As a middle-aged man, I’m a sucker for the true property part in The Wall Road Journal.

That they had a narrative this previous week concerning the sale of Paul Newman and Joanne Woodward’s Central Park residence in Manhattan. Good view if you will get it:

The place was listed for simply shy of $10 million however bought for 40% over asking at $14 million.

This a part of the story caught my finance eye:

“If you happen to have been nice with having a incredible one bed room, you have been by no means going to discover a higher one than this,” he mentioned. “What was loopy to us was how deep that market was.”

The irony, he mentioned, was that the week the showings occurred, the climate in New York was horrible. “It was raining each single day, identical to monsoons,” he mentioned. “It was the worst time to ever launch one thing like this. It simply exhibits that none of it issues.”

Right here’s a realtor who sells homes to uber-rich folks in Manhattan and even he was stunned by what number of uber-rich folks there have been lining as much as purchase this residence.

That is an excessive instance however everybody has an financial anecdote lately about spending or prices being uncontrolled.

They paid how a lot for that home?!

$25 for beers at that live performance?!

Did you see their Instagram? They went on trip to the Amalfi Coast…once more?

It now prices how a lot for a brand new automobile?!

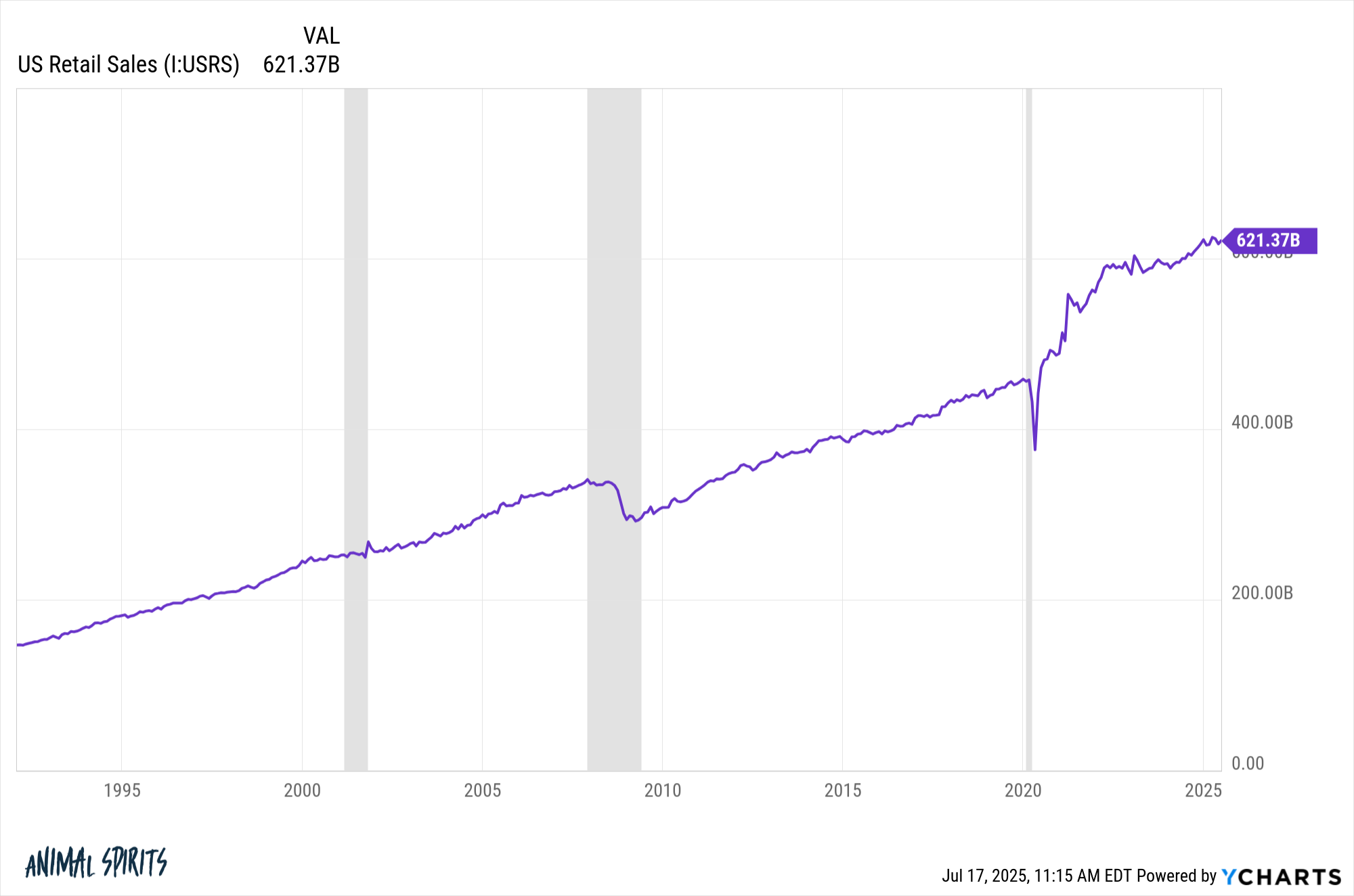

The price of all the things retains going up but customers hold consuming:

We hold listening to tales about how pressured individuals are about cash but it surely doesn’t appear to matter. Individuals simply hold spending regardless of all the things.

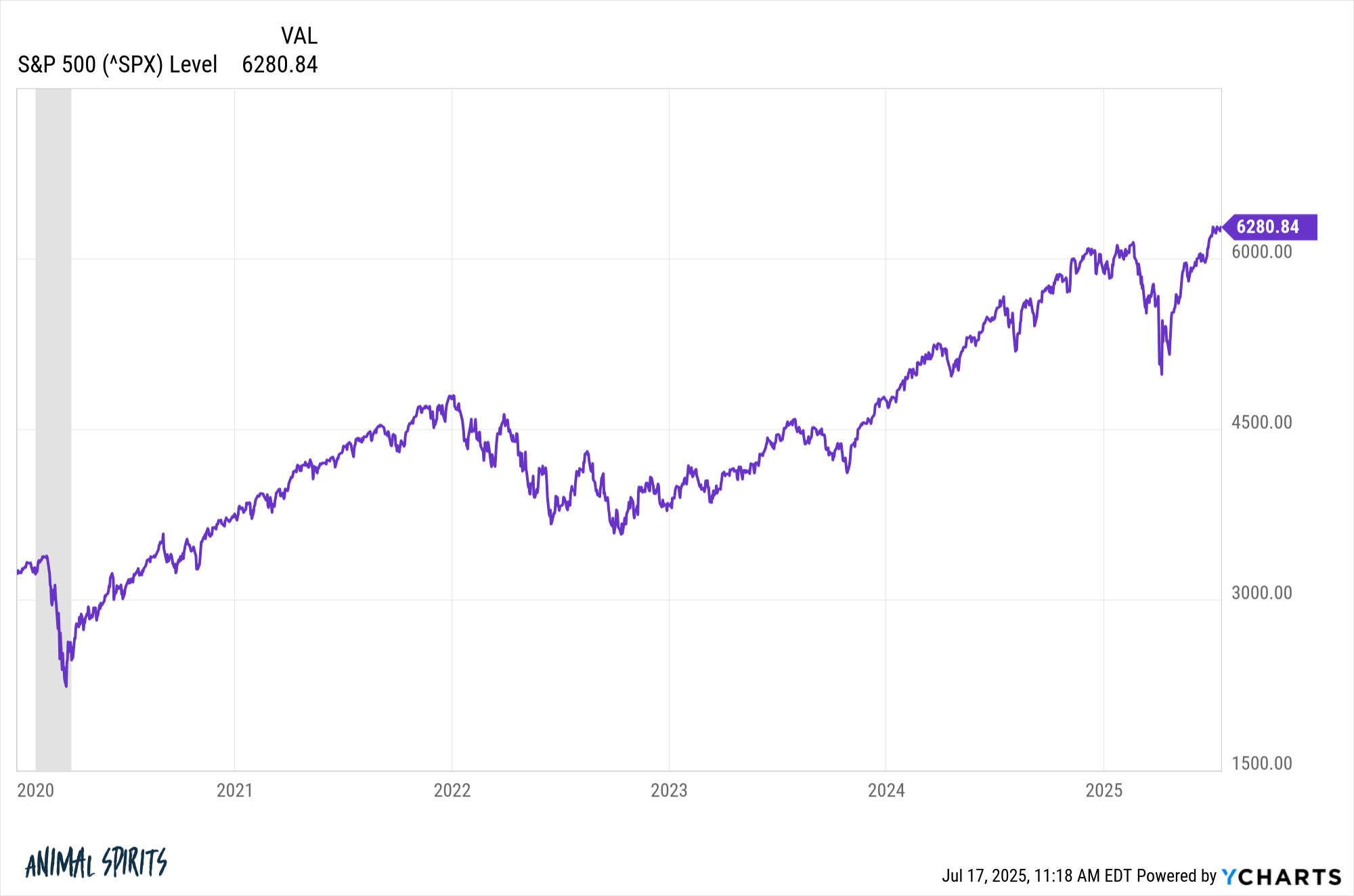

The inventory market is simply as resilient as the patron:

There have been loads of downturns this decade, however the market simply retains coming again with a vengeance.

The variety of insanely huge companies continues to develop as properly.

Nvidia just lately hit a $4 trillion market cap. There are 8 different corporations in the US with a trillion greenback valuation: Microsoft ($3.8 trillion), Apple ($3.1 trillion), Amazon ($2.4 trillion), Google ($2.2 trillion), Fb ($1.8 trillion), Broadcom ($1.4 trillion), Tesla ($1.0 trillion) and Berkshire Hathaway ($1.0 trillion).

The massive ones hold getting larger.

Authorities debt isn’t slowing down anytime quickly both:

For my total grownup life I’ve been advised taxes have nowhere to go however up due to all the federal government spending and deficits. But tax charges simply hold taking place and we simply handed one other large tax minimize.

So the large query is: What stops this practice?

What causes wealthy folks to rein of their spending?

What causes customers to cease touring, consuming out and paying for Doordash?

What causes the inventory market to expertise a correction that lasts longer than a film preview?

What causes buyers to drag again on speculative conduct?

What causes the U.S. authorities to gradual its spending?

What causes the U.S. to expertise its first true recession in additional than 15 years?

That is going to sound like a cop-out Grand Rapids hedge reply however I truthfully don’t know. It could possibly be a Black Swan occasion nobody sees coming. It could possibly be an AI bubble that pops. Perhaps it’s a coverage mistake by the Fed or the White Home.

The almost definitely reply is human nature will get us in some unspecified time in the future.

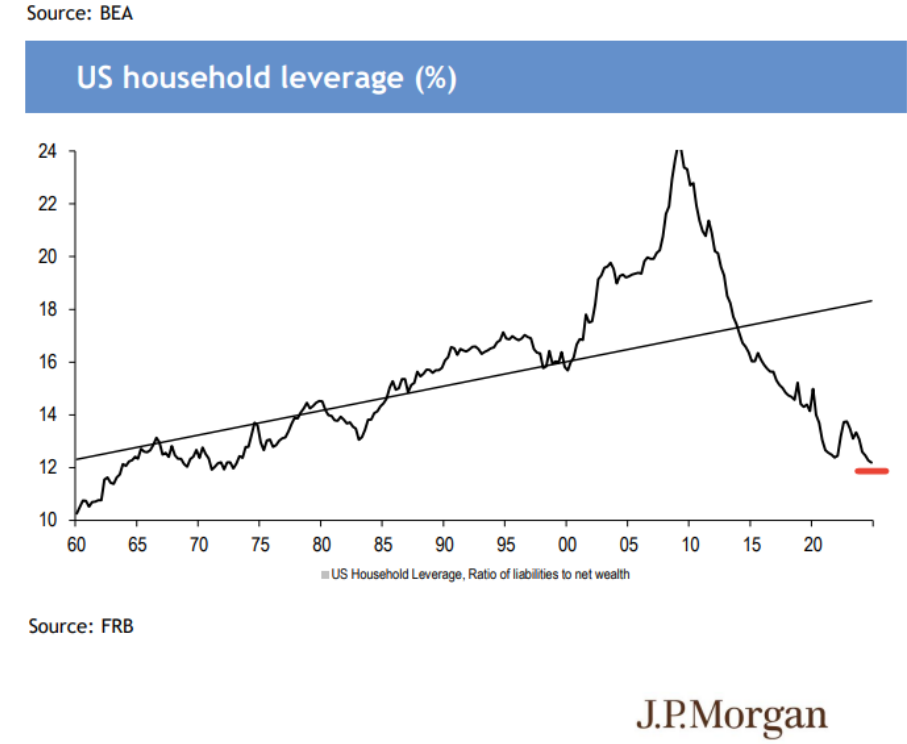

Excesses will construct as households and companies change into an increasing number of comfy making dangerous bets. Leverage will enhance. Individuals will change into complacent. An excessive amount of stability will result in instability.

Good luck guessing when that may occur.

I vividly bear in mind the market lastly reaching new all-time highs in 2013 for the primary time for the reason that Nice Monetary Disaster. A sure pundit was pounding the desk that This market REEKS of euphoria!

Ah properly.

The one factor I do know is that cycles don’t final eternally. They all the time really feel like they may hold going when you’re in them however they by no means do.

The unusual factor is family stability sheets are in such good condition that when an actual downturn lastly occurs there may be loads of dry powder accessible to lever up:

Sorry, even when contemplating the potential dangers that exist I’ve to look on the intense facet of issues.

Michael and I talked about an extreme quantity of wealthy folks, what stops this practice and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

I Don’t Really feel Wealthy

Now right here’s what I’ve been studying this week:

Books: