At the same time as California strikes to deal with regulatory obstacles to truthful, actuarially sound insurance coverage underwriting and pricing, the state’s danger profile continues to evolve in ways in which impede progress, in accordance with the newest Triple-I Points Transient.

Like many states, California has suffered vastly from climate-related pure disaster losses. Like some disaster-prone states, it additionally has skilled a decline in insurers’ urge for food for masking its property/casualty dangers.

However a lot of California’s downside is pushed by regulators’ utility of Proposition 103 – a decades-old measure that constrains insurers’ skill to profitably write enterprise within the state. As utilized, Proposition 103 has:

- Saved insurers from pricing disaster danger prospectively utilizing fashions, requiring them to cost primarily based on historic information alone;

- Barred insurers from incorporating reinsurance prices into pricing; and

- Allowed shopper advocacy teams to intervene within the rate-approval course of, making it onerous for insurers to reply rapidly to altering market circumstances and driving up administration prices.

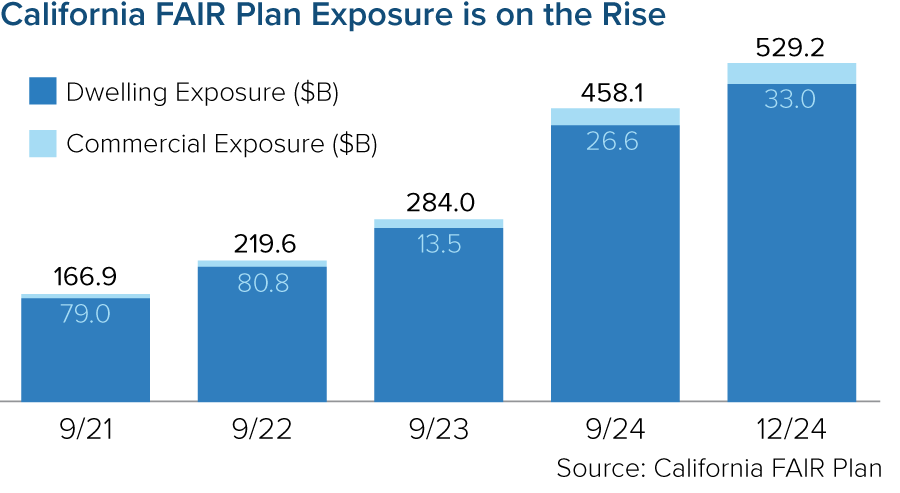

As insurers have adjusted their danger urge for food to mirror these constraints, extra property house owners have been pushed into the California FAIR plan – the state’s property insurer of final resort. As of December 2024, the FAIR plan’s publicity was $529 billion – a 15 p.c improve since September 2024 (the prior fiscal yr finish) and a 217 p.c improve since fiscal yr finish 2021. In 2025, that publicity will improve additional as FAIR begins providing increased business protection for bigger owners, condominium associations, homebuilders and different companies.

Insurance coverage Commissioner Ricardo Lara has carried out a Sustainable Insurance coverage Technique to alleviate these pressures. The technique has generated optimistic impacts, nevertheless it continues to satisfy resistance from legislators and shopper teams. And, no matter what regulators or legislators do, California owners’ insurance coverage premiums might want to rise.

The Triple-I transient factors out that – regardless of the Golden State’s many challenges – its owners truly take pleasure in below-average house and auto insurance coverage charges as a share of median revenue. Insurance coverage availability in the end is determined by insurers having the ability to cost charges that adequately mirror the total influence of accelerating local weather danger within the state. In a disaster-prone state like California, these artificially low premium charges usually are not sustainable.

“Greater charges and decreased regulatory restrictions will enable extra carriers to broaden their underwriting urge for food, relieving the provision disaster and reliance on the FAIR plan,” mentioned Triple-I Chief Insurance coverage Officer Dale Porfilio.

With occasions like January’s devastating fires, frequent “atmospheric rivers” that deliver floods and mudslides, and the ever-present risk of earthquakes – alongside the numerous extra mundane perils California shares with its 49 sister states – premium charges that adequately mirror the total influence of those dangers are important to continued availability of personal insurance coverage.

Study Extra:

California Insurance coverage Market at a Essential Juncture

California Finalizes Up to date Modeling Guidelines, Clarifies Applicability Past Wildfire