.

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.