There are two massive financial developments this decade:

1. Customers hold spending cash it doesn’t matter what.

2. Buyers hold shopping for the dip it doesn’t matter what.

Folks hold ready for these developments to interrupt however they merely received’t. Not but no less than.

What’s it going to take?

One would think about a recession would break the spending patterns for a lot of shoppers. We will see. Inflation didn’t do it.

I’m unsure what it’s going to take to cease buyers from moving into purchase the ache when shares are down.

April has been an especially unstable atmosphere for the inventory market. Buyers aren’t speeding for the exits, no less than of the retail selection.

Retail has been a purchaser:

I wrote a chunk again in 2014 known as Millennials & The New Dying of Equities. This was from a UBS report on the time:

The Subsequent Gen investor is markedly conservative, extra just like the WWII technology who got here of age in the course of the Nice Melancholy and are in retirement. This interprets into their perspective towards the market as we see Millennials, together with these with larger internet price, holding considerably additional cash than every other technology. And whereas optimistic about their skills to attain objectives and their monetary futures, Millennials appear considerably skeptical about long-term investing as the best way to get there.

The bursting of the dot-com bubble mixed with the Nice Monetary Disaster unnerved a variety of buyers. Millennials had been skeptical of markets.

The following technology now has a very totally different relationship with danger.

The Wall Avenue Journal profiled a handful of youthful buyers to see how the volatility is impacting their funding selections. They’re leaning into the ache:

“It’s only a screaming shopping for alternative,” stated Oksnevad, who retains about 90% of his seven-figure portfolio–together with retirement funds–within the cryptocurrency and associated shares akin to bitcoin purchaser Technique. “I’m operating straight into it.”

The 37-year-old advertising and marketing director didn’t thoughts that the value of bitcoin sank practically 6% that day, or that he was rising his publicity to a comparatively dangerous asset throughout probably the most important market meltdown since March 2020. As an alternative, he targeted on the prospect of a rebound.

“That’s what I’m after–making many years of returns in weeks or months,” he stated. “I really suppose volatility is the place fortunes are made.”

Right here’s one other one:

“The youngsters today say, ‘No danger, no ‘rari,’” stated Patrick Wieland, a content material creator and day dealer who has in current weeks poured hundreds of {dollars} into ProShares UltraPro QQQ. (“Rari” is slang for Ferrari.) Shares of the fund, a triple-leveraged ETF that goals to generate thrice the each day efficiency of the Nasdaq-100 index, notched double-digit features throughout a historic rally on April 9, however are nonetheless down greater than 20% this month.

“I believe you’ve obtained to be aggressive,” he stated. “When you’ve got such massive swings available in the market, it’s exhausting to be danger averse.”

The bull market and pandemic-induced features have created a brand new breed of buyers who aren’t afraid of volatility. They’re speeding into the burning constructing.

Some buyers would possibly quibble with their autos of selection however this habits is noteworthy. For years and years it’s been drilled into the heads of buyers that falling markets are a possibility. I believe it’s nice that youthful buyers have discovered this lesson so early.

Might they ultimately study one other lesson when the subsequent misplaced decade comes round? Certain, however these durations aren’t straightforward for any investor, no matter age and expertise.

It’s additionally no assure {that a} gigantic market crash would instantly change investor habits.

The bull market of the Nineteen Eighties and Nineties had been one other wonderful interval when buyers discovered the artwork of long-term investing and shopping for the dip. Even when the inventory market fell 50% in the course of the bursting of the dot-com bubble, most buyers stayed the course.

Maggie Mahar chronicled this era in her e-book Bull:

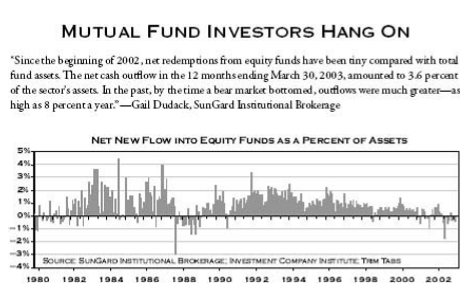

So, even after it grew to become clear to the overwhelming majority of buyers that the Nice Bull Market of 1982-99 had ended, mutual fund buyers stood agency. The mass redemptions from fairness funds that many had predicted by no means happened. As late as March 2003, Gail Dudack noticed: “Web redemptions for the reason that starting of 2002 have been tiny in contrast with whole inventory fund property. The web money outflow within the 12 months ending March 30, 2003, amounted to three.6 % of the sector’s property.

Right here’s the visible:

In 2002, the inventory market was down 22% however Vanguard discovered the common account steadiness grew by 1% as a result of individuals saved funneling cash into the market.

It wasn’t till the 2008 disaster that many buyers started tapping out.

As soon as a behavior types it’s not that straightforward to interrupt the sample.

Perhaps a recession will do it, however the subsequent technology of buyers is snug with volatility.

That’s a welcome improvement.

Michael and I talked about buyers shopping for the dip and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

One of many Greatest Funding Books I’ve Learn in a Whereas

Now right here’s what I’ve been studying currently:

Books: