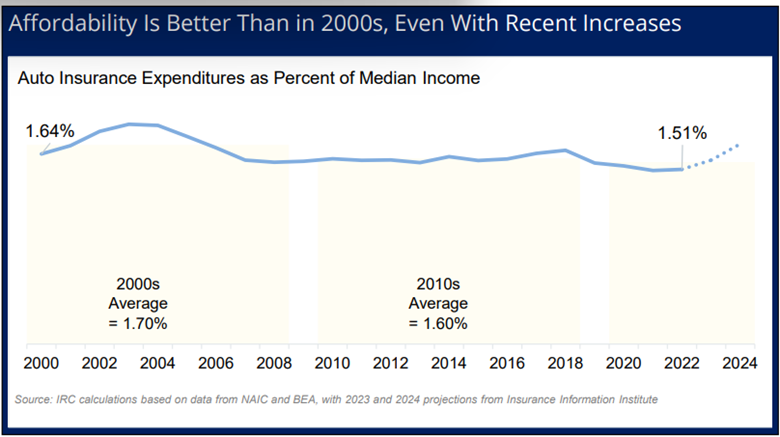

You learn that proper. As a proportion of median family earnings, private auto insurance coverage premiums nationally have been extra inexpensive in 2022 (the newest information out there) than they’ve been for the reason that starting of this century.

And even the premium will increase of the previous two years are solely anticipated to carry affordability again into the 2000 vary, in line with the Insurance coverage Analysis Council (IRC).

A brand new IRC report – Auto Insurance coverage Affordability: Countrywide Traits and State Comparisons – appears to be like on the common auto insurance coverage expenditure as a % of median earnings. The measure ranges from a low of 0.93 % in North Dakota (probably the most inexpensive state for auto insurance coverage) to a excessive of two.67 % in Louisiana (the least inexpensive).

The ache is actual

This isn’t to downplay the ache being skilled by shoppers – significantly these in areas the place premium charges have been rising whereas family earnings has been flat to decrease. It’s simply to supply perspective as to the various components that come into play when discussing insurance coverage affordability.

Between 2000 and 2022, median family earnings grew considerably sooner than auto insurance coverage expenditures, inflicting the affordability index to say no from 1.64 % in 2000 to 1.51 % in 2022. In different phrases, auto insurance coverage was considerably extra inexpensive in 2022 than in 2000.

“With the latest will increase in insurance coverage prices, affordability is projected to deteriorate in 2023 and 2024,” stated Dale Porfilio, FCAS, MAAA, president of the IRC and chief insurance coverage officer at Triple-I. “The affordability index is projected to extend to roughly 1.6 % in 2023 and 1.7 % in 2024, a major improve from the low in 2021 however nonetheless under the height of 1.9 % in 2003.”

In different phrases, we’ve been right here earlier than; and, if dangers and prices could be contained, so can premium progress in the long run.

Value components range by state

Auto insurance coverage affordability is essentially decided by the important thing underlying price drivers in every state. They embrace:

- Accident frequency

- Restore prices

- Declare severity

- Tendency to file harm claims

- Damage declare severity

- Expense index

- Uninsured and underinsured motorists

- Declare litigation.

These components range extensively by state, and the IRC report appears to be like on the profiles of every state to reach at its affordability index.

Lowering danger and prices is vital

Porfilio famous that “whereas state-level information can not straight deal with affordability points amongst historically underserved populations, collaborative efforts to cut back these key price drivers can enhance affordability for all shoppers.”

Continued replacement-cost inflation is prone to preserve upward stress on premium charges. Tariffs may exacerbate that pattern, in addition to hurting family earnings in areas depending on industries prone to be affected by them.

On the similar time, some states are working laborious to ameliorate different components hurting affordability. Florida, for instance, was the second least inexpensive state for auto insurance coverage in 2022; nonetheless, the state has made latest progress to cut back authorized system abuse, a significant contributor to claims prices within the Sunshine State. In 2022 and 2023, Florida handed a number of key reforms which have led to vital decreases in lawsuits. In consequence, insurers have been writing extra enterprise within the state after a multi-year exodus. This elevated competitors places downward stress on charges, which must be mirrored within the IRC’s subsequent affordability research.

Study Extra:

IRC Report: Private Auto Insurance coverage State Regulation Techniques

Florida Reforms Bear Fruit as Premium Charges Stabilize

What Florida’s Misguided Investigation Means for Georgia Tort Reform

Florida Payments Would Reverse Progress on Expensive Authorized System Abuse

Inflation Continues to Drive Up Shoppers’ Insurance coverage Prices

Improved Business Auto Underwriting Profitability Anticipated After Years of Battle

Louisiana Is Least Inexpensive State for Private Auto Protection Throughout the South and U.S.

Georgia Is Among the many Least Inexpensive States for Auto Insurance coverage

Report: No-Fault Reforms Improved Michigan’s Private Auto Insurance coverage Affordability

Auto Insurers’ Efficiency Improves, However Don’t Anticipate Charges to Flatten Quickly