By William Nibbelin, Senior Analysis Actuary, Triple-I

In line with a brand new examine by the Insurance coverage Analysis Council (IRC), the speed submitting course of for private auto insurance coverage has develop into extra inefficient and ineffective, taking longer to attain charge approval with larger prevalence of authorized charge impression decrease than filed charge impression and a bigger disparity between the speed impression authorized and the speed impression filed.

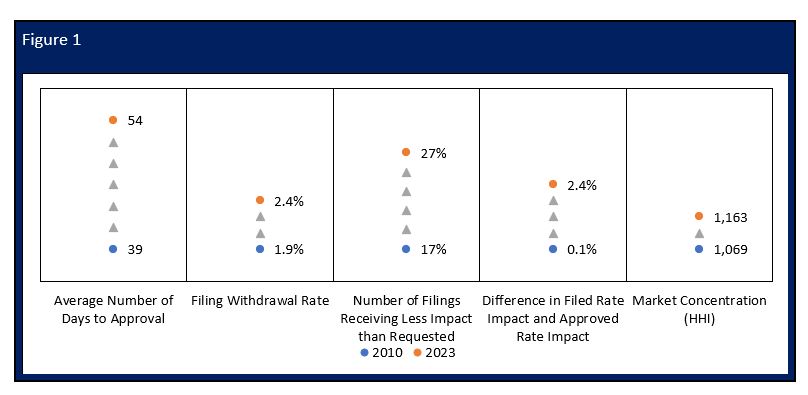

The report, Price Regulation in Private Auto Insurance coverage: A Comparability of State Methods, analyzes Private Auto Insurance coverage trade knowledge from 2010 via 2023 throughout all states and the District of Columbia. Key findings:

- There have been roughly 10,200 charge filings every year with out a lot variance throughout the interval.

- The typical variety of days to approval grew from 39 to 54 days.

- The variety of filings withdrawn elevated from 1,900 to three,200.

- The proportion of filings receiving much less charge impression than requested grew 10 factors.

- The disparity in authorized charge impression grew by greater than 2 factors.

- Market focus (as measured by the Herfindahl-Hirschman Index, or HHI) elevated by 9 p.c.

- A robust-to-moderate correlation exists between web underwriting losses and premium shortfalls inside states and throughout time.

- Submitting course of measures and market outcomes fluctuate by regulatory techniques.

Throughout this identical interval from 2010 via 2023, the non-public auto insurance coverage trade skilled a direct mixed ratio over 100 in 11 of the 14 years. Mixed ratio is a key measure of underwriting profitability for insurance coverage carriers, calculated as losses and bills divided by earned premium plus working bills divided by written premium. A mixed ratio over 100 represents an underwriting loss. The report consists of the willpower of a powerful correlation between underwriting loss and premium shortfalls, outlined because the potential greenback distinction between the efficient filed charge impression and authorized charge impression.

Overview of Price Regulation

Insurance coverage is regulated by the states. This technique of regulation stems from the McCarran-Ferguson Act of 1945, which describes state regulation and taxation of the trade as being in “the general public curiosity” and clearly provides it preeminence over federal legislation.

Whereas the regulatory processes in every state fluctuate, three ideas information each state’s charge regulation system (Regulation | III): that charges be satisfactory (to keep up insurance coverage firm solvency) however not extreme (not so excessive as to result in exorbitant earnings) nor unfairly discriminatory (worth variations should replicate anticipated declare and expense variations).

In line with the NAIC (NAIC Auto Insurance coverage Database Report, p. 193), the first regulatory approaches embody:

- Prior Approval System: Insurance coverage firms should file their charges and get approval from the state insurance coverage division earlier than utilizing them.

- Flex Score: States permit insurers to vary charges inside a pre-established vary (usually a proportion enhance or lower) with no need approval. Bigger adjustments, nonetheless, require prior approval.

- File-and-Use System: Insurers can file charges with the state and start utilizing them instantly or after a set interval. The charges can nonetheless be reviewed by regulators, however they don’t require prior approval.

- Use-and-File System: Insurers can implement new charges with out prior approval however should file them with the state inside a sure interval after they begin getting used. Regulators can evaluate and probably disapprove them later.

- No Submitting: In some states, insurers shouldn’t have to file charges for sure traces of insurance coverage. The thought is that competitors amongst insurers will maintain charges in test. Nevertheless, regulators nonetheless have authority to intervene if charges are deemed unreasonable.

Regulatory Methods

IRC used Nationwide Affiliation of Insurance coverage Commissioners (NAIC) definitions to phase states into 4 regulatory techniques: Prior Approval, File and Use, Use and File (together with No Submitting states), and an extra phase, Price Cap, for Flex Score states and any state with an express charge impression cap on charge filings per state laws.

The report then highlights key findings and different market outcomes throughout these 4 regulatory surroundings techniques. For instance, the examine decided underwriting profitability in private auto insurance coverage was weakest in Price Cap states throughout the interval from 2010 via 2023 with the best common direct mixed ratio of any regulatory surroundings system in 2023. Prior Approval states had the second highest.

Under are a number of the outcomes of this examine for California private auto, which performs worse on a number of key charge submitting course of measures.

California

California has an express charge cap of seven p.c (California Insurance coverage Code Article 161.05) and is due to this fact labeled as a Price Cap regulatory surroundings system within the IRC examine. California solely rivals Colorado for the best common variety of days to approval over the previous seven years and has the best common variety of days to approval for 2023 at 246 in comparison with the subsequent highest, Colorado, at 167.

California additionally has the best common withdrawn charge throughout all states at 14.1 p.c from 2010 to 2023. From 2010 to 2023, California achieved a Direct Mixed Ratio underneath 100 4 instances, and the newest three-year direct mixed ratio is 110.4, in comparison with the countrywide 106.4. The residual market has grown in California from 0.01 p.c in 2010 to 0.09 p.c in 2021 which is larger than the countrywide common of 0.07 p.c.